-

Bitcoin

Bitcoin $117300

1.99% -

Ethereum

Ethereum $3884

5.89% -

XRP

XRP $3.268

9.33% -

Tether USDt

Tether USDt $1.000

0.02% -

BNB

BNB $783.0

1.78% -

Solana

Solana $173.6

3.51% -

USDC

USDC $0.9999

0.00% -

Dogecoin

Dogecoin $0.2193

7.00% -

TRON

TRON $0.3380

0.30% -

Cardano

Cardano $0.7769

5.08% -

Stellar

Stellar $0.4350

9.36% -

Hyperliquid

Hyperliquid $40.23

5.78% -

Sui

Sui $3.739

6.95% -

Chainlink

Chainlink $18.30

9.46% -

Bitcoin Cash

Bitcoin Cash $581.7

2.11% -

Hedera

Hedera $0.2577

5.51% -

Ethena USDe

Ethena USDe $1.001

0.00% -

Avalanche

Avalanche $23.08

4.23% -

Litecoin

Litecoin $121.7

2.24% -

UNUS SED LEO

UNUS SED LEO $8.962

-0.34% -

Toncoin

Toncoin $3.332

1.36% -

Shiba Inu

Shiba Inu $0.00001273

3.39% -

Uniswap

Uniswap $10.35

6.84% -

Polkadot

Polkadot $3.818

4.01% -

Dai

Dai $1.000

0.01% -

Bitget Token

Bitget Token $4.446

2.13% -

Cronos

Cronos $0.1491

4.96% -

Monero

Monero $255.4

-9.78% -

Pepe

Pepe $0.00001099

4.80% -

Aave

Aave $284.0

8.01%

What do the three red soldiers and the three black soldiers indicate respectively?

The Red Three Soldiers and the Black Three Soldiers are common K-line patterns, indicating that the market may reverse or continue the trend, and investors need to make a comprehensive judgment based on other indicators and the market environment.

Apr 03, 2025 at 03:27 pm

In the cryptocurrency market, technical analysis tools are one of the important means traders use to predict market trends. Among them, the Red Three Soldiers and the Black Three Soldiers are common K-line patterns, which can provide investors with important signals about the future market trend. This article will discuss in detail the market conditions that the Red Three Soldiers and Black Three Soldiers each predict, and provide specific identification methods and application scenarios.

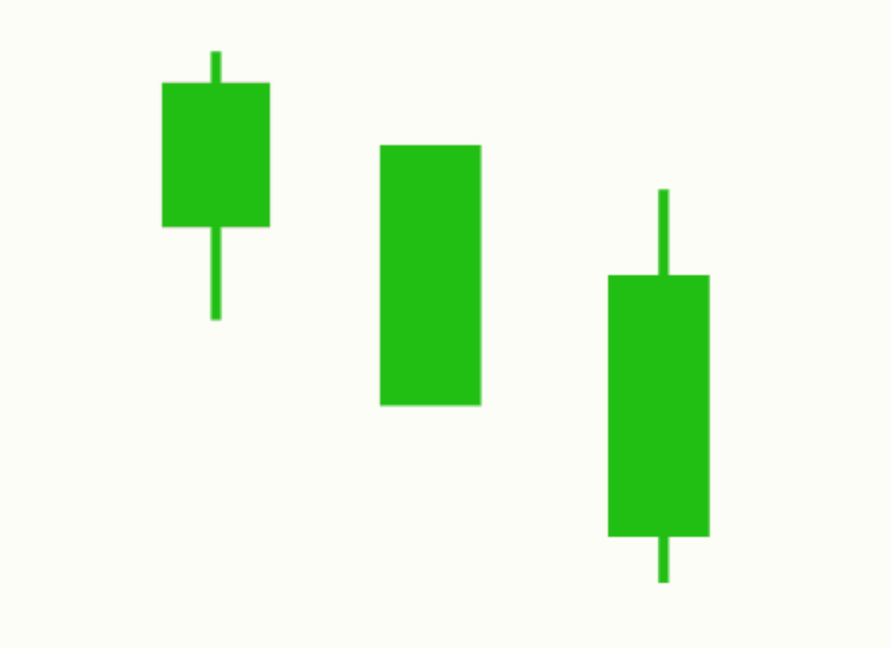

What is the Red Three Soldiers?

