|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A16Z最近向Coinbase Prime的Comp Token转移猜测,并突出了Defi Lending部门中不断发展的动态。这对化合物的未来意味着什么?

a16z, Compound, and Coinbase: Decoding the DeFi Shuffle

A16Z,化合物和共插基:解码Defi洗牌

The crypto world is always buzzing, and recently, the spotlight's been on a16z, Compound (COMP), and Coinbase. A big transaction has everyone talking, hinting at strategic shifts in the DeFi landscape. Let's break it down, New York style.

加密世界总是在嗡嗡作响,最近,聚光灯在A16Z,Compound(Comp)和Coinbase上。一项重大交易使每个人都在谈论,暗示了Defi格局的战略转变。让我们分解,纽约风格。

a16z's Big Move: COMP Tokens Head to Coinbase Prime

A16Z的重大举动:Comp Tokens to Coinbase Prime

a16z crypto, known for its savvy investments, just moved 300,000 COMP tokens—that's about $13.75 million—to Coinbase Prime. Why Coinbase Prime? It's the VIP lounge for institutional investors, offering top-notch security, trading tools, and all the bells and whistles for managing serious digital assets. This move suggests a16z is playing chess, not checkers, with their crypto strategy.

A16Z加密货币以其精明的投资而闻名,刚刚将300,000个COMP代币(约为1375万美元)移至Coinbase Prime。为什么要共同基本?它是机构投资者的VIP休息室,提供一流的安全性,交易工具以及所有铃铛和哨子,用于管理严重的数字资产。此举表明,A16Z通过加密策略正在下棋,而不是跳棋。

Compound: The DeFi OG

化合物:defi和

Compound is a big deal in decentralized finance (DeFi). Launched in 2018, it lets you lend and borrow crypto without needing a bank. Think peer-to-peer lending, but with smart contracts. The COMP token is the key, giving holders a say in the protocol's future. a16z was an early believer, leading Compound's funding round back in 2020. They still hold a significant chunk of COMP, showing they're not losing faith.

化合物在分散的金融(DEFI)方面是一件大事。它于2018年推出,可让您无需银行就借入和借用加密货币。考虑点对点贷款,但要签订智能合同。补充令牌是关键,在协议未来为持有人提供了发言权。 A16Z是早期的信徒,在2020年领先于Compound的资金。他们仍然拥有很大一部分的补充,表明他们不会失去信心。

Why This Matters

为什么这很重要

When a big player like a16z makes a move, the market takes notice. This transfer could mean a few things: maybe they're planning to sell some COMP, rebalance their portfolio, or use the tokens for something strategic like staking or collateral. Whatever it is, it highlights how institutional money is shaping DeFi. It also underscores the importance of governance tokens like COMP. They're not just for speculation; they give the community control.

当像A16Z这样的大型球员采取行动时,市场会引起人们的注意。这种转移可能意味着几件事:也许他们计划出售一些补充,重新平衡其投资组合或将令牌用于战略性的东西,例如Stage或Collectral。无论是什么,它都强调了机构金钱如何塑造defi。它还强调了像Comp一样的治理令牌的重要性。他们不仅是为了猜测;他们给予社区控制。

The Price of COMP: A Wild Ride

Comp的价格:狂野的旅程

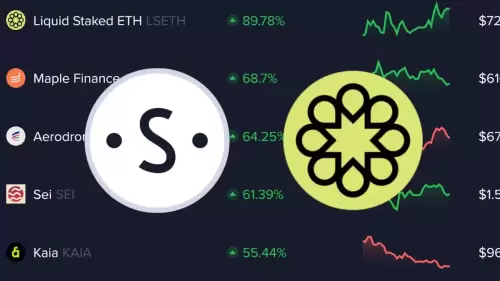

COMP's price has been all over the place. Late 2024 saw a surge, but then it dipped. As of late June 2025, it was hovering around $45.84, a far cry from its all-time high of $911.20 in May 2021. Like many governance tokens, COMP struggles to maintain long-term demand. Newer lending protocols are also giving Compound a run for its money.

