|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Blast, a layer 2 scaling network for Ethereum, is struggling to recover amid a mass exodus following its June airdrop

Aug 20, 2024 at 07:01 pm

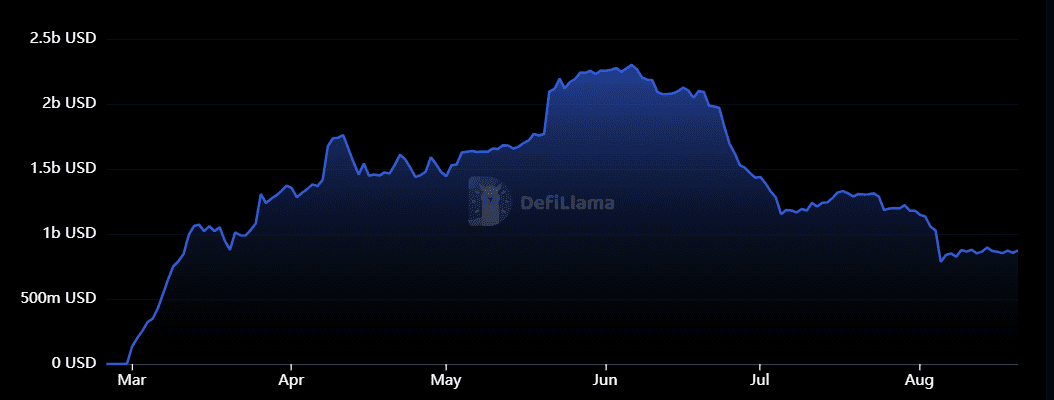

The network has lost over $300 million in liquidity, with its total value locked (TVL) declining from $1.1 billion to $785 million

Blast, a layer 2 scaling network for Ethereum, is still trying to recover from a mass exodus of users following its June airdrop. At the start of August, the network lost over $300 million in liquidity, with its total value locked (TVL) declining from $1.1 billion to $785 million by August 5, its lowest level in six months.

The network has managed to recover over $100 million in TVL within two weeks, but it still struggles to attract liquidity. The TVL figure is down over 60% since setting a record high of $2.3 billion at the beginning of June. In April, we reported that the network’s TVL had surged to over $1.7 billion shortly after its launch.

According to data from growthepie, the number of daily users on Blast dropped to 27,800 on August 18, which was the lowest level since the end of February, when the scaling solution launched.

In mid-June, over 180,000 wallets per day were using Blast-based decentralized applications (dapps).

Blast’s user activity pales in comparison to that of Base or Arbitrum, whose daily active wallets surpassed 740,000 and 360,000, respectively.

The dramatic decline in Blast’s key metrics suggests that decentralized finance (DeFi) projects and public decentralized networks should pay closer attention to securing organic growth and focus on their communities and use cases. It turns out that the rapid growth of the ecosystem was driven by the highly anticipated airdrop. However, once the giveaway began in June, reactions were mixed, with many users being disappointed with the token-claiming process and its allocation.

Not only were airdrop participants unhappy with the network’s approach, some projects building on Blast were also frustrated. For instance, Pacmoon, once the largest meme coin on the layer 2, is migrating to Solana. Pacmoon’s Lamboland said on X:

“We think that tokens, community, and culture are what make a blockchain successful. However, Blast never focused on that. In fact, they created a system where native tokens on Blast are actively disincentivized and they provided zero social support.”

Stay updated:

Subscribe to our newsletter using this link – we won’t spam!

Follow us on X and Telegram.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.