Three White Soldiers is a bullish K-line pattern, composed of three consecutive small positive lines. This pattern usually appears at the end of a downward trend, indicating that the market may be about to reverse and enter an upward trend.

The key to identifying the Red Three Soldiers lies in the following characteristics:

Each K-line is a positive line , that is, the closing price is higher than the opening price.

The opening price of each K-line is within the physical range of the previous K-line , usually in the middle or close to the closing price of the previous K-line.

The closing price of each K-line is higher than the closing price of the previous K-line , showing continuous upward momentum.

When the three-man style of the red soldier appears, the market has usually shifted from seller-led to buyer-led, indicating that the buyer's strength is gradually increasing and market sentiment is gradually turning to optimistic.

The market foreshadowing of the Red Three Soldiers

The emergence of the Red Three Soldiers usually indicates the following market conditions:

Market reversal : If the Red Three soldiers appear after a long-term downward trend, it may be a signal that the market is about to reversal. Investors can consider buying in this situation, expecting further price increases.

Continuation of the upward trend : If the Red Three soldiers appear in an existing upward trend, it may be a signal that the upward trend will continue. Investors can use this pattern to confirm the current trend and look for buying opportunities in the pullback.

What are the Black Three Soldiers?

Three Black Crows is a bearish K-line pattern composed of three consecutive small negative lines. This pattern usually appears at the end of an uptrend, indicating that the market may be about to reverse and enter a downtrend.

The key to identifying the three black soldiers lies in the following characteristics:

Each K-line is a negative line , that is, the closing price is lower than the opening price.

The opening price of each K-line is within the physical range of the previous K-line , usually in the middle or close to the opening price of the previous K-line.

The closing price of each K-line is lower than the closing price of the previous K-line , showing continuous downward momentum.

When the black three soldiers form appears, the market has usually shifted from buyer-led to seller-led, indicating that the seller's strength is gradually increasing and market sentiment is gradually turning to pessimism.

The market foreshadowing of the three black soldiers

The emergence of the Black Three Soldiers usually indicates the following market conditions:

Market reversal : If the Black Three Bing appears after a long-term upward trend, it may be a signal that the market is about to reversal. Investors can consider selling in this case, expecting further price declines.

Continuation of the downward trend : If the Black Three soldiers appear in an already existing downward trend, it may be a signal that the downward trend will continue. Investors can use this pattern to confirm the current trend and look for selling opportunities when they rebound.

How to apply the Red Three Soldiers and the Black Three Soldiers in the transaction?

In actual transactions, identifying and applying the forms of the Red Three Soldiers and the Black Three Soldiers requires comprehensive judgment based on other technical indicators and market environment. The following are the specific application steps:

Confirm the pattern : First, make sure that the red three soldiers or black three soldiers are indeed on the K-line chart. It can be confirmed by manual observation or using the trading platform's technical analysis tools.

Combined with other indicators : The effectiveness of the Red Three Soldiers and Black Three Soldiers can be verified by combining other technical indicators (such as moving averages, RSI, MACD, etc.). For example, if the Red Three-Soldier pattern appears when the RSI indicator breaks up from the oversold range, it may be a stronger buying signal.

Assess the market environment : Consider the current market environment, including overall trends, the impact of major events, etc. For example, if the Red Three-Soldier pattern appears near an important support level, it may be a more reliable buy signal.

Formulate a trading plan : Develop specific trading plans based on the pattern and market environment, including entry points, stop loss points and target prices. For example, if you decide to buy after the Red Three Soldier pattern appears, you can set the stop loss below the low point before the pattern, and the target price can be set near the nearest high or resistance level.

The limitations of the Red Three Soldiers and the Black Three Soldiers

Although the Red Three Soldiers and the Black Three Soldiers are effective technical analysis tools, they also have their limitations. Investors need to pay attention to the following points:

Fake signals : Sometimes the red three soldiers or black three soldiers may show false signals, and the market does not reverse or continue the trend as expected. Therefore, investors need to make comprehensive judgments based on other indicators and market environment.

