-

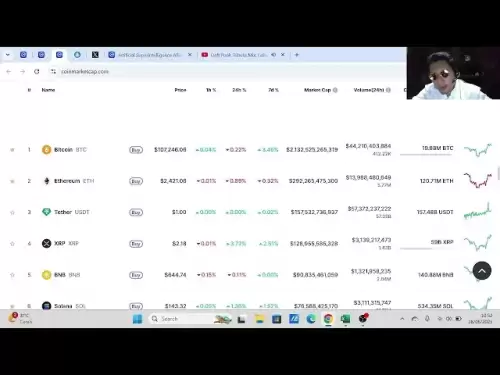

Bitcoin

Bitcoin $107,490.3555

0.12% -

Ethereum

Ethereum $2,429.0242

-0.68% -

Tether USDt

Tether USDt $1.0003

-0.01% -

XRP

XRP $2.1909

4.62% -

BNB

BNB $647.0228

0.21% -

Solana

Solana $145.4573

2.77% -

USDC

USDC $0.9998

0.00% -

TRON

TRON $0.2743

1.11% -

Dogecoin

Dogecoin $0.1629

0.78% -

Cardano

Cardano $0.5639

1.17% -

Hyperliquid

Hyperliquid $36.8090

0.45% -

Bitcoin Cash

Bitcoin Cash $498.6939

-0.90% -

Sui

Sui $2.7064

2.60% -

Chainlink

Chainlink $13.1161

0.01% -

UNUS SED LEO

UNUS SED LEO $9.0785

0.73% -

Stellar

Stellar $0.2383

1.62% -

Avalanche

Avalanche $17.6030

0.75% -

Toncoin

Toncoin $2.8449

0.32% -

Shiba Inu

Shiba Inu $0.0...01137

1.06% -

Litecoin

Litecoin $85.4672

0.49% -

Hedera

Hedera $0.1473

2.72% -

Monero

Monero $314.3940

1.03% -

Bitget Token

Bitget Token $4.7116

0.51% -

Dai

Dai $1.0001

0.02% -

Polkadot

Polkadot $3.3462

1.11% -

Ethena USDe

Ethena USDe $1.0004

0.04% -

Uniswap

Uniswap $6.9306

0.38% -

Pi

Pi $0.5343

-2.80% -

Pepe

Pepe $0.0...09292

0.33% -

Aave

Aave $255.4154

-0.75%

Is the low opening volume on the next day of the daily limit a wash? Under what circumstances can it be retained?

A daily limit in crypto restricts price movement, and low opening volume post-limit may signal hesitation or manipulation.

Jun 28, 2025 at 10:57 am

Understanding the Daily Limit in Cryptocurrency Markets

In cryptocurrency trading, a daily limit refers to the maximum price movement allowed within a single trading session. While traditional stock markets often have circuit breakers to halt trading when prices swing beyond set thresholds, cryptocurrency exchanges do not universally enforce daily limits, though some platforms may implement them during periods of high volatility or manipulation attempts.

When a digital asset hits its upper or lower daily limit, it means that trading is temporarily restricted, preventing further buying or selling at extreme prices. This mechanism aims to prevent panic selling or speculative bubbles, especially for smaller-cap tokens prone to sharp price swings.

What Is Low Opening Volume and Why Does It Matter?

The term "low opening volume" refers to a situation where an asset opens the next trading session with significantly reduced trading activity compared to its previous session. In crypto markets, this can signal lack of interest, uncertainty among traders, or deliberate market manipulation.

After a token hits a daily limit, the next day's open becomes crucial. If the volume remains low, it may indicate that market participants are hesitant to engage with the asset, possibly due to unclear fundamentals, regulatory concerns, or technical issues on the exchange itself.

Is Low Opening Volume After a Daily Limit Considered a Wash?

A "wash trade" is a manipulative practice where a trader buys and sells the same asset to create artificial volume or manipulate price action without actual change in ownership. When an asset experiences a daily limit followed by low opening volume, it raises questions about whether the prior volume was genuine or artificially inflated.

If the volume drops dramatically after hitting a limit, and there is no significant news or event to justify the decline, it may suggest that the previous surge was wash trading. However, confirming this requires deeper analysis of order books, trade sizes, and exchange data.

