|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

该网络损失了超过 3 亿美元的流动性,其锁定总价值 (TVL) 从 11 亿美元下降至 7.85 亿美元

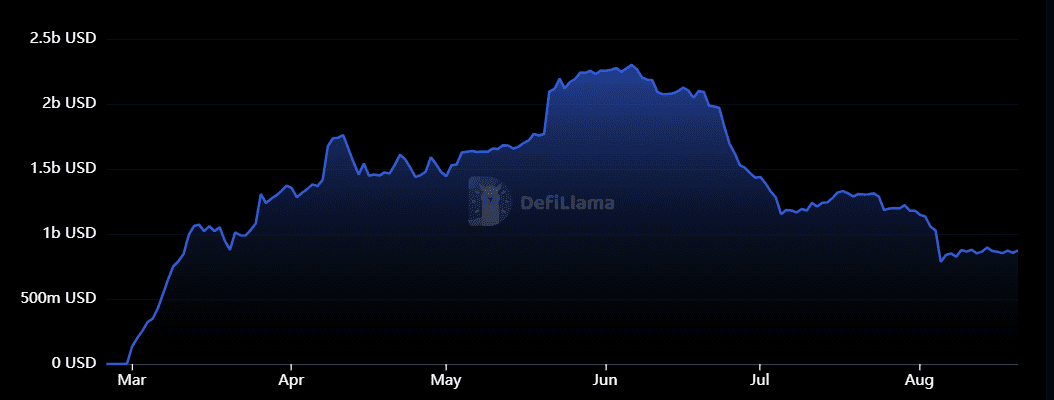

Blast, a layer 2 scaling network for Ethereum, is still trying to recover from a mass exodus of users following its June airdrop. At the start of August, the network lost over $300 million in liquidity, with its total value locked (TVL) declining from $1.1 billion to $785 million by August 5, its lowest level in six months.

Blast 是以太坊的第 2 层扩展网络,仍在努力从 6 月空投后的大量用户流失中恢复过来。 8 月初,该网络损失了超过 3 亿美元的流动性,截至 8 月 5 日,其锁定总价值 (TVL) 从 11 亿美元下降至 7.85 亿美元,为六个月来的最低水平。

The network has managed to recover over $100 million in TVL within two weeks, but it still struggles to attract liquidity. The TVL figure is down over 60% since setting a record high of $2.3 billion at the beginning of June. In April, we reported that the network’s TVL had surged to over $1.7 billion shortly after its launch.

该网络已在两周内成功收回超过 1 亿美元的 TVL,但仍难以吸引流动性。自 6 月初创下 23 亿美元的历史新高以来,TVL 数字已下降超过 60%。 4 月份,我们报道称该网络的 TVL 在推出后不久就飙升至 17 亿美元以上。

According to data from growthepie, the number of daily users on Blast dropped to 27,800 on August 18, which was the lowest level since the end of February, when the scaling solution launched.

Growthepie的数据显示,8月18日,Blast的日活用户数降至27,800人,这是自2月底推出扩容解决方案以来的最低水平。

In mid-June, over 180,000 wallets per day were using Blast-based decentralized applications (dapps).

6 月中旬,每天有超过 180,000 个钱包使用基于 Blast 的去中心化应用程序 (dapp)。

Blast’s user activity pales in comparison to that of Base or Arbitrum, whose daily active wallets surpassed 740,000 and 360,000, respectively.

Blast 的用户活动与 Base 或 Arbitrum 相比相形见绌,后者的日活跃钱包分别超过 74 万和 36 万。

The dramatic decline in Blast’s key metrics suggests that decentralized finance (DeFi) projects and public decentralized networks should pay closer attention to securing organic growth and focus on their communities and use cases. It turns out that the rapid growth of the ecosystem was driven by the highly anticipated airdrop. However, once the giveaway began in June, reactions were mixed, with many users being disappointed with the token-claiming process and its allocation.

Blast 关键指标的急剧下降表明,去中心化金融 (DeFi) 项目和公共去中心化网络应更加关注确保有机增长,并关注其社区和用例。事实证明,生态系统的快速增长是由备受期待的空投推动的。然而,当赠品活动于 6 月开始后,反应不一,许多用户对代币领取过程及其分配感到失望。

Not only were airdrop participants unhappy with the network’s approach, some projects building on Blast were also frustrated. For instance, Pacmoon, once the largest meme coin on the layer 2, is migrating to Solana. Pacmoon’s Lamboland said on X:

空投参与者不仅对该网络的做法不满意,一些基于 Blast 的项目也感到沮丧。例如,Pacmoon,曾经是第 2 层最大的 meme 币,正在迁移到 Solana。 Pacmoon 的 Lamboland 在 X 上说道:

“We think that tokens, community, and culture are what make a blockchain successful. However, Blast never focused on that. In fact, they created a system where native tokens on Blast are actively disincentivized and they provided zero social support.”

“我们认为代币、社区和文化是区块链成功的因素。然而,Blast 从未关注过这一点。事实上,他们创建了一个系统,其中 Blast 上的原生代币被积极抑制,并且他们提供了零社会支持。”

Stay updated:

保持更新:

Subscribe to our newsletter using this link – we won’t spam!

使用此链接订阅我们的时事通讯 - 我们不会发送垃圾邮件!

Follow us on X and Telegram.

在 X 和 Telegram 上关注我们。

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

- 比特币:策略公司的风险下注还是抢士?

- 2025-09-22 23:55:52

- 尽管价格下跌,Strategy Inc.还是购买了更多的比特币。这是冒险的赌注还是精明的举动?让我们研究比特币的战略和市场波动。

-

- 等离子体,Stablecoin,Neobank:数字金融的新时代?

- 2025-09-22 23:54:39

- 探索等离子体,稳定币和Neobanks的融合,重点是等离子体对全球数字美元访问的创新方法。

-

-

- Steam,Crypto游戏和骗局:保持安全的纽约分钟

- 2025-09-22 23:50:45

- Steam用加密恶意软件的刷子突出了游戏和加密骗局的增长。了解如何在Web3游戏的野生西部保持安全。

-

- Solana的机构激增:解码每周流入

- 2025-09-22 23:46:38

- 索拉纳(Solana)以1.27亿美元的机构流入转向头部。是什么驱动了这一激增,Sol可以达到500美元?让我们研究每周的细节。

-

- 机构觉醒:在风格上浏览加密货币未来

- 2025-09-22 23:46:30

- 探索机构投资,尤其是通过ETF,如何重塑加密货币景观,从而影响从市场动态到监管框架的所有事物。

-

- 钢制房屋:象征性社区中抗飓风的避风港?

- 2025-09-22 23:45:10

- 探索令牌社区中钢制房屋的兴起,在佛罗里达和德克萨斯州提供飓风抵抗和负担能力。

-

-