-

Bitcoin

Bitcoin $108,594.7476

-1.02% -

Ethereum

Ethereum $2,772.9627

-0.74% -

Tether USDt

Tether USDt $1.0001

0.01% -

XRP

XRP $2.2672

-1.52% -

BNB

BNB $667.1228

-0.80% -

Solana

Solana $160.7533

-2.13% -

USDC

USDC $0.9999

0.01% -

Dogecoin

Dogecoin $0.1929

-2.05% -

TRON

TRON $0.2789

-4.07% -

Cardano

Cardano $0.6963

-2.56% -

Hyperliquid

Hyperliquid $41.5241

-1.30% -

Sui

Sui $3.3781

-2.77% -

Chainlink

Chainlink $14.8762

-3.16% -

Avalanche

Avalanche $21.5210

-4.09% -

Stellar

Stellar $0.2770

-1.22% -

Bitcoin Cash

Bitcoin Cash $428.0648

-2.37% -

UNUS SED LEO

UNUS SED LEO $9.0968

2.54% -

Toncoin

Toncoin $3.2288

-3.02% -

Shiba Inu

Shiba Inu $0.0...01290

-3.18% -

Hedera

Hedera $0.1725

-4.17% -

Litecoin

Litecoin $91.4493

-2.03% -

Polkadot

Polkadot $4.1817

-2.07% -

Monero

Monero $328.0326

-2.89% -

Ethena USDe

Ethena USDe $1.0009

0.02% -

Bitget Token

Bitget Token $4.7553

-1.15% -

Dai

Dai $0.9998

0.00% -

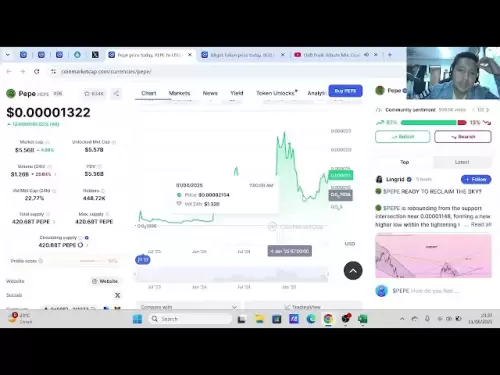

Pepe

Pepe $0.0...01239

-4.34% -

Uniswap

Uniswap $8.0951

-4.51% -

Pi

Pi $0.6335

-1.28% -

Aave

Aave $303.0725

-0.99%

What is the significance of the VR indicator falling below 70? What are the signals of volume recovery?

When the VR indicator falls below 70, it signals potential bearish trends; watch for volume recovery to anticipate bullish reversals in crypto trading.

Jun 09, 2025 at 10:56 pm

The Volume Reversal (VR) indicator is a crucial tool used by cryptocurrency traders to gauge the strength of a price trend based on volume. When the VR indicator falls below 70, it often signals a potential bearish trend or a weakening of the bullish momentum. This article will delve into the significance of the VR indicator falling below 70 and explore the signals of volume recovery in the context of cryptocurrency trading.

Understanding the VR Indicator

The VR indicator is calculated by comparing the volume on days when the price goes up to the volume on days when the price goes down. The formula for VR is:

[ \text{VR} = \frac{\text{Volume on Up Days}}{\text{Volume on Down Days}} ]

A VR value above 100 indicates that the volume on up days is higher than on down days, suggesting bullish momentum. Conversely, a VR value below 100 suggests bearish momentum. When the VR falls below 70, it is a strong indication that the bearish pressure is intensifying, and traders should be cautious.

Significance of VR Falling Below 70

When the VR indicator falls below 70, it is a significant event for traders. This level is often used as a threshold to identify potential reversal points in the market. Here are some key points to consider:

- Bearish Confirmation: A VR below 70 confirms bearish sentiment in the market. Traders might see this as a signal to either exit long positions or initiate short positions.

- Potential Reversal: This level can indicate that a bullish trend is losing steam and a reversal might be imminent. It is a critical point for traders to monitor closely.

- Risk Management: Traders should use this signal to adjust their risk management strategies, potentially reducing exposure or tightening stop-loss orders.

Signals of Volume Recovery

Volume recovery signals are essential for traders looking to identify when a downtrend might be reversing. Here are some key signals to watch for:

- Increasing Volume on Up Days: A clear sign of volume recovery is when the volume on up days starts to increase. This indicates that buyers are becoming more active and could be regaining control of the market.

- VR Moving Above 70: If the VR indicator, which had previously fallen below 70, starts to move back above this level, it is a strong signal that volume is recovering, and bullish momentum might be returning.

- Volume Spikes: Sudden spikes in volume, especially on days when the price is moving upwards, can be a precursor to a trend reversal. These spikes suggest that new buyers are entering the market.