Market Noise : Short-term market noise may interfere with the identification and application of patterns. Investors need to be patient and avoid trading without clear signals.

Transaction costs : Frequent transactions may lead to high transaction costs, affecting overall returns. Investors need to reasonably control the frequency of transactions to ensure the cost-effectiveness of transactions.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

- Bitcoin Reserve, Gold Revaluation, Congress Considers: A New Era for US Financial Strategy?

- 2025-08-08 04:30:12

- KAITO's Momentum: Can It Reclaim Support Amidst Social Media Scrutiny?

- 2025-08-08 04:30:12

- Pi Coin's dApp and AI Potential: Building a Decentralized Future

- 2025-08-08 02:30:12

- Ruvi AI Takes the Lead: Outshining Dogecoin on CoinMarketCap

- 2025-08-08 02:50:12

- Cryptos Under $1: Is Ripple Still the King?

- 2025-08-08 03:50:12

- Cold Wallet, Bonk Price, ICP Price: Navigating the Crypto Landscape in 2025

- 2025-08-08 03:56:12

Related knowledge

What is the difference between CeFi and DeFi?

Jul 22,2025 at 12:28am

Understanding CeFi and DeFiIn the world of cryptocurrency, CeFi (Centralized Finance) and DeFi (Decentralized Finance) represent two distinct financia...

How to qualify for potential crypto airdrops?

Jul 23,2025 at 06:49am

Understanding What Crypto Airdrops AreCrypto airdrops refer to the distribution of free tokens or coins to a large number of wallet addresses, often u...

What is a crypto "airdrop farmer"?

Jul 24,2025 at 10:22pm

Understanding the Role of a Crypto 'Airdrop Farmer'A crypto 'airdrop farmer' refers to an individual who actively participates in cryptocurrency airdr...

What is the difference between a sidechain and a Layer 2?

Jul 20,2025 at 11:35pm

Understanding the Concept of SidechainsA sidechain is a separate blockchain that runs parallel to the main blockchain, typically the mainnet of a cryp...

What is the Inter-Blockchain Communication Protocol (IBC)?

Jul 19,2025 at 10:43am

Understanding the Inter-Blockchain Communication Protocol (IBC)The Inter-Blockchain Communication Protocol (IBC) is a cross-chain communication protoc...

How does sharding improve scalability?

Jul 20,2025 at 01:21am

Understanding Sharding in BlockchainSharding is a database partitioning technique that is increasingly being adopted in blockchain technology to enhan...

What is the difference between CeFi and DeFi?

Jul 22,2025 at 12:28am

Understanding CeFi and DeFiIn the world of cryptocurrency, CeFi (Centralized Finance) and DeFi (Decentralized Finance) represent two distinct financia...

How to qualify for potential crypto airdrops?

Jul 23,2025 at 06:49am

Understanding What Crypto Airdrops AreCrypto airdrops refer to the distribution of free tokens or coins to a large number of wallet addresses, often u...

What is a crypto "airdrop farmer"?

Jul 24,2025 at 10:22pm

Understanding the Role of a Crypto 'Airdrop Farmer'A crypto 'airdrop farmer' refers to an individual who actively participates in cryptocurrency airdr...

What is the difference between a sidechain and a Layer 2?

Jul 20,2025 at 11:35pm

Understanding the Concept of SidechainsA sidechain is a separate blockchain that runs parallel to the main blockchain, typically the mainnet of a cryp...

What is the Inter-Blockchain Communication Protocol (IBC)?

Jul 19,2025 at 10:43am

Understanding the Inter-Blockchain Communication Protocol (IBC)The Inter-Blockchain Communication Protocol (IBC) is a cross-chain communication protoc...

How does sharding improve scalability?

Jul 20,2025 at 01:21am

Understanding Sharding in BlockchainSharding is a database partitioning technique that is increasingly being adopted in blockchain technology to enhan...

See all articles