Comp的价格到处都是。 2024年下半年看到了激增,但后来蘸了。截至2025年6月下旬,它徘徊在45.84美元左右,与2021年5月的历史高处的911.20美元相去甚远。与许多治理令牌一样,Comp努力以维持长期需求。较新的贷款协议也使化合物赚钱。

What's Next for Compound?

化合物的下一步是什么?

Predictions are mixed. Some say COMP could see a small surge soon, while others are more cautious. By 2030, forecasts range from almost zero to over $1000. The truth is, it's tough to say. If DeFi picks up steam, Compound could benefit. But it's a volatile market, so buckle up.

预测混合在一起。有些人说,Comp很快就会看到一小段激增,而另一些则更加谨慎。到2030年,预测范围从零到$ 1000不等。事实是,很难说。如果Defi接收Steam,则Compound可能会受益。但这是一个动荡的市场,所以扣紧了。

My Take: Cautiously Optimistic

我的看法:谨慎乐观

Here's my two cents: a16z's move is a sign that DeFi is maturing. Institutional players are getting involved, and that brings stability and capital. However, it's important to not marry yourself to one coin. The market can change on a dime. So, stay informed, diversify, and don't bet the farm on any single token.

这是我的两分钱:A16Z的举动是Defi成熟的标志。机构参与者正在参与其中,这带来了稳定和资本。但是,重要的是不要将自己嫁给一枚硬币。市场可以在一角钱上改变。因此,请保持知情,多样化,并且不要在任何单一令牌上押注农场。

The fact that a16z still holds a substantial amount of COMP, even after the transfer, shows that they still believe in the project. This is further substantiated by the information that they received 1 million COMP tokens initially and still retain approximately 500,000 COMP tokens. That’s more than just a fling; it’s a relationship. But relationships, like crypto, can be complicated.

A16Z仍然拥有大量补充的事实,即使转移后,他们仍然相信该项目。他们最初收到的100万个补偿令牌的信息进一步证实了这一点,并且仍然保留了大约500,000个补偿令牌。这不仅仅是逃跑。这是一种关系。但是像加密一样的关系可能很复杂。

The Bottom Line

底线

a16z, Compound, and Coinbase are all key players in the crypto game. This latest transaction is a reminder that the game is constantly evolving. So, keep your eyes open, do your homework, and remember: in the world of crypto, anything can happen.

A16Z,Compound和Coinbase都是加密游戏中的关键参与者。这项最新的交易提醒人们,游戏正在不断发展。因此,保持眼睛睁开,做功课,并记住:在加密货币世界中,任何事情都可能发生。

Now, go forth and conquer the crypto world... or at least try not to lose all your shirt!

现在,出去征服加密世界……或至少尽量不要失去所有的衬衫!

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

-

- 情感数据的隐藏宝石:您缺少的最佳性能加密

- 2025-07-01 23:10:15

- 揭开了由情感数据加油的最高表现的加密货币,包括隐藏的宝石和市场上意外的潮流。

-

-

- 雪崩,合作伙伴和比特币:加密货币的纽约分钟

- 2025-07-01 23:10:15

- 探索雪崩,伙伴关系和比特币的交集,突出了加密货币领域的最新发展和未来趋势。

-

-

- Zachxbt,Ripple和RLUSD采用:深度潜水

- 2025-07-01 22:30:12

- 分析Zachxbt的批评,Ripple的RLUSD采用策略以及对加密生态系统的更广泛影响。

-

- Jasmycoin(Jasmy):看涨前景和价格预测

- 2025-07-01 23:15:11

- 根据最近的市场趋势,分析师预测和关键支持水平,探索茉莉素币的潜在看涨激增。日本的比特币准备好突破了吗?

-

- Open XP赎回乐观:7月15日为OP代币做好准备!

- 2025-07-01 22:35:12

- Superstacks于6月30日结束!从7月15日开始,通过官方应用程序兑换XP。

-

- 斧头积分和排放减少:Axie Infinity中发生了什么?

- 2025-07-01 22:55:12

- Axie Infinity一半轴轴承排放,影响通货膨胀和APY。另外,新的基于收藏品还可以提高市场效率。