|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A16Z最近向Coinbase Prime的Comp Token轉移猜測,並突出了Defi Lending部門中不斷發展的動態。這對化合物的未來意味著什麼?

a16z, Compound, and Coinbase: Decoding the DeFi Shuffle

A16Z,化合物和共插基:解碼Defi洗牌

The crypto world is always buzzing, and recently, the spotlight's been on a16z, Compound (COMP), and Coinbase. A big transaction has everyone talking, hinting at strategic shifts in the DeFi landscape. Let's break it down, New York style.

加密世界總是在嗡嗡作響,最近,聚光燈在A16Z,Compound(Comp)和Coinbase上。一項重大交易使每個人都在談論,暗示了Defi格局的戰略轉變。讓我們分解,紐約風格。

a16z's Big Move: COMP Tokens Head to Coinbase Prime

A16Z的重大舉動:Comp Tokens to Coinbase Prime

a16z crypto, known for its savvy investments, just moved 300,000 COMP tokens—that's about $13.75 million—to Coinbase Prime. Why Coinbase Prime? It's the VIP lounge for institutional investors, offering top-notch security, trading tools, and all the bells and whistles for managing serious digital assets. This move suggests a16z is playing chess, not checkers, with their crypto strategy.

A16Z加密貨幣以其精明的投資而聞名,剛剛將300,000個COMP代幣(約為1375萬美元)移至Coinbase Prime。為什麼要共同基本?它是機構投資者的VIP休息室,提供一流的安全性,交易工具以及所有鈴鐺和哨子,用於管理嚴重的數字資產。此舉表明,A16Z通過加密策略正在下棋,而不是跳棋。

Compound: The DeFi OG

化合物:defi和

Compound is a big deal in decentralized finance (DeFi). Launched in 2018, it lets you lend and borrow crypto without needing a bank. Think peer-to-peer lending, but with smart contracts. The COMP token is the key, giving holders a say in the protocol's future. a16z was an early believer, leading Compound's funding round back in 2020. They still hold a significant chunk of COMP, showing they're not losing faith.

化合物在分散的金融(DEFI)方面是一件大事。它於2018年推出,可讓您無需銀行就借入和借用加密貨幣。考慮點對點貸款,但要簽訂智能合同。補充令牌是關鍵,在協議未來為持有人提供了發言權。 A16Z是早期的信徒,在2020年領先於Compound的資金。他們仍然擁有很大一部分的補充,表明他們不會失去信心。

Why This Matters

為什麼這很重要

When a big player like a16z makes a move, the market takes notice. This transfer could mean a few things: maybe they're planning to sell some COMP, rebalance their portfolio, or use the tokens for something strategic like staking or collateral. Whatever it is, it highlights how institutional money is shaping DeFi. It also underscores the importance of governance tokens like COMP. They're not just for speculation; they give the community control.

當像A16Z這樣的大型球員採取行動時,市場會引起人們的注意。這種轉移可能意味著幾件事:也許他們計劃出售一些補充,重新平衡其投資組合或將令牌用於戰略性的東西,例如Stage或Collectral。無論是什麼,它都強調了機構金錢如何塑造defi。它還強調了像Comp一樣的治理令牌的重要性。他們不僅是為了猜測;他們給予社區控制。

The Price of COMP: A Wild Ride

Comp的價格:狂野的旅程

COMP's price has been all over the place. Late 2024 saw a surge, but then it dipped. As of late June 2025, it was hovering around $45.84, a far cry from its all-time high of $911.20 in May 2021. Like many governance tokens, COMP struggles to maintain long-term demand. Newer lending protocols are also giving Compound a run for its money.

Comp的價格到處都是。 2024年下半年看到了激增,但後來蘸了。截至2025年6月下旬,它徘徊在45.84美元左右,與2021年5月的歷史高處的911.20美元相去甚遠。與許多治理令牌一樣,Comp努力以維持長期需求。較新的貸款協議也使化合物賺錢。

What's Next for Compound?

化合物的下一步是什麼?

Predictions are mixed. Some say COMP could see a small surge soon, while others are more cautious. By 2030, forecasts range from almost zero to over $1000. The truth is, it's tough to say. If DeFi picks up steam, Compound could benefit. But it's a volatile market, so buckle up.

