-

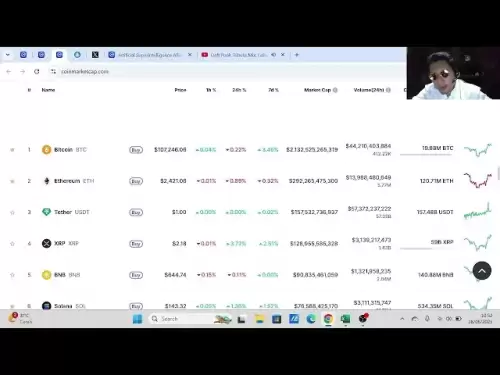

Bitcoin

Bitcoin $107,352.1067

0.28% -

Ethereum

Ethereum $2,429.3531

-0.90% -

Tether USDt

Tether USDt $1.0001

-0.02% -

XRP

XRP $2.1894

4.62% -

BNB

BNB $646.7968

0.36% -

Solana

Solana $147.4290

4.03% -

USDC

USDC $0.9998

-0.02% -

TRON

TRON $0.2756

1.52% -

Dogecoin

Dogecoin $0.1630

1.14% -

Cardano

Cardano $0.5612

1.18% -

Hyperliquid

Hyperliquid $37.0580

-0.05% -

Bitcoin Cash

Bitcoin Cash $496.9410

-0.09% -

Sui

Sui $2.7318

3.19% -

Chainlink

Chainlink $13.1503

0.58% -

UNUS SED LEO

UNUS SED LEO $9.0766

0.55% -

Avalanche

Avalanche $17.7220

1.46% -

Stellar

Stellar $0.2380

1.52% -

Toncoin

Toncoin $2.8439

0.38% -

Shiba Inu

Shiba Inu $0.0...01143

1.84% -

Litecoin

Litecoin $85.8053

1.47% -

Hedera

Hedera $0.1483

2.70% -

Monero

Monero $314.3240

2.12% -

Bitget Token

Bitget Token $4.6725

0.77% -

Dai

Dai $1.0000

0.00% -

Polkadot

Polkadot $3.3555

1.28% -

Ethena USDe

Ethena USDe $1.0001

0.02% -

Uniswap

Uniswap $7.0890

2.64% -

Pi

Pi $0.5355

-3.40% -

Pepe

Pepe $0.0...09393

1.06% -

Aave

Aave $256.8136

-1.90%

Will Tokamak Network coin become a 100x coin?

Investors seeking 100x growth should assess factors such as market demand, network adoption, tokenomics, historical precedents, team experience, and competition when considering the Tokamak Network coin.

Dec 26, 2024 at 01:27 am

Key Points:

- Understanding the Tokamak Network and its Purpose

- Assessing the Potential for 100x Growth

- Exploring the Factors Influencing Token Value

- Examining Historical Precedents and Market Sentiment

- Analyzing the Project's Roadmap and Development Progress

- Evaluating Team Experience and Partnerships

- Considering Market Conditions and Competition

Understanding the Tokamak Network and its Purpose

Tokamak Network is a blockchain-based platform designed to provide a high-performance, energy-efficient alternative to Proof-of-Work (PoW) consensus mechanisms. It employs a hybrid Proof-of-Stake (PoS) and Proof-of-Useful-Work (PoUW) model, aiming to reduce transaction fees and energy consumption. The network's primary focus is on addressing the scalability and sustainability concerns prevalent in the cryptocurrency industry.

Assessing the Potential for 100x Growth

The potential for a 100x return on investment in Tokamak Network coin depends on several factors, including:

- Market demand: The overall adoption and demand for energy-efficient blockchain solutions can drive token value.

- Network adoption: The growth of the network, in terms of transaction volume and active users, can increase token usage and demand.

- Exchange listings and liquidity: Wider availability on exchanges and increased liquidity can improve accessibility and price stability.

- Project updates and developments: Regular updates, new partnerships, and product launches can enhance investor confidence and drive price appreciation.