- Analyze time-stamped trades to detect repetitive patterns

- Examine wallet movements associated with large trades

- Compare off-chain and on-chain transaction volumes

These steps help determine if the volume preceding the daily limit was legitimate or fabricated.

Under What Conditions Can Low Opening Volume Be Retained Without Being Wash Trading?

There are several legitimate reasons why low opening volume might persist after a daily limit:

- Market fatigue: After rapid price movements, traders may pause to reassess positions before placing new orders.

- Liquidity constraints: Some exchanges may struggle to maintain consistent liquidity, especially for less popular tokens.

- Regulatory developments: Announcements from authorities regarding taxation, compliance, or bans can cause hesitation.

- Seasonal or cyclical trends: Certain assets experience predictable lulls based on investor behavior or macroeconomic factors.

- Exchange-specific issues: Technical downtimes or maintenance can reduce trading activity temporarily.

In such cases, low volume does not necessarily imply manipulation, but rather reflects current market conditions and sentiment.

How to Differentiate Between Genuine and Artificial Volume Patterns

To assess whether low opening volume following a daily limit is part of normal market behavior or indicative of wash trading, consider the following indicators:

- Order book depth: Real volume typically correlates with deep order books; wash trades often show shallow liquidity.

- Time between trades: Artificial volume tends to cluster closely in time, while organic trading shows more dispersion.

- Wallet tracking: Use blockchain explorers to trace large trades back to unique wallets and check for circular transfers.

- Volume-to-trade ratio: A disproportionately high number of trades relative to total volume may suggest spoofing or wash activity.

- Exchange reputation: Established platforms with strong anti-manipulation policies are less likely to host wash trading.

Using these tools helps traders and analysts distinguish between legitimate market behavior and potentially fraudulent practices.

Technical Steps to Monitor Post-Daily Limit Volume Behavior

For traders seeking to analyze post-limit volume behavior manually or via bots, follow these steps:

- Access real-time or historical trade data from reliable APIs like CoinGecko, CoinMarketCap, or CryptoCompare

- Export the data into a spreadsheet or analytics tool (e.g., Excel, Python with Pandas)

- Filter trades that occurred just before and after the daily limit event

- Calculate average volume per minute/hour and compare it to baseline levels

- Plot candlestick charts overlaid with volume indicators to visualize anomalies

- Cross-reference with social media, news feeds, or regulatory updates around the event

These methods allow traders to build a clearer picture of whether volume patterns are natural or manipulated.

Frequently Asked Questions

Q: How do I know if a daily limit was triggered on a specific cryptocurrency?

A: Check the official announcements or market status pages of the exchange hosting the token. Some platforms display real-time alerts when limits are reached.

Q: Can decentralized exchanges (DEXs) also trigger daily limits?

A: Most DEXs operate without centralized price controls, so daily limits are rarely enforced unless governed by smart contract rules or protocol-level mechanisms.

Q: Are there legal consequences for engaging in wash trading in crypto markets?

A: Yes, many jurisdictions classify wash trading as market manipulation, which can result in fines or criminal charges depending on local regulations.

Q: Do all exchanges report accurate volume figures?

A: No, some exchanges inflate their reported volume through bots or internal transfers. Always cross-check with third-party analytics platforms for verified volume metrics.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

- Undervalued Crypto Gems: Time to Buy Now?

- 2025-06-28 14:30:12

- Stablecoins, Risk Reward, and Regulation: Navigating the Crypto Minefield

- 2025-06-28 14:30:12

- Binance Coin (BNB): Whale Moves, Exchange Activity, and the Path to $900?

- 2025-06-28 14:50:13

- XRP Lawsuit: SEC Appeal Looms, Lawyer Warns – Is It Really Over?

- 2025-06-28 15:10:16

- Bitcoin's Long-Term Holders: An Accumulation Signal You Can't Ignore

- 2025-06-28 15:30:12

- Bitcoin, Elections, and Voters: A New Political Force?

- 2025-06-28 15:30:12

Related knowledge

Can I add positions after the EXPMA golden cross steps back on the yellow line?

Jun 28,2025 at 11:57am

Understanding the EXPMA Indicator and Its RelevanceThe EXPMA (Exponential Moving Average) is a technical analysis tool used by traders to identify trends and potential entry or exit points in financial markets, including cryptocurrency trading. Unlike simple moving averages, EXPMA gives more weight to recent price data, making it more responsive to new ...

How to operate the next day after the daily limit is released with huge volume?

