|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

深入了解 AAVE、USDC 和 DeFi 流動性的世界。發現關鍵趨勢、見解以及塑造去中心化金融未來的因素。

AAVE, USDC, and liquidity are at the heart of decentralized finance (DeFi). Let's break down the latest trends and insights shaping this dynamic space. The most recent developments highlight Aave's growing integration with real-world asset tokenization and liquidity management solutions.

AAVE、USDC 和流動性是去中心化金融(DeFi)的核心。讓我們來分析一下塑造這個動態空間的最新趨勢和見解。最新的發展凸顯了 Aave 與現實世界資產代幣化和流動性管理解決方案的日益融合。

AAVE's Technical Resilience and Market Position

AAVE 的技術彈性和市場地位

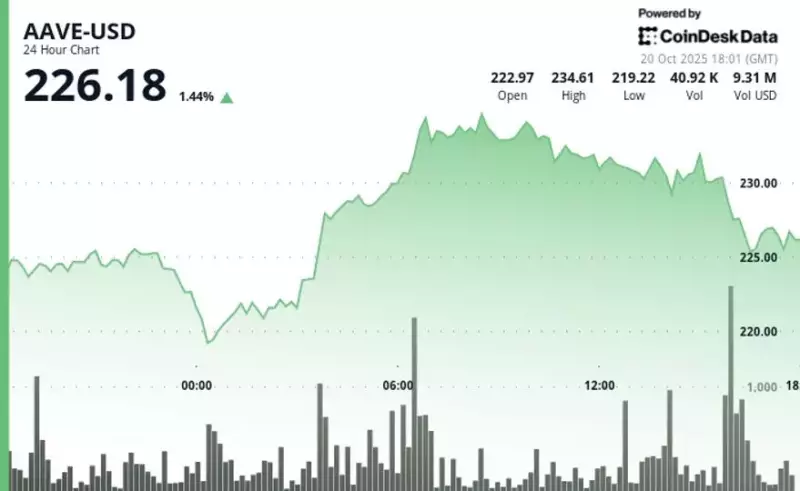

AAVE has shown resilience, testing lower Bollinger Band support at $215. Despite a broader downtrend, the token attempts to bounce from oversold conditions, reflecting broader crypto market dynamics. Technical analysis reveals a struggle to maintain gains above key moving averages, with the 7-day SMA at $231.19 acting as immediate resistance. The Daily RSI hovers in neutral-to-oversold territory, suggesting potential for further upside if buying pressure emerges.

AAVE 表現出了韌性,測試了布林帶下限支撐位 215 美元。儘管出現更廣泛的下跌趨勢,但該代幣試圖從超賣狀況中反彈,反映了更廣泛的加密市場動態。技術分析顯示,維持漲幅高於關鍵移動均線的難度很大,231.19 美元的 7 日移動平均線是直接阻力。每日 RSI 徘徊在中性至超賣區域,表明如果出現購買壓力,則有可能進一步上漲。

USDC and Institutional Lending

USDC 和機構貸款

Aave is gaining momentum in the tokenized asset lending market. Grove, closely related to Sky, plans to supply RLUSD and Circle's USDC stablecoins to Horizon, Aave's new institutional lending market. This integration, pending governance approval, aims to deepen liquidity for institutions borrowing against tokenized real-world assets. By using assets like U.S. Treasury tokens as collateral, Aave could transform tokenized assets into practical working capital.

Aave 在代幣化資產借貸市場中勢頭強勁。 Grove 與 Sky 關係密切,計劃向 Aave 的新機構借貸市場 Horizon 提供 RLUSD 和 Circle 的 USDC 穩定幣。此次整合正在等待治理批准,旨在加深機構以代幣化現實資產借款的流動性。通過使用美國國債代幣等資產作為抵押品,Aave 可以將代幣化資產轉化為實際的營運資金。

Liquidity Distribution and Turtle's Role

流動性分佈和海龜的角色

Liquidity distribution is getting a major upgrade. Turtle, an on-chain liquidity distribution protocol, recently raised an additional $5.5 million, bringing its total funding to $11.7 million. Turtle connects capital and protocols through a transparent, data-driven coordination layer, curating opportunities, consolidating liquidity, and distributing them across a network of partners. This approach addresses the fragmentation in the liquidity market, aligning incentives between liquidity providers and protocols.

流動性分配正在重大升級。 Turtle 是一種鏈上流動性分配協議,最近又籌集了 550 萬美元,使其總資金達到 1170 萬美元。 Turtle 通過透明的、數據驅動的協調層連接資本和協議,策劃機會,整合流動性,並將其分配給合作夥伴網絡。這種方法解決了流動性市場的碎片化問題,調整了流動性提供者和協議之間的激勵措施。

Whale Movements and Market Sentiment

鯨魚運動和市場情緒

Keep an eye on whale activity! Recently, a well-known whale deposited $30 million in USDC to Hyperliquid and opened a 10x short position on Bitcoin. This move highlights lingering bearish sentiment despite Bitcoin's attempts to recover. While the market watches these high-profile trades, it's crucial to remember that on-chain data has its limits, and these moves might not tell the whole story.

密切關注鯨魚活動!最近,一位知名鯨魚向 Hyperliquid 存入了 3000 萬美元的 USDC,並開設了 10 倍的比特幣空頭頭寸。儘管比特幣試圖復甦,但此舉凸顯了揮之不去的看跌情緒。雖然市場關注這些備受矚目的交易,但重要的是要記住,鏈上數據有其局限性,而且這些舉措可能並不能說明全部情況。

Final Thoughts

最後的想法

So, what’s the takeaway? AAVE, USDC, and liquidity are evolving rapidly. From technical bounces and institutional lending to innovative liquidity solutions, the DeFi landscape is full of opportunities and challenges. Keep your eyes peeled, do your own research, and remember: in the world of crypto, anything can happen!

那麼,要點是什麼? AAVE、USDC 和流動性正在迅速發展。從技術反彈和機構借貸到創新的流動性解決方案,DeFi 領域充滿機遇和挑戰。請擦亮眼睛,進行自己的研究,並記住:在加密世界中,任何事情都可能發生!

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。