Exploring the Factors Influencing Token Value

The value of the Tokamak Network coin is primarily influenced by:

- Tokenomics: The distribution, issuance schedule, and burn mechanisms of the token can impact its supply and demand dynamics.

- Network utility: The token's role within the ecosystem, such as transaction fees, governance, or staking rewards, determines its utility and demand.

- Speculative interest: Market sentiment and investor speculation can contribute to price fluctuations.

Examining Historical Precedents and Market Sentiment

Historical precedents of high-growth altcoins suggest that successful projects often:

- Solve a significant problem or provide a unique solution

- Demonstrate strong community support and developer involvement

- Experience positive market sentiment and media attention

Analyzing the Project's Roadmap and Development Progress

The Tokamak Network project has a well-defined roadmap with clear development milestones. Key areas to consider include:

- Token distribution and staking rewards implementation

- Launch of mainnet and token bridges

- Integration with other blockchain ecosystems and applications

Evaluating Team Experience and Partnerships

The team behind Tokamak Network possesses a strong technical background and industry experience. Partnerships with leading organizations can enhance credibility and accelerate network growth.

Considering Market Conditions and Competition

Macroeconomic factors, such as interest rates and inflation, can affect risk appetite and investment sentiment. Competition from other energy-efficient blockchain platforms should also be evaluated.

FAQs

- What is the unique value proposition of the Tokamak Network?

Its hybrid PoS/PoUW consensus mechanism, low energy consumption, and high transaction throughput provide advantages over traditional PoW blockchains. - What are the risks associated with investing in the Tokamak Network coin?

Market volatility, competition, regulatory uncertainties, and technological advancements can influence token price. - How can I purchase Tokamak Network coin?

It is available on several cryptocurrency exchanges, including (Provide a list of exchanges where the coin is traded)

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

- Pi2Day Disappointment: Why the Pi Network Community Is Losing Faith

- 2025-06-28 18:30:12

- Silver Lining: Robert Kiyosaki's July 2025 Silver Prediction

- 2025-06-28 18:30:12

- Gotta Go Fast! Sonic Speeds into Magic: The Gathering Secret Lair

- 2025-06-28 18:50:12

- Bitcoin Price Swings: Navigating Volatility and Predicting the Future

- 2025-06-28 19:10:14

- Meme Coins in 2025: Will Shiba Inu Make a Comeback?

- 2025-06-28 19:30:12

- Pi Network's AI App Studio and Staking Utility: Revolution or Red Herring?

- 2025-06-28 19:30:12

Related knowledge

How to customize USDT TRC20 mining fees? Flexible adjustment tutorial

Jun 13,2025 at 01:42am

Understanding USDT TRC20 Mining FeesMining fees on the TRON (TRC20) network are essential for processing transactions. Unlike Bitcoin or Ethereum, where miners directly validate transactions, TRON uses a delegated proof-of-stake (DPoS) mechanism. However, users still need to pay bandwidth and energy fees, which are collectively referred to as 'mining fe...

USDT TRC20 transaction is stuck? Solution summary

Jun 14,2025 at 11:15pm

Understanding USDT TRC20 TransactionsWhen users mention that a USDT TRC20 transaction is stuck, they typically refer to a situation where the transfer of Tether (USDT) on the TRON blockchain has not been confirmed for an extended period. This issue may arise due to various reasons such as network congestion, insufficient transaction fees, or wallet-rela...

How to cancel USDT TRC20 unconfirmed transactions? Operation guide

Jun 13,2025 at 11:01pm

Understanding USDT TRC20 Unconfirmed TransactionsWhen dealing with USDT TRC20 transactions, it’s crucial to understand what an unconfirmed transaction means. An unconfirmed transaction is one that has been broadcasted to the blockchain network but hasn’t yet been included in a block. This typically occurs due to low transaction fees or network congestio...