預測混合在一起。有些人說,Comp很快就會看到一小段激增,而另一些則更加謹慎。到2030年,預測範圍從零到$ 1000不等。事實是,很難說。如果Defi接收Steam,則Compound可能會受益。但這是一個動蕩的市場,所以扣緊了。

My Take: Cautiously Optimistic

我的看法:謹慎樂觀

Here's my two cents: a16z's move is a sign that DeFi is maturing. Institutional players are getting involved, and that brings stability and capital. However, it's important to not marry yourself to one coin. The market can change on a dime. So, stay informed, diversify, and don't bet the farm on any single token.

這是我的兩分錢:A16Z的舉動是Defi成熟的標誌。機構參與者正在參與其中,這帶來了穩定和資本。但是,重要的是不要將自己嫁給一枚硬幣。市場可以在一角錢上改變。因此,請保持知情,多樣化,並且不要在任何單一令牌上押注農場。

The fact that a16z still holds a substantial amount of COMP, even after the transfer, shows that they still believe in the project. This is further substantiated by the information that they received 1 million COMP tokens initially and still retain approximately 500,000 COMP tokens. That’s more than just a fling; it’s a relationship. But relationships, like crypto, can be complicated.

A16Z仍然擁有大量補充的事實,即使轉移後,他們仍然相信該項目。他們最初收到的100萬個補償令牌的信息進一步證實了這一點,並且仍然保留了大約500,000個補償令牌。這不僅僅是逃跑。這是一種關係。但是像加密一樣的關係可能很複雜。

The Bottom Line

底線

a16z, Compound, and Coinbase are all key players in the crypto game. This latest transaction is a reminder that the game is constantly evolving. So, keep your eyes open, do your homework, and remember: in the world of crypto, anything can happen.

A16Z,Compound和Coinbase都是加密遊戲中的關鍵參與者。這項最新的交易提醒人們,遊戲正在不斷發展。因此,保持眼睛睜開,做功課,並記住:在加密貨幣世界中,任何事情都可能發生。

Now, go forth and conquer the crypto world... or at least try not to lose all your shirt!

現在,出去征服加密世界……或至少盡量不要失去所有的襯衫!

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

-

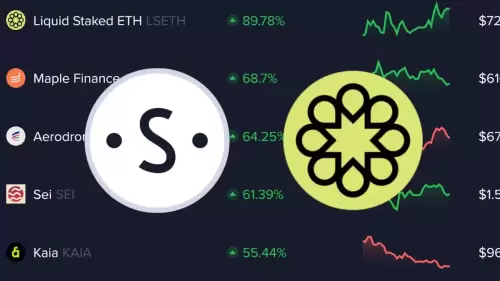

- 情感數據的隱藏寶石:您缺少的最佳性能加密

- 2025-07-01 23:10:15

- 揭開了由情感數據加油的最高表現的加密貨幣,包括隱藏的寶石和市場上意外的潮流。

-

-

- 雪崩,合作夥伴和比特幣:加密貨幣的紐約分鐘

- 2025-07-01 23:10:15

- 探索雪崩,夥伴關係和比特幣的交集,突出了加密貨幣領域的最新發展和未來趨勢。

-

-

- Zachxbt,Ripple和RLUSD採用:深度潛水

- 2025-07-01 22:30:12

- 分析Zachxbt的批評,Ripple的RLUSD採用策略以及對加密生態系統的更廣泛影響。

-

- Jasmycoin(Jasmy):看漲前景和價格預測

- 2025-07-01 23:15:11

- 根據最近的市場趨勢,分析師預測和關鍵支持水平,探索茉莉素幣的潛在看漲激增。日本的比特幣準備好突破了嗎?

-

- Open XP贖回樂觀:7月15日為OP代幣做好準備!

- 2025-07-01 22:35:12

- Superstacks於6月30日結束!從7月15日開始,通過官方應用程序兌換XP。

-

- 斧頭積分和排放減少:Axie Infinity中發生了什麼?

- 2025-07-01 22:55:12

- Axie Infinity一半軸軸承排放,影響通貨膨脹和APY。另外,新的基於收藏品還可以提高市場效率。