-

Bitcoin

Bitcoin $108,889.8084

-0.81% -

Ethereum

Ethereum $2,820.7248

1.62% -

Tether USDt

Tether USDt $1.0001

0.01% -

XRP

XRP $2.2946

-0.26% -

BNB

BNB $667.5348

0.01% -

Solana

Solana $163.1955

-0.68% -

USDC

USDC $0.9998

0.01% -

Dogecoin

Dogecoin $0.1952

0.01% -

TRON

TRON $0.2822

-3.29% -

Cardano

Cardano $0.7056

-0.52% -

Hyperliquid

Hyperliquid $42.3451

2.52% -

Sui

Sui $3.4321

-0.90% -

Chainlink

Chainlink $15.1702

-0.54% -

Avalanche

Avalanche $21.8254

-2.44% -

Stellar

Stellar $0.2791

0.06% -

Bitcoin Cash

Bitcoin Cash $436.7091

0.31% -

UNUS SED LEO

UNUS SED LEO $9.0234

3.09% -

Toncoin

Toncoin $3.2576

-1.49% -

Shiba Inu

Shiba Inu $0.0...01322

0.08% -

Hedera

Hedera $0.1760

-2.66% -

Litecoin

Litecoin $92.2057

0.26% -

Polkadot

Polkadot $4.2486

-0.88% -

Monero

Monero $326.1263

-4.20% -

Ethena USDe

Ethena USDe $1.0006

0.00% -

Bitget Token

Bitget Token $4.8236

0.40% -

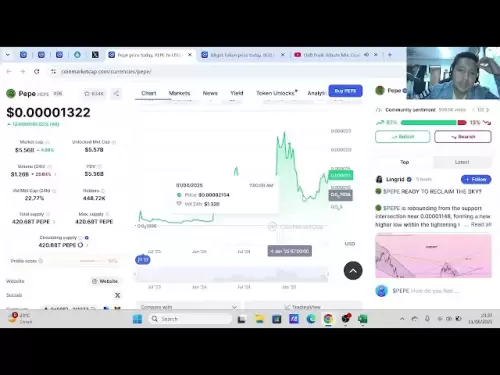

Pepe

Pepe $0.0...01278

-1.09% -

Dai

Dai $0.9998

0.01% -

Uniswap

Uniswap $8.0639

-3.53% -

Pi

Pi $0.6359

-1.17% -

Aave

Aave $307.7143

0.18%

How to adjust Bitget leverage multiples? Bitget contract position management skills

Adjusting leverage on Bitget up to 125x and mastering position management are key for optimizing crypto trading strategies and managing risk effectively.

Jun 09, 2025 at 10:50 am

Adjusting leverage multiples and managing positions effectively on Bitget are crucial skills for any trader looking to optimize their cryptocurrency trading strategy. This article will guide you through the process of adjusting leverage on Bitget, as well as share essential position management skills to help you navigate the volatile world of crypto trading.

Understanding Leverage on Bitget

Leverage is a tool that allows traders to control a larger position with a smaller amount of capital. On Bitget, you can trade with leverage up to 125x on certain contracts. Understanding how leverage works is the first step in using it effectively. Higher leverage can amplify both gains and losses, making it a double-edged sword that requires careful management.

To adjust the leverage on Bitget, follow these steps:

- Log into your Bitget account and navigate to the futures trading section.

- Select the contract you wish to trade. Bitget offers various types of contracts, including USDT-Margined and Coin-Margined futures.

- Click on the 'Open Position' button. Before you open a position, you will see an option to adjust the leverage.

- Use the slider or input box to set your desired leverage level. You can choose from a range of leverage options, depending on the contract.

- Confirm your leverage setting and proceed to place your order.

Position Management Skills on Bitget

Effective position management is key to success in futures trading. Here are some essential skills and strategies to help you manage your positions on Bitget:

Setting Stop-Loss and Take-Profit Orders

Stop-loss and take-profit orders are crucial tools for managing risk and locking in profits. On Bitget, you can set these orders when opening a position or after the position is open.

- To set a stop-loss or take-profit order, go to the 'Positions' tab and select the position you want to manage.

- Click on 'Modify' next to the position. You will see options to set a stop-loss and take-profit.

- Enter the price levels at which you want the orders to be triggered. Make sure these levels align with your risk management strategy.

- Confirm the settings to apply the stop-loss and take-profit orders to your position.

Monitoring and Adjusting Positions

Regular monitoring of your open positions is essential, especially in the fast-paced crypto market. Bitget provides real-time data and charts to help you keep track of your positions.