How to Use VR and Volume Recovery Signals in Trading

Incorporating the VR indicator and volume recovery signals into a trading strategy requires careful analysis. Here are some steps traders can follow:

- Monitor the VR Indicator: Keep a close eye on the VR indicator, especially when it approaches or falls below 70. Use this as a trigger to reassess your trading positions.

- Look for Volume Recovery Signals: After a VR drop below 70, watch for signs of volume recovery. This includes increasing volume on up days and the VR moving back above 70.

- Combine with Other Indicators: Use the VR indicator in conjunction with other technical indicators, such as moving averages or the Relative Strength Index (RSI), to confirm signals and reduce false positives.

- Set Appropriate Stop-Losses: Adjust your stop-loss orders based on the VR and volume recovery signals to manage risk effectively.

Practical Example of VR and Volume Recovery

Let's consider a practical example of how to apply the VR indicator and volume recovery signals in a real trading scenario:

- Initial Drop: Suppose the VR indicator for a cryptocurrency falls from 120 to 65 over a period of two weeks, indicating a strong bearish trend.

- Volume Recovery Signs: Over the next week, you notice that the volume on up days starts to increase, and the VR begins to climb back to 75.

- Trading Decision: Based on these signals, you might decide to close any short positions and consider entering long positions, anticipating a potential bullish reversal.

Interpreting VR and Volume Recovery in Different Market Conditions

The effectiveness of the VR indicator and volume recovery signals can vary depending on the overall market conditions. Here are some considerations:

- Bull Markets: In a strong bull market, a VR drop below 70 might be less significant as the overall trend remains bullish. However, it could still signal a short-term correction.

- Bear Markets: In a bear market, a VR drop below 70 is more likely to indicate a continuation of the downtrend. Volume recovery signals might take longer to materialize.

- Sideways Markets: In a sideways market, the VR indicator can help identify potential breakouts. A drop below 70 followed by volume recovery could signal an upcoming bullish breakout.

Technical Analysis Tools to Complement VR and Volume Recovery

To enhance the effectiveness of the VR indicator and volume recovery signals, traders often use additional technical analysis tools. Some of these include:

- Moving Averages: Using moving averages can help confirm trends identified by the VR indicator. For example, a VR drop below 70 combined with a price moving below a key moving average can strengthen the bearish signal.

- Relative Strength Index (RSI): The RSI can help identify overbought or oversold conditions. A VR drop below 70 combined with an RSI below 30 might indicate a strong bearish trend.

- Candlestick Patterns: Certain candlestick patterns, such as bearish engulfing or doji, can provide additional confirmation of a trend reversal signaled by the VR indicator.

Frequently Asked Questions

Q: Can the VR indicator be used alone for trading decisions?

A: While the VR indicator is a powerful tool, it is generally recommended to use it in conjunction with other indicators to confirm signals and reduce the risk of false positives. Combining it with moving averages, RSI, and candlestick patterns can provide a more comprehensive view of market conditions.

Q: How frequently should the VR indicator be monitored?

A: The frequency of monitoring the VR indicator depends on your trading style. For day traders, monitoring the VR indicator on an hourly or daily basis might be necessary. Swing traders and long-term investors might check it on a daily or weekly basis to identify longer-term trends.

Q: What other volume-based indicators can complement the VR indicator?

A: Other volume-based indicators that can complement the VR indicator include the On-Balance Volume (OBV), the Accumulation/Distribution Line, and the Chaikin Money Flow. These indicators can provide additional insights into the volume dynamics of the market.

Q: Is a VR drop below 70 always a signal to sell?

A: Not necessarily. A VR drop below 70 should be considered in the context of other market indicators and conditions. It is a signal to be cautious and reassess your positions, but it might not always warrant an immediate sell. Always use it as part of a broader trading strategy.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

- OpenAI's ChatGPT Predicts Continued Bullish Price Trend for the Cryptocurrency Market

- 2025-06-12 07:40:12

- Interactive Strength (TRNR) Announces $500M Strategic Funding to Acquire FET Tokens

- 2025-06-12 07:40:12

- Bitdeer Technologies Reports Sharp Rise in Mining Output and Infrastructure Expansion During May 2025

- 2025-06-12 07:36:49

- Pi Network (PI) Market Braces for a Possible Move Above $1.67 Resistance as Whales Accumulate

- 2025-06-12 07:35:12

- Binance Coin (BNB) vs. Ruvi AI: The Next Big Crypto Challenger?

- 2025-06-12 07:30:12

- With a Remarkable Performance This Year, Ethereum

- 2025-06-12 07:30:12

Related knowledge

Two Yangs and one Yin on the quarterly line: Long-term bullish signal confirmed?

