|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

a16z, Compound, and Coinbase: Decoding the DeFi Shuffle

Jun 29, 2025 at 02:00 am

a16z's recent COMP token transfer to Coinbase Prime sparks speculation and highlights the evolving dynamics within the DeFi lending sector. What does it mean for Compound's future?

a16z, Compound, and Coinbase: Decoding the DeFi Shuffle

The crypto world is always buzzing, and recently, the spotlight's been on a16z, Compound (COMP), and Coinbase. A big transaction has everyone talking, hinting at strategic shifts in the DeFi landscape. Let's break it down, New York style.

a16z's Big Move: COMP Tokens Head to Coinbase Prime

a16z crypto, known for its savvy investments, just moved 300,000 COMP tokens—that's about $13.75 million—to Coinbase Prime. Why Coinbase Prime? It's the VIP lounge for institutional investors, offering top-notch security, trading tools, and all the bells and whistles for managing serious digital assets. This move suggests a16z is playing chess, not checkers, with their crypto strategy.

Compound: The DeFi OG

Compound is a big deal in decentralized finance (DeFi). Launched in 2018, it lets you lend and borrow crypto without needing a bank. Think peer-to-peer lending, but with smart contracts. The COMP token is the key, giving holders a say in the protocol's future. a16z was an early believer, leading Compound's funding round back in 2020. They still hold a significant chunk of COMP, showing they're not losing faith.

Why This Matters

When a big player like a16z makes a move, the market takes notice. This transfer could mean a few things: maybe they're planning to sell some COMP, rebalance their portfolio, or use the tokens for something strategic like staking or collateral. Whatever it is, it highlights how institutional money is shaping DeFi. It also underscores the importance of governance tokens like COMP. They're not just for speculation; they give the community control.

The Price of COMP: A Wild Ride

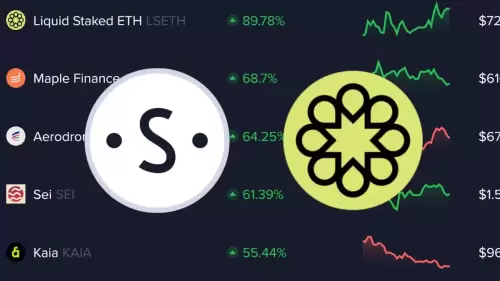

COMP's price has been all over the place. Late 2024 saw a surge, but then it dipped. As of late June 2025, it was hovering around $45.84, a far cry from its all-time high of $911.20 in May 2021. Like many governance tokens, COMP struggles to maintain long-term demand. Newer lending protocols are also giving Compound a run for its money.

What's Next for Compound?

Predictions are mixed. Some say COMP could see a small surge soon, while others are more cautious. By 2030, forecasts range from almost zero to over $1000. The truth is, it's tough to say. If DeFi picks up steam, Compound could benefit. But it's a volatile market, so buckle up.

My Take: Cautiously Optimistic

Here's my two cents: a16z's move is a sign that DeFi is maturing. Institutional players are getting involved, and that brings stability and capital. However, it's important to not marry yourself to one coin. The market can change on a dime. So, stay informed, diversify, and don't bet the farm on any single token.

The fact that a16z still holds a substantial amount of COMP, even after the transfer, shows that they still believe in the project. This is further substantiated by the information that they received 1 million COMP tokens initially and still retain approximately 500,000 COMP tokens. That’s more than just a fling; it’s a relationship. But relationships, like crypto, can be complicated.

The Bottom Line

a16z, Compound, and Coinbase are all key players in the crypto game. This latest transaction is a reminder that the game is constantly evolving. So, keep your eyes open, do your homework, and remember: in the world of crypto, anything can happen.

Now, go forth and conquer the crypto world... or at least try not to lose all your shirt!

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.