-

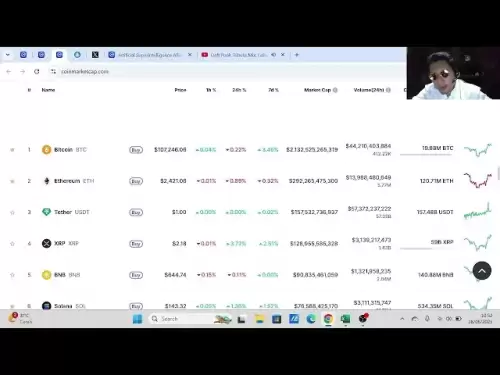

Bitcoin

Bitcoin $107,352.1067

0.28% -

Ethereum

Ethereum $2,429.3531

-0.90% -

Tether USDt

Tether USDt $1.0001

-0.02% -

XRP

XRP $2.1894

4.62% -

BNB

BNB $646.7968

0.36% -

Solana

Solana $147.4290

4.03% -

USDC

USDC $0.9998

-0.02% -

TRON

TRON $0.2756

1.52% -

Dogecoin

Dogecoin $0.1630

1.14% -

Cardano

Cardano $0.5612

1.18% -

Hyperliquid

Hyperliquid $37.0580

-0.05% -

Bitcoin Cash

Bitcoin Cash $496.9410

-0.09% -

Sui

Sui $2.7318

3.19% -

Chainlink

Chainlink $13.1503

0.58% -

UNUS SED LEO

UNUS SED LEO $9.0766

0.55% -

Avalanche

Avalanche $17.7220

1.46% -

Stellar

Stellar $0.2380

1.52% -

Toncoin

Toncoin $2.8439

0.38% -

Shiba Inu

Shiba Inu $0.0...01143

1.84% -

Litecoin

Litecoin $85.8053

1.47% -

Hedera

Hedera $0.1483

2.70% -

Monero

Monero $314.3240

2.12% -

Bitget Token

Bitget Token $4.6725

0.77% -

Dai

Dai $1.0000

0.00% -

Polkadot

Polkadot $3.3555

1.28% -

Ethena USDe

Ethena USDe $1.0001

0.02% -

Uniswap

Uniswap $7.0890

2.64% -

Pi

Pi $0.5355

-3.40% -

Pepe

Pepe $0.0...09393

1.06% -

Aave

Aave $256.8136

-1.90%

What industries does Lianbi Financial invest in?

Lianbi Financial, as a strategic venture capital firm, focuses on investments in companies operating within the realms of blockchain infrastructure, decentralized finance, cryptocurrency trading, NFTs, and Metaverse/Web3, emphasizing team expertise, market potential, technical innovation, tokenomics, and financial sustainability in its investment decision-making process.

Jan 09, 2025 at 03:36 pm

Key Points:

- Lianbi Financial's Core Investment Sectors

- Criteria for Lianbi Financial's Investment Decisions

- Lianbi Financial's Investment Portfolio Breakdown

- Due Diligence and Deal Execution Process

- Investment Success Stories and Case Studies

Lianbi Financial's Core Investment Sectors

Lianbi Financial, a leading venture capital firm in the cryptocurrency space, primarily focuses on investing in companies operating within the following industries:

- Blockchain Infrastructure: This includes companies building protocols, middleware, and other core components of the blockchain ecosystem.

- Decentralized Finance (DeFi): This encompasses investments in protocols that leverage blockchain technology to offer financial services such as lending, borrowing, and yield farming.

- Cryptocurrency Trading and Exchanges: Lianbi Financial supports companies that provide platforms for trading cryptocurrencies and stablecoins.

- Non-Fungible Tokens (NFTs): Investments are made in companies developing and utilizing NFTs for various applications, such as digital art, collectibles, and gaming.

- Metaverse and Web3: This includes companies building virtual worlds, decentralized applications (dApps), and other elements of the evolving Web3 ecosystem.