Jun 28,2025 at 12:35pm

Understanding the Daily Limit and Its ReleaseIn cryptocurrency trading, daily limits are often set by exchanges to manage volatility or during periods of high market activity. These limits can restrict how much an asset's price can fluctuate within a 24-hour period. When the daily limit is released, it typically means that the price cap has been lifted,...

Can I chase after the W bottom neckline breaks through with large volume?

Jun 28,2025 at 07:28am

Understanding the W Bottom Pattern in Cryptocurrency TradingThe W bottom pattern is a common technical analysis formation used by traders to identify potential bullish reversals. In cryptocurrency markets, this pattern typically appears after a downtrend and signals that the selling pressure may be diminishing. The structure of the W bottom includes two...

Is it effective if the gap is not filled for three days?

Jun 28,2025 at 01:00pm

Understanding Gaps in Cryptocurrency MarketsIn the context of cryptocurrency trading, a gap refers to a situation where the price of an asset opens significantly higher or lower than its previous closing price, with no trading activity occurring in between. These gaps are commonly observed during periods of high volatility, especially when major news ev...

Is it necessary to clear the position when the 5-day moving average crosses the 10-day moving average?

Jun 27,2025 at 07:21pm

Understanding the 5-Day and 10-Day Moving AveragesIn the realm of technical analysis within the cryptocurrency market, moving averages play a crucial role in identifying trends and potential reversal points. The 5-day moving average (MA) and 10-day moving average are two of the most commonly used short-term indicators by traders. These tools smooth out ...

Can I add positions after breaking through the upper edge of the box and stepping back without breaking?

Jun 27,2025 at 09:56pm

Understanding the Box Breakout StrategyIn cryptocurrency trading, box breakout strategies are commonly used by technical analysts to identify potential price movements. A box, or a trading range, refers to a period where the price of an asset moves within two horizontal levels — the support (lower boundary) and resistance (upper boundary). When the pric...

Can I add positions after the EXPMA golden cross steps back on the yellow line?

Jun 28,2025 at 11:57am

Understanding the EXPMA Indicator and Its RelevanceThe EXPMA (Exponential Moving Average) is a technical analysis tool used by traders to identify trends and potential entry or exit points in financial markets, including cryptocurrency trading. Unlike simple moving averages, EXPMA gives more weight to recent price data, making it more responsive to new ...

How to operate the next day after the daily limit is released with huge volume?

Jun 28,2025 at 12:35pm

Understanding the Daily Limit and Its ReleaseIn cryptocurrency trading, daily limits are often set by exchanges to manage volatility or during periods of high market activity. These limits can restrict how much an asset's price can fluctuate within a 24-hour period. When the daily limit is released, it typically means that the price cap has been lifted,...

Can I chase after the W bottom neckline breaks through with large volume?

Jun 28,2025 at 07:28am

Understanding the W Bottom Pattern in Cryptocurrency TradingThe W bottom pattern is a common technical analysis formation used by traders to identify potential bullish reversals. In cryptocurrency markets, this pattern typically appears after a downtrend and signals that the selling pressure may be diminishing. The structure of the W bottom includes two...

Is it effective if the gap is not filled for three days?

Jun 28,2025 at 01:00pm

Understanding Gaps in Cryptocurrency MarketsIn the context of cryptocurrency trading, a gap refers to a situation where the price of an asset opens significantly higher or lower than its previous closing price, with no trading activity occurring in between. These gaps are commonly observed during periods of high volatility, especially when major news ev...

Is it necessary to clear the position when the 5-day moving average crosses the 10-day moving average?

Jun 27,2025 at 07:21pm

Understanding the 5-Day and 10-Day Moving AveragesIn the realm of technical analysis within the cryptocurrency market, moving averages play a crucial role in identifying trends and potential reversal points. The 5-day moving average (MA) and 10-day moving average are two of the most commonly used short-term indicators by traders. These tools smooth out ...

Can I add positions after breaking through the upper edge of the box and stepping back without breaking?

Jun 27,2025 at 09:56pm

Understanding the Box Breakout StrategyIn cryptocurrency trading, box breakout strategies are commonly used by technical analysts to identify potential price movements. A box, or a trading range, refers to a period where the price of an asset moves within two horizontal levels — the support (lower boundary) and resistance (upper boundary). When the pric...

See all articles