|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

深入了解 AAVE、USDC 和 DeFi 流动性的世界。发现关键趋势、见解以及塑造去中心化金融未来的因素。

AAVE, USDC, and liquidity are at the heart of decentralized finance (DeFi). Let's break down the latest trends and insights shaping this dynamic space. The most recent developments highlight Aave's growing integration with real-world asset tokenization and liquidity management solutions.

AAVE、USDC 和流动性是去中心化金融(DeFi)的核心。让我们来分析一下塑造这个动态空间的最新趋势和见解。最新的发展凸显了 Aave 与现实世界资产代币化和流动性管理解决方案的日益融合。

AAVE's Technical Resilience and Market Position

AAVE 的技术弹性和市场地位

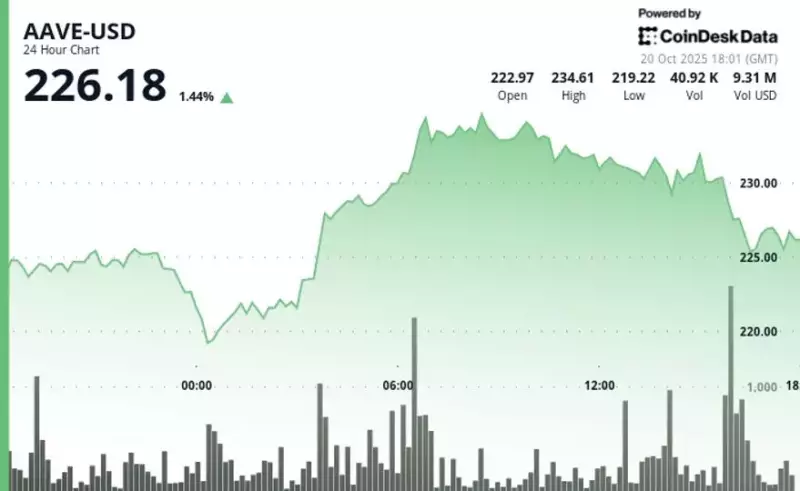

AAVE has shown resilience, testing lower Bollinger Band support at $215. Despite a broader downtrend, the token attempts to bounce from oversold conditions, reflecting broader crypto market dynamics. Technical analysis reveals a struggle to maintain gains above key moving averages, with the 7-day SMA at $231.19 acting as immediate resistance. The Daily RSI hovers in neutral-to-oversold territory, suggesting potential for further upside if buying pressure emerges.

AAVE 表现出了韧性,测试了布林带下限支撑位 215 美元。尽管出现更广泛的下跌趋势,但该代币试图从超卖状况中反弹,反映了更广泛的加密市场动态。技术分析显示,维持涨幅高于关键移动均线的难度很大,231.19 美元的 7 日移动平均线是直接阻力。每日 RSI 徘徊在中性至超卖区域,表明如果出现购买压力,则有可能进一步上涨。

USDC and Institutional Lending

USDC 和机构贷款

Aave is gaining momentum in the tokenized asset lending market. Grove, closely related to Sky, plans to supply RLUSD and Circle's USDC stablecoins to Horizon, Aave's new institutional lending market. This integration, pending governance approval, aims to deepen liquidity for institutions borrowing against tokenized real-world assets. By using assets like U.S. Treasury tokens as collateral, Aave could transform tokenized assets into practical working capital.

Aave 在代币化资产借贷市场中势头强劲。 Grove 与 Sky 关系密切,计划向 Aave 的新机构借贷市场 Horizon 提供 RLUSD 和 Circle 的 USDC 稳定币。此次整合正在等待治理批准,旨在加深机构以代币化现实资产借款的流动性。通过使用美国国债代币等资产作为抵押品,Aave 可以将代币化资产转化为实际的营运资金。

Liquidity Distribution and Turtle's Role

流动性分布和海龟的角色

Liquidity distribution is getting a major upgrade. Turtle, an on-chain liquidity distribution protocol, recently raised an additional $5.5 million, bringing its total funding to $11.7 million. Turtle connects capital and protocols through a transparent, data-driven coordination layer, curating opportunities, consolidating liquidity, and distributing them across a network of partners. This approach addresses the fragmentation in the liquidity market, aligning incentives between liquidity providers and protocols.

流动性分配正在重大升级。 Turtle 是一种链上流动性分配协议,最近又筹集了 550 万美元,使其总资金达到 1170 万美元。 Turtle 通过透明的、数据驱动的协调层连接资本和协议,策划机会,整合流动性,并将其分配给合作伙伴网络。这种方法解决了流动性市场的碎片化问题,调整了流动性提供者和协议之间的激励措施。

Whale Movements and Market Sentiment

鲸鱼运动和市场情绪

Keep an eye on whale activity! Recently, a well-known whale deposited $30 million in USDC to Hyperliquid and opened a 10x short position on Bitcoin. This move highlights lingering bearish sentiment despite Bitcoin's attempts to recover. While the market watches these high-profile trades, it's crucial to remember that on-chain data has its limits, and these moves might not tell the whole story.

密切关注鲸鱼活动!最近,一位知名鲸鱼向 Hyperliquid 存入了 3000 万美元的 USDC,并开设了 10 倍的比特币空头头寸。尽管比特币试图复苏,但此举凸显了挥之不去的看跌情绪。虽然市场关注这些备受瞩目的交易,但重要的是要记住,链上数据有其局限性,而且这些举措可能并不能说明全部情况。

Final Thoughts

最后的想法

So, what’s the takeaway? AAVE, USDC, and liquidity are evolving rapidly. From technical bounces and institutional lending to innovative liquidity solutions, the DeFi landscape is full of opportunities and challenges. Keep your eyes peeled, do your own research, and remember: in the world of crypto, anything can happen!

那么,要点是什么? AAVE、USDC 和流动性正在迅速发展。从技术反弹和机构借贷到创新的流动性解决方案,DeFi 领域充满机遇和挑战。请擦亮眼睛,进行自己的研究,并记住:在加密世界中,任何事情都可能发生!

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

-

-

- 避险抛售狂潮中,比特币触及 8.3 万美元,ETF 资金大量流出

- 2026-01-31 01:17:20

- 由于避险情绪引发大量抛售,比特币价格徘徊在 8.3 万美元左右,ETF 经历了大量资金外流和清算增加。

-

-

-

-

-

-

- 法夫学校校长因虐待男生腰带而被定罪

- 2026-01-31 00:15:16

- 前校长亚历山大·卡梅伦因使用皮带和其他手段惩罚欧文斯通学校的小男孩而被判犯有袭击罪。该案凸显了历史上的体罚做法。