|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Federal Reserve and Bitcoin: No Interest in Stockpiling

Dec 19, 2024 at 05:14 pm

Federal Reserve Chair Jerome Powell clarified that the U.S. central bank has no intention of stockpiling bitcoin. During a press conference following the latest policy meeting, Powell stated that the Fed is not allowed to own bitcoin.

Federal Reserve Chair Jerome Powell has stated that the U.S. central bank is not permitted to own bitcoin, and this issue is for Congress to handle.

During a press conference following the latest policy meeting, Powell was asked about the possibility of the U.S. government accumulating large amounts of bitcoin, particularly in the context of a potential government-backed Bitcoin reserve.

“We’re not allowed to own bitcoin,” Powell said. “This is something for Congress.”

The idea of a “Strategic Bitcoin Reserve” has gained traction since President-elect Donald Trump’s election victory. The concept, which was suggested by Trump, proposes that the U.S. government could stockpile bitcoin, potentially using assets seized from criminals.

However, specifics about how this reserve would work remain unclear. Some have speculated that the reserve could involve buying up to 200,000 bitcoins annually, eventually reaching a total of 1 million tokens. This would be funded through the U.S. Treasury’s gold holdings and Fed bank deposits.

Bitcoin has been on an upward trend since Trump’s victory, with its value more than doubling this year. The currency has surged past $100,000, fueled by optimism over Trump’s crypto-friendly policies.

However, while bitcoin and other crypto assets have gained popularity, they are still largely seen as speculative investments rather than practical alternatives to traditional currency. The volatility of bitcoin and its 15-year history of large price swings make it less effective as a stable store of value or a reliable unit of exchange, two critical aspects of a reserve currency.

The proposal to create a Strategic Bitcoin Reserve faces several legal and regulatory hurdles. For one, it would likely require approval from Congress.

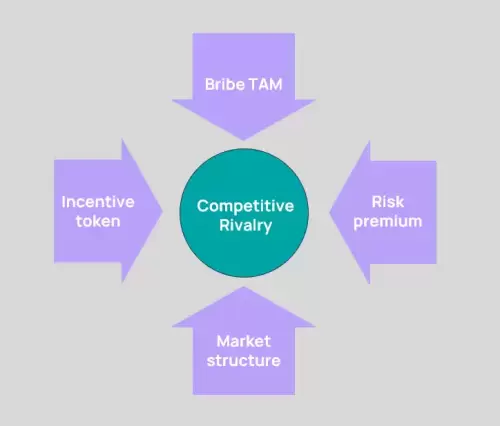

Additionally, such a move could necessitate new Treasury debt and raise questions about how the government would fund the reserve. Barclays analysts have pointed out that creating a reserve of this size would likely encounter strong resistance from the Fed, given its current stance on crypto assets.

Powell’s remarks emphasize that the central bank is not looking for changes to its legal position regarding bitcoin.

Powell and other Fed officials have expressed skepticism toward cryptocurrencies. Although the Fed has not pushed for its own digital dollar, it has focused on monitoring how crypto assets interact with the banking sector.

Powell explained that the Fed’s main concern is ensuring that the relationship between crypto businesses and banks does not pose a threat to the stability of the banking system. However, the Fed does not directly regulate crypto assets themselves, leaving that responsibility to other agencies.

As part of his administration’s focus on crypto, Trump plans to appoint former PayPal executive David Sacks as the White House’s AI and Crypto Czar. He also intends to place pro-crypto consultant Paul Atkins in charge of the Securities and Exchange Commission.

This signals a shift toward a more hands-off approach from the government on crypto matters. However, the details about what this new leadership will mean for the future of crypto regulation remain to be seen.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.