How to check USDT TRC20 balance? Introduction to multiple query methods

Jun 21,2025 at 02:42am

Understanding USDT TRC20 and Its ImportanceUSDT (Tether) is one of the most widely used stablecoins in the cryptocurrency market. It exists on multiple blockchain networks, including TRC20, which operates on the Tron (TRX) network. Checking your USDT TRC20 balance accurately is crucial for users who hold or transact with this asset. Whether you're sendi...

What to do if USDT TRC20 transfers are congested? Speed up trading skills

Jun 13,2025 at 09:56am

Understanding USDT TRC20 Transfer CongestionWhen transferring USDT TRC20, users may occasionally experience delays or congestion. This typically occurs due to network overload on the TRON blockchain, which hosts the TRC20 version of Tether. Unlike the ERC20 variant (which runs on Ethereum), TRC20 transactions are generally faster and cheaper, but during...

The relationship between USDT TRC20 and TRON chain: technical background analysis

Jun 12,2025 at 01:28pm

What is USDT TRC20?USDT TRC20 refers to the Tether (USDT) token issued on the TRON blockchain using the TRC-20 standard. Unlike the more commonly known ERC-20 version of USDT (which runs on Ethereum), the TRC-20 variant leverages the TRON network's infrastructure for faster and cheaper transactions. The emergence of this version came as part of Tether’s...

How to customize USDT TRC20 mining fees? Flexible adjustment tutorial

Jun 13,2025 at 01:42am

Understanding USDT TRC20 Mining FeesMining fees on the TRON (TRC20) network are essential for processing transactions. Unlike Bitcoin or Ethereum, where miners directly validate transactions, TRON uses a delegated proof-of-stake (DPoS) mechanism. However, users still need to pay bandwidth and energy fees, which are collectively referred to as 'mining fe...

USDT TRC20 transaction is stuck? Solution summary

Jun 14,2025 at 11:15pm

Understanding USDT TRC20 TransactionsWhen users mention that a USDT TRC20 transaction is stuck, they typically refer to a situation where the transfer of Tether (USDT) on the TRON blockchain has not been confirmed for an extended period. This issue may arise due to various reasons such as network congestion, insufficient transaction fees, or wallet-rela...

How to cancel USDT TRC20 unconfirmed transactions? Operation guide

Jun 13,2025 at 11:01pm

Understanding USDT TRC20 Unconfirmed TransactionsWhen dealing with USDT TRC20 transactions, it’s crucial to understand what an unconfirmed transaction means. An unconfirmed transaction is one that has been broadcasted to the blockchain network but hasn’t yet been included in a block. This typically occurs due to low transaction fees or network congestio...

How to check USDT TRC20 balance? Introduction to multiple query methods

Jun 21,2025 at 02:42am

Understanding USDT TRC20 and Its ImportanceUSDT (Tether) is one of the most widely used stablecoins in the cryptocurrency market. It exists on multiple blockchain networks, including TRC20, which operates on the Tron (TRX) network. Checking your USDT TRC20 balance accurately is crucial for users who hold or transact with this asset. Whether you're sendi...

What to do if USDT TRC20 transfers are congested? Speed up trading skills

Jun 13,2025 at 09:56am

Understanding USDT TRC20 Transfer CongestionWhen transferring USDT TRC20, users may occasionally experience delays or congestion. This typically occurs due to network overload on the TRON blockchain, which hosts the TRC20 version of Tether. Unlike the ERC20 variant (which runs on Ethereum), TRC20 transactions are generally faster and cheaper, but during...

The relationship between USDT TRC20 and TRON chain: technical background analysis

Jun 12,2025 at 01:28pm

What is USDT TRC20?USDT TRC20 refers to the Tether (USDT) token issued on the TRON blockchain using the TRC-20 standard. Unlike the more commonly known ERC-20 version of USDT (which runs on Ethereum), the TRC-20 variant leverages the TRON network's infrastructure for faster and cheaper transactions. The emergence of this version came as part of Tether’s...

See all articles