Dive into the world of AAVE, USDC, and liquidity in DeFi. Discover key trends, insights, and what's shaping the future of decentralized finance.

AAVE, USDC, and liquidity are at the heart of decentralized finance (DeFi). Let's break down the latest trends and insights shaping this dynamic space. The most recent developments highlight Aave's growing integration with real-world asset tokenization and liquidity management solutions.

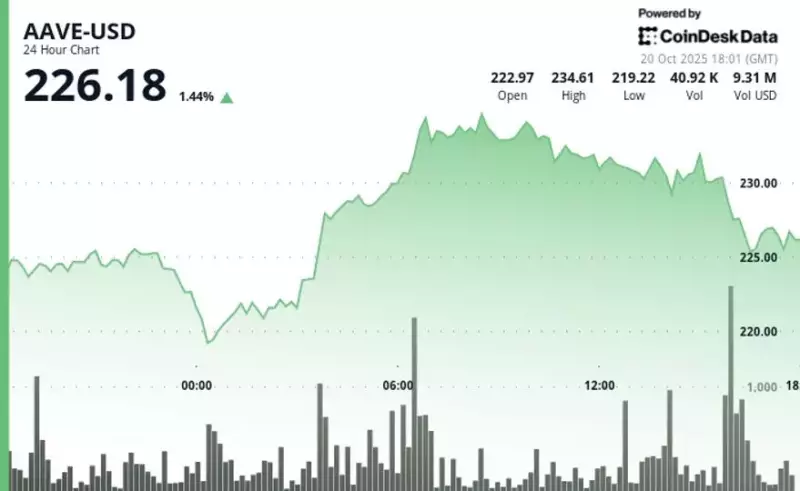

AAVE's Technical Resilience and Market Position

AAVE has shown resilience, testing lower Bollinger Band support at $215. Despite a broader downtrend, the token attempts to bounce from oversold conditions, reflecting broader crypto market dynamics. Technical analysis reveals a struggle to maintain gains above key moving averages, with the 7-day SMA at $231.19 acting as immediate resistance. The Daily RSI hovers in neutral-to-oversold territory, suggesting potential for further upside if buying pressure emerges.

USDC and Institutional Lending

Aave is gaining momentum in the tokenized asset lending market. Grove, closely related to Sky, plans to supply RLUSD and Circle's USDC stablecoins to Horizon, Aave's new institutional lending market. This integration, pending governance approval, aims to deepen liquidity for institutions borrowing against tokenized real-world assets. By using assets like U.S. Treasury tokens as collateral, Aave could transform tokenized assets into practical working capital.

Liquidity Distribution and Turtle's Role

Liquidity distribution is getting a major upgrade. Turtle, an on-chain liquidity distribution protocol, recently raised an additional $5.5 million, bringing its total funding to $11.7 million. Turtle connects capital and protocols through a transparent, data-driven coordination layer, curating opportunities, consolidating liquidity, and distributing them across a network of partners. This approach addresses the fragmentation in the liquidity market, aligning incentives between liquidity providers and protocols.

Whale Movements and Market Sentiment

Keep an eye on whale activity! Recently, a well-known whale deposited $30 million in USDC to Hyperliquid and opened a 10x short position on Bitcoin. This move highlights lingering bearish sentiment despite Bitcoin's attempts to recover. While the market watches these high-profile trades, it's crucial to remember that on-chain data has its limits, and these moves might not tell the whole story.

Final Thoughts

So, what’s the takeaway? AAVE, USDC, and liquidity are evolving rapidly. From technical bounces and institutional lending to innovative liquidity solutions, the DeFi landscape is full of opportunities and challenges. Keep your eyes peeled, do your own research, and remember: in the world of crypto, anything can happen!