- Use the 'Positions' tab to view all your open positions. You can see the current profit/loss, margin, and other key metrics.

- Adjust your positions as needed based on market conditions. You might need to increase or decrease your position size, or even close the position entirely.

- Consider using the 'Trailing Stop' feature on Bitget, which can help you lock in profits while allowing the position to continue running if the market moves in your favor.

Managing Margin and Leverage

Margin and leverage are interconnected, and managing them effectively can help you maximize your trading potential while minimizing risk.

- Keep an eye on your margin level. If the market moves against your position, your margin level may decrease, potentially leading to a liquidation.

- Adjust your leverage if necessary. If you find that your position is too risky, you can reduce the leverage to lower your exposure.

- Add more margin if needed to prevent liquidation. Bitget allows you to add margin to an open position to increase your margin level.

Utilizing Bitget's Advanced Features

Bitget offers several advanced features that can enhance your position management capabilities.

- Use the 'Conditional Order' feature to automate your trading strategy. You can set conditions for opening or closing positions based on specific market conditions.

- Leverage the 'One-Click Close' feature to quickly close multiple positions at once. This can be useful during volatile market conditions when you need to act fast.

- Explore Bitget's 'Strategy Trading' section, which allows you to backtest and execute trading strategies automatically.

Risk Management on Bitget

Risk management is a critical aspect of trading on Bitget. Here are some tips to help you manage risk effectively:

- Set a risk-reward ratio for each trade. A common ratio is 1:2, meaning you aim to make twice as much as you risk.

- Diversify your positions. Don't put all your capital into one trade. Spread your risk across multiple positions and assets.

- Use position sizing. Calculate the size of each position based on your overall trading capital and risk tolerance.

- Stay informed about market conditions. Keep up with news and market analysis to make informed trading decisions.

Common Mistakes to Avoid

Avoiding common mistakes can help you improve your trading performance on Bitget. Here are some pitfalls to watch out for:

- Over-leveraging. Using too much leverage can lead to rapid losses. Always use leverage cautiously and within your risk tolerance.

- Ignoring stop-loss orders. Failing to set stop-loss orders can result in significant losses if the market moves against you.

- Chasing losses. Trying to recover losses by taking on more risk is a dangerous strategy. Stick to your trading plan and risk management rules.

- Neglecting to monitor positions. Failing to keep an eye on your positions can lead to missed opportunities and unexpected losses.

Frequently Asked Questions

Q: Can I change the leverage of an existing position on Bitget?

A: No, you cannot change the leverage of an existing position on Bitget. You need to close the position and open a new one with the desired leverage level.

Q: What happens if my position gets liquidated on Bitget?

A: If your position gets liquidated, Bitget will automatically close the position to prevent further losses. Any remaining margin will be returned to your account, minus any fees.

Q: How can I reduce the risk of liquidation on Bitget?

A: To reduce the risk of liquidation, you can add more margin to your position, reduce your leverage, or set a stop-loss order to close the position before it reaches the liquidation price.

Q: Is it possible to trade without leverage on Bitget?

A: Yes, you can trade without leverage on Bitget by setting the leverage to 1x. This means you are trading with your actual capital, without any borrowed funds.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

- CFTC Announces Default Judgment Against Mark Gillespie and John Roche in My Big Coin Digital Asset Fraud Scheme

- 2025-06-12 03:14:16

- Kaia [KAIA], the native token of the merged Klaytn-Finschia network, surged over 20%

- 2025-06-12 03:12:15

- The Next Top Meme Coin in 2025 Isn't Just Hype, It's Reshaping the Reward, Growth, and Engagement of Meme Coins

- 2025-06-12 03:10:59

- Launch of QFSCOIN's Most Profitable Bitcoin Mining Service in 2025

- 2025-06-12 03:00:12

- The United States is on the brink of a new technological frontier

- 2025-06-12 03:00:12

- All Heart Piece Locations In The Legend Of Zelda: The Wind Waker

- 2025-06-12 02:56:52

Related knowledge

Gate.io copy trading risk control: how to set the maximum loss and ratio adjustment

Jun 10,2025 at 11:21pm

Understanding the Basics of Gate.io Copy TradingGate.io copy trading allows users to automatically mirror the trades of experienced traders. This feature is particularly appealing for those who may lack the time or expertise to actively trade on their own. However, engaging in copy trading comes with its own set of risks that need to be managed effectiv...

