|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

加密货币新闻

Meta (formerly Facebook) is back in the blockchain arena with a more cautious and refined approach: The Meta stablecoin program.

2025/05/09 14:40

In 2019, Meta (then Facebook) unveiled the Libra Project, an ambitious bid at a universal currency that quickly faced intense regulatory backlash and ultimately had to be shelved in 2022 following the rebranding of Diem. Now, three years later, Meta is returning to the blockchain scene with a more cautious and refined focus: the Meta stablecoin initiative.

What Is Meta’s Second Chance in Crypto?

According to The Information, Meta is in the midst of discussing possible use cases for a stablecoin with crypto infrastructure firms for cross-border payments in a bid to reduce transaction costs, particularly for small payments to creators on platforms like Instagram. There isn’t a full-scale crypto launch; rather, an exterior shoe is being put on the blockchain for practical financial services.”

This renewed interest is driven by several factors. Notably, Stripe recently acquired the stablecoin startup Bridge for $1.1 billion, Visa announced partnerships with blockchain companies, and Fidelity is developing its own stablecoin. Moreover, with the 2024 U.S. presidential election promising a crypto-friendlier regime and two bills aiming to provide a proper legal framework for stablecoins in the works, companies like Meta are seeing the regulatory moats starting to clear.

Lessons Learned: From Libra to Now

Unlike Libra, which aimed for a global digital currency backed by a basket of fiat currencies, the current initiative focuses on infrastructure and utility, converging well-known stablecoins like USDC or newer entrants like Bridge. This allows for a more decentralized, partner-driven setup that largely evades the major regulatory scrutiny that ultimately led to Diem's demise.

To spearhead this effort, Meta has hired Ginger Baker, an experienced fintech CEO formerly with Plaid and on the Stellar Development Foundation board. Baker is said to be coordinating with crypto infrastructure providers and guiding Meta's strategy toward scalable, regulated applications.

Circle, the issuer of USDC, has also reportedly entered early-stage talks with Meta. While none of the parties have confirmed the details, it seems these discussions are pivoting toward the use of stablecoins for payouts rather than the creation of new consumer-facing tokens.

Instagram and Creator Payouts: The First Use Case

Among the initial use cases being explored is a rather fascinating one: micro-payouts for Instagram creators. This would enable Meta to pay small amounts to creators—let's say $100—in batches in countries across the globe without