|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

摩根大通对Stablecoin市场的期望与对数万亿美元估值的预测形成鲜明对比。真正的潜力是什么?

The stablecoin scene is buzzing, with projections ranging from grounded to stratospheric. Can the stablecoin market really hit that trillion-dollar mark, or is JPMorgan's more cautious outlook closer to the truth?

稳定的场景正在嗡嗡作响,投影范围从接地到平流层不等。 Stablecoin市场能否真正达到这一万亿美元的标记,还是摩根大通更谨慎的外观更接近真相?

JPM's Reality Check: Crypto-Native Demand Reigns

JPM的现实检查:加密本地需求统治

JPMorgan analysts, led by Nikolaos Panigirtzoglou, aren't buying into the hype of exponential growth. Their forecast? A more moderate trajectory, driven primarily by crypto-native activity like trading and decentralized finance (DeFi). They dismiss forecasts of the stablecoin universe ballooning to $1 trillion - $2 trillion as overly optimistic.

由Nikolaos Panigirtzoglou领导的JPMorgan分析师没有购买指数增长的炒作。他们的预测?更温和的轨迹,主要由加密本地活动(如交易和分散融资(DEFI))驱动。他们驳斥了稳定宇宙的预测,这些宇宙的热情量为1万亿美元 - 2万亿美元过于乐观。

According to JPM's analysis, a whopping 88% of today's stablecoin demand comes from within the crypto ecosystem. Forget mass adoption for payments; even with generous assumptions, that sector won't significantly move the needle.

根据JPM的分析,当今的Stablecoin需求中有88%来自加密生态系统。忘记大规模收养付款;即使有慷慨的假设,该部门也不会显着移动针头。

They also pour cold water on comparisons to China’s e-CNY or the Alipay/WeChat Pay phenomenon. Those are centralized systems, unlike the decentralized nature of most stablecoins.

他们还将冷水与中国的E-CNY或支付宝/微信付费现象进行比较。这些是集中式系统,与大多数稳定剂的分散性不同。

The Bullish Counterpoint: $2 Trillion by 2028?

看涨对立面:到2028年,$ 2万亿美元?

Other institutions see a brighter future. Standard Chartered, for example, previously suggested that clear U.S. legislation could legitimize the stablecoin industry, potentially pushing the total stablecoin supply to $2 trillion by the end of 2028.

其他机构会看到更美好的未来。例如,宪章以前提出,明确的立法可以使Stablecoin行业合法化,这可能会在2028年底之前将Stablecoin供应总额提高到2万亿美元。

The Current Landscape: USDT Dominates

当前的景观:USDT主导

As of July 1, 2025, the stablecoin market cap hovers around $257.46 billion, representing 7.81% of the total crypto market. Tether (USDT) remains the undisputed king, commanding 62.54% of the market share with a capitalization of $157.7 billion and a staggering $62.2 billion in daily trading volume. USD Coin (USDC) follows with a $61.5 billion market cap, but a lower $8.4 billion in trading volume.

截至2025年7月1日,Stablecoin市值徘徊在2574.6亿美元中,占加密货币总市场的7.81%。 Tether(USDT)仍然是无可争议的国王,占市场份额的62.54%,资本化为1577亿美元,每日交易量达到622亿美元。美元硬币(USDC)的市值为615亿美元,但交易量减少了84亿美元。

While DAI and USDe have similar market caps, DAI sees significantly higher transactional activity, indicating broader acceptance within DeFi.

尽管DAI和USD具有相似的市值,但DAI的交易活动明显更高,这表明在DEFI中接受了更广泛的接受。

My Take: A Measured Dose of Optimism

我的看法:一定的乐观剂量

While a trillion-dollar stablecoin market might be a stretch in the short term, dismissing its potential is short-sighted. The key lies in real-world adoption beyond crypto trading. For instance, cross-border payments are a perfect fit for stablecoins as they offer faster, cheaper, and more transparent option compared to traditional methods. For example, remittances to countries with unstable currencies could benefit greatly from the stability of USD-pegged stablecoins.

虽然短期内可能会有一万亿美元的稳定市场可能是一个遥不可及的市场,但驳回其潜力是短视的。关键在于超出加密交易以外的现实领养。例如,与传统方法相比,跨境支付非常适合稳定币,因为它们提供更快,更便宜,更透明的选择。例如,货币不稳定的国家的汇款可能会受益于美元固定稳定的稳定性。

However, regulatory clarity is paramount. Without a clear legal framework, institutional investors will remain hesitant, hindering broader adoption. Furthermore, stablecoins need to overcome concerns about transparency and security to build trust with mainstream users.

但是,监管清晰度至关重要。没有明确的法律框架,机构投资者将保持犹豫,阻碍更广泛的采用。此外,稳定的人需要克服对透明度和安全性的担忧,以建立与主流用户的信任。

The Bottom Line

底线

So, will stablecoins hit the trillion-dollar mark? Maybe someday. But for now, a more grounded approach, focusing on regulatory compliance, real-world use cases, and building trust, is the key to unlocking the true potential of these digital dollars. It's a marathon, not a sprint, folks! Keep your eyes on the prize!

那么,Stablecoins会击中万亿美元的商标吗?也许有一天。但是目前,一种更扎实的方法,专注于法规合规性,现实世界中的用例和建立信任,是释放这些数字美元真正潜力的关键。这是一场马拉松,不是冲刺,伙计们!请注意奖品!

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

-

-

- 比特币,自由和杠杆:在新加密时代解锁财务火力

- 2025-07-04 04:00:15

- 探索比特币如何超越简单投资的发展,为财务自由和现实世界应用中的杠杆作用提供了新的途径。

-

- Luna Crypto崩溃:从数十亿美元失去到一个安静的复出?

- 2025-07-04 02:35:18

- 探索戏剧性的露娜加密货币崩溃,目前的状态,以及它是建立稳定的未来还是面临另一个崩溃。

-

-

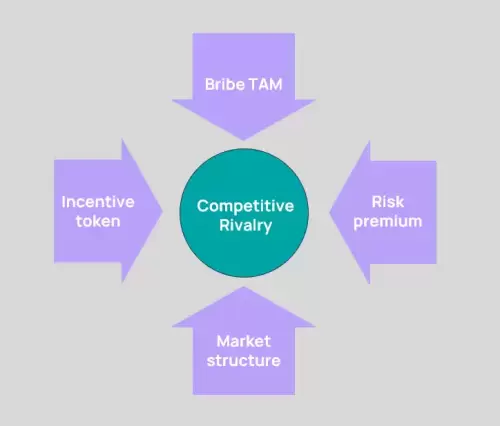

- 贿赂的四种力量:解码加密动机的动力

- 2025-07-04 02:35:18

- 探索加密货币中的“四个动力,四个力量”,特别是在酒中,揭示了激励措施的效率及其对代币持有人的影响。让我们潜入!

-

- Solana Defi积累:骑波浪还是只是在努力?

- 2025-07-04 02:40:12

- Solana Defi认为有趣的积累趋势。从Memecoin的潮流到机构ETH的购买,我们深入介绍了加密货币的心脏。

-

-

- 比特币的公牛运行:标准特许和ETF流入效应

- 2025-07-04 00:30:13

- 标准特许预测,到2025年,在ETF流入的推动下,比特币将达到200,000美元。这对加密的未来意味着什么?