Jun 12,2025 at 07:00am

Understanding the 'Two Yangs and One Yin' Candlestick PatternIn technical analysis, candlestick patterns play a pivotal role in identifying potential market reversals or continuations. The 'Two Yangs and One Yin' pattern is one such formation that traders often observe on longer timeframes like the quarterly chart. This pattern consists of two bullish (...

The MACD bar line shrinks: Has the upward momentum exhausted?

Jun 12,2025 at 12:49am

Understanding the MACD Bar LineThe Moving Average Convergence Divergence (MACD) is a widely used technical indicator in cryptocurrency trading. It consists of three main components: the MACD line, the signal line, and the MACD histogram (also known as the bar line). The MACD bar line represents the difference between the MACD line and the signal line. W...

The chip peak moves up: Is the main force quietly shipping?

Jun 12,2025 at 01:01am

Understanding the Chip Peak Movement in Cryptocurrency MiningIn recent years, the chip peak movement has become a critical topic within the cryptocurrency mining community. This phrase typically refers to the point at which mining hardware reaches its maximum efficiency and output capacity. When this peak shifts upward, it often signals changes in the s...

The black line reverses the positive line: a confirmation signal of trend reversal?

Jun 12,2025 at 12:22am

Understanding the Black Line and Positive Line in Technical AnalysisIn the realm of cryptocurrency trading, technical indicators play a crucial role in interpreting price movements. Among these, the MACD (Moving Average Convergence Divergence) is one of the most widely used tools by traders to identify potential trend reversals. Within the MACD indicato...

Long black line with huge volume at high position: a clear signal of main force selling?

Jun 12,2025 at 04:14am

Understanding the Long Black Line with Huge Volume at High PositionIn technical analysis of cryptocurrency markets, candlestick patterns serve as crucial indicators for predicting price movements. One such pattern is the long black line with huge volume at a high position, which often raises questions about whether major players are selling off their ho...

MACD red column shortens: the beginning of adjustment or a short break?

Jun 12,2025 at 05:28am

Understanding the MACD Indicator in Cryptocurrency TradingThe Moving Average Convergence Divergence (MACD) is a widely used technical analysis tool in cryptocurrency trading. It helps traders identify potential trend reversals, momentum shifts, and entry or exit points. The MACD consists of three main components: the MACD line, the signal line, and the ...

Two Yangs and one Yin on the quarterly line: Long-term bullish signal confirmed?

Jun 12,2025 at 07:00am

Understanding the 'Two Yangs and One Yin' Candlestick PatternIn technical analysis, candlestick patterns play a pivotal role in identifying potential market reversals or continuations. The 'Two Yangs and One Yin' pattern is one such formation that traders often observe on longer timeframes like the quarterly chart. This pattern consists of two bullish (...

The MACD bar line shrinks: Has the upward momentum exhausted?

Jun 12,2025 at 12:49am

Understanding the MACD Bar LineThe Moving Average Convergence Divergence (MACD) is a widely used technical indicator in cryptocurrency trading. It consists of three main components: the MACD line, the signal line, and the MACD histogram (also known as the bar line). The MACD bar line represents the difference between the MACD line and the signal line. W...

The chip peak moves up: Is the main force quietly shipping?

Jun 12,2025 at 01:01am

Understanding the Chip Peak Movement in Cryptocurrency MiningIn recent years, the chip peak movement has become a critical topic within the cryptocurrency mining community. This phrase typically refers to the point at which mining hardware reaches its maximum efficiency and output capacity. When this peak shifts upward, it often signals changes in the s...

The black line reverses the positive line: a confirmation signal of trend reversal?

Jun 12,2025 at 12:22am

Understanding the Black Line and Positive Line in Technical AnalysisIn the realm of cryptocurrency trading, technical indicators play a crucial role in interpreting price movements. Among these, the MACD (Moving Average Convergence Divergence) is one of the most widely used tools by traders to identify potential trend reversals. Within the MACD indicato...

Long black line with huge volume at high position: a clear signal of main force selling?

Jun 12,2025 at 04:14am

Understanding the Long Black Line with Huge Volume at High PositionIn technical analysis of cryptocurrency markets, candlestick patterns serve as crucial indicators for predicting price movements. One such pattern is the long black line with huge volume at a high position, which often raises questions about whether major players are selling off their ho...

MACD red column shortens: the beginning of adjustment or a short break?

Jun 12,2025 at 05:28am

Understanding the MACD Indicator in Cryptocurrency TradingThe Moving Average Convergence Divergence (MACD) is a widely used technical analysis tool in cryptocurrency trading. It helps traders identify potential trend reversals, momentum shifts, and entry or exit points. The MACD consists of three main components: the MACD line, the signal line, and the ...

See all articles