Gate.io fund transfer guide: steps for transferring between spot and contract accounts

Jun 11,2025 at 09:57pm

Understanding the Fund Transfer Process on Gate.ioGate.io is one of the leading cryptocurrency exchanges offering a wide range of services, including spot trading and futures contracts. Users often need to transfer funds between their spot account and contract account based on trading strategies or risk management preferences. This guide provides a deta...

Gate.io Lending Market Operation Guide: Detailed explanation of mortgage borrowing and interest rate rules

Jun 12,2025 at 03:00am

Understanding the Gate.io Lending MarketThe Gate.io lending market provides users with a decentralized platform to lend or borrow digital assets. It is part of Gate.io's broader DeFi ecosystem, allowing participants to earn interest by supplying liquidity or gain access to funds through collateralized borrowing. This guide aims to break down the core op...

Where is Coinbase's social trading function? Can I copy the strategies of experts?

Jun 12,2025 at 12:35am

Understanding Coinbase and Its Current FeaturesCoinbase is one of the most popular cryptocurrency exchanges in the world, offering a wide range of services from buying and selling crypto to staking, earning, and even NFT trading. However, when it comes to social trading or copy-trading functionalities, many users are left wondering whether Coinbase prov...

Which chains does Coinbase's NFT market support? How to set up creator royalties?

Jun 11,2025 at 05:21pm

Overview of Chains Supported by Coinbase NFT MarketplaceCoinbase's NFT marketplace is designed to offer a user-friendly and secure platform for buying, selling, and creating non-fungible tokens. Currently, the platform primarily supports the Ethereum blockchain, which is widely recognized for its robust smart contract capabilities and extensive NFT ecos...

Are Coinbase's financial products principal-guaranteed? How often is the annualized rate of return updated?

Jun 11,2025 at 10:43pm

Understanding Coinbase's Financial ProductsCoinbase, one of the most prominent cryptocurrency exchanges globally, offers a variety of financial products beyond basic crypto trading. These include Coinbase Earn, Coinbase Savings, and Coinbase Staking. Each product is designed to provide users with opportunities to earn passive income through different me...

Gate.io copy trading risk control: how to set the maximum loss and ratio adjustment

Jun 10,2025 at 11:21pm

Understanding the Basics of Gate.io Copy TradingGate.io copy trading allows users to automatically mirror the trades of experienced traders. This feature is particularly appealing for those who may lack the time or expertise to actively trade on their own. However, engaging in copy trading comes with its own set of risks that need to be managed effectiv...

Gate.io fund transfer guide: steps for transferring between spot and contract accounts

Jun 11,2025 at 09:57pm

Understanding the Fund Transfer Process on Gate.ioGate.io is one of the leading cryptocurrency exchanges offering a wide range of services, including spot trading and futures contracts. Users often need to transfer funds between their spot account and contract account based on trading strategies or risk management preferences. This guide provides a deta...

Gate.io Lending Market Operation Guide: Detailed explanation of mortgage borrowing and interest rate rules

Jun 12,2025 at 03:00am

Understanding the Gate.io Lending MarketThe Gate.io lending market provides users with a decentralized platform to lend or borrow digital assets. It is part of Gate.io's broader DeFi ecosystem, allowing participants to earn interest by supplying liquidity or gain access to funds through collateralized borrowing. This guide aims to break down the core op...

Where is Coinbase's social trading function? Can I copy the strategies of experts?

Jun 12,2025 at 12:35am

Understanding Coinbase and Its Current FeaturesCoinbase is one of the most popular cryptocurrency exchanges in the world, offering a wide range of services from buying and selling crypto to staking, earning, and even NFT trading. However, when it comes to social trading or copy-trading functionalities, many users are left wondering whether Coinbase prov...

Which chains does Coinbase's NFT market support? How to set up creator royalties?

Jun 11,2025 at 05:21pm

Overview of Chains Supported by Coinbase NFT MarketplaceCoinbase's NFT marketplace is designed to offer a user-friendly and secure platform for buying, selling, and creating non-fungible tokens. Currently, the platform primarily supports the Ethereum blockchain, which is widely recognized for its robust smart contract capabilities and extensive NFT ecos...

Are Coinbase's financial products principal-guaranteed? How often is the annualized rate of return updated?

Jun 11,2025 at 10:43pm

Understanding Coinbase's Financial ProductsCoinbase, one of the most prominent cryptocurrency exchanges globally, offers a variety of financial products beyond basic crypto trading. These include Coinbase Earn, Coinbase Savings, and Coinbase Staking. Each product is designed to provide users with opportunities to earn passive income through different me...

See all articles