Criteria for Lianbi Financial's Investment Decisions

Lianbi Financial follows a rigorous investment process to identify and support the most promising companies in the cryptocurrency space. Key criteria for investment decisions include:

- Team Experience and Expertise: The firm thoroughly evaluates the founding team's backgrounds, technical abilities, and industry knowledge.

- Market Opportunity and Value Proposition: Lianbi Financial assesses the size and growth potential of the target market and the company's competitive positioning.

- Technical Innovation and Differentiation: Investments focus on companies with innovative technology or disruptive approaches that solve real-world problems.

- Strong Tokenomics: Lianbi Financial analyzes the token model, token distribution strategy, and economic incentives within the company's ecosystem.

- Financial Planning and Sustainability: The firm assesses the company's financial projections, cash flow management, and long-term viability.

Lianbi Financial's Investment Portfolio Breakdown

Lianbi Financial's investment portfolio is well-diversified across various sectors within the cryptocurrency industry. The current portfolio breakdown is approximately as follows:

- Blockchain Infrastructure: 35%

- Decentralized Finance (DeFi): 25%

- Cryptocurrency Trading and Exchanges: 20%

- Non-Fungible Tokens (NFTs): 15%

- Metaverse and Web3: 5%

Due Diligence and Deal Execution Process

Lianbi Financial's due diligence process involves comprehensive analysis of company data, market research, and consultation with industry experts. The firm follows a standardized deal execution process that ensures transparency, efficiency, and compliance with regulatory requirements.

Investment Success Stories and Case Studies

Lianbi Financial has a track record of successfully investing in and supporting numerous startups within the cryptocurrency space. Some notable success stories include investments in:

- Chainlink: A leading provider of decentralized oracle networks, enabling smart contracts to access real-world data.

- Uniswap: A pioneer in the automated market maker (AMM) space for token trading on Ethereum.

- OpenSea: The largest NFT marketplace, facilitating the trade of digital art, collectibles, and other NFT assets.

FAQs

- What is Lianbi Financial's total assets under management (AUM)?

Lianbi Financial's current AUM is approximately $2 billion. - Does Lianbi Financial have any geographical investment preferences?

Lianbi Financial invests globally, with a focus on companies in North America, Europe, and Asia. - How does Lianbi Financial support its portfolio companies?

Beyond capital investment, Lianbi Financial provides portfolio companies with mentorship, access to its network of partners and resources, and strategic advisory support.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

- SEI Mirroring Solana: Price Spikes and the Next Big Crypto?

- 2025-06-28 20:52:13

- PENGU Price Surges: Are Whales Targeting $0.0149?

- 2025-06-28 20:30:12

- Notcoin's Wild Ride: Price Swings, Market Cap, and What's Next

- 2025-06-28 20:30:12

- COMP Price Wobbles as a16z Moves Tokens Amid Crypto Jitters

- 2025-06-28 20:52:13

- Bitcoin, XRP, and Macro Trends: Navigating the Crypto Landscape in 2025 and Beyond

- 2025-06-28 20:55:12

- Navigating Offshore Casinos: A Safe Haven for US Players?

- 2025-06-28 20:55:12

Related knowledge

What are the skills of Bitcoin option hedging? Practical case sharing

Jun 24,2025 at 04:01pm

Understanding Bitcoin Option HedgingBitcoin option hedging is a risk management strategy used by traders and investors to protect their positions in the volatile cryptocurrency market. By using options, individuals can limit potential losses while retaining the opportunity for profit. In essence, it allows one to insulate against adverse price movements...

How to use the price difference between Bitcoin spot and futures? Arbitrage strategy

Jun 20,2025 at 02:56pm

Understanding Bitcoin Spot and Futures MarketsTo effectively leverage arbitrage opportunities between Bitcoin spot and futures markets, it's essential to understand the fundamental differences between these two types of markets. The spot market refers to the direct buying and selling of Bitcoin for immediate delivery at the current market price. In cont...

How to increase DeFi lending income? Strategy and risk analysis

Jun 24,2025 at 02:08pm

Understanding DeFi Lending and Its Income PotentialDeFi (Decentralized Finance) lending has emerged as a popular way to earn passive income in the cryptocurrency space. Unlike traditional banking systems, DeFi lending platforms allow users to lend their crypto assets directly to borrowers without intermediaries. The lenders earn interest based on the su...

How to operate cryptocurrency cross-market arbitrage? Practical analysis

Jun 23,2025 at 04:01am

Understanding Cryptocurrency Cross-Market ArbitrageCryptocurrency cross-market arbitrage involves taking advantage of price differences for the same digital asset across different exchanges. The core idea is to buy low on one exchange and sell high on another, capturing the profit from the discrepancy. This strategy relies heavily on real-time market da...

How to make profits from high-frequency cryptocurrency trading? Sharing core skills

Jun 19,2025 at 05:07pm

Understanding High-Frequency Cryptocurrency TradingHigh-frequency trading (HFT) in the cryptocurrency market involves executing a large number of trades at extremely fast speeds, often within milliseconds. This method relies on small price discrepancies across exchanges or within a single exchange’s order book. Traders use complex algorithms and ultra-l...

What are the methods of cryptocurrency quantitative trading? Detailed analysis

Jun 22,2025 at 11:07pm

Understanding the Core of Cryptocurrency Quantitative TradingCryptocurrency quantitative trading refers to the use of mathematical models and algorithms to execute trades in the digital asset market. Unlike traditional discretionary trading, which relies heavily on human judgment, quantitative trading leverages data-driven strategies to identify profita...

What are the skills of Bitcoin option hedging? Practical case sharing

Jun 24,2025 at 04:01pm

Understanding Bitcoin Option HedgingBitcoin option hedging is a risk management strategy used by traders and investors to protect their positions in the volatile cryptocurrency market. By using options, individuals can limit potential losses while retaining the opportunity for profit. In essence, it allows one to insulate against adverse price movements...

How to use the price difference between Bitcoin spot and futures? Arbitrage strategy

Jun 20,2025 at 02:56pm

Understanding Bitcoin Spot and Futures MarketsTo effectively leverage arbitrage opportunities between Bitcoin spot and futures markets, it's essential to understand the fundamental differences between these two types of markets. The spot market refers to the direct buying and selling of Bitcoin for immediate delivery at the current market price. In cont...

How to increase DeFi lending income? Strategy and risk analysis

Jun 24,2025 at 02:08pm

Understanding DeFi Lending and Its Income PotentialDeFi (Decentralized Finance) lending has emerged as a popular way to earn passive income in the cryptocurrency space. Unlike traditional banking systems, DeFi lending platforms allow users to lend their crypto assets directly to borrowers without intermediaries. The lenders earn interest based on the su...

How to operate cryptocurrency cross-market arbitrage? Practical analysis

Jun 23,2025 at 04:01am

Understanding Cryptocurrency Cross-Market ArbitrageCryptocurrency cross-market arbitrage involves taking advantage of price differences for the same digital asset across different exchanges. The core idea is to buy low on one exchange and sell high on another, capturing the profit from the discrepancy. This strategy relies heavily on real-time market da...

How to make profits from high-frequency cryptocurrency trading? Sharing core skills

Jun 19,2025 at 05:07pm

Understanding High-Frequency Cryptocurrency TradingHigh-frequency trading (HFT) in the cryptocurrency market involves executing a large number of trades at extremely fast speeds, often within milliseconds. This method relies on small price discrepancies across exchanges or within a single exchange’s order book. Traders use complex algorithms and ultra-l...

What are the methods of cryptocurrency quantitative trading? Detailed analysis

Jun 22,2025 at 11:07pm

Understanding the Core of Cryptocurrency Quantitative TradingCryptocurrency quantitative trading refers to the use of mathematical models and algorithms to execute trades in the digital asset market. Unlike traditional discretionary trading, which relies heavily on human judgment, quantitative trading leverages data-driven strategies to identify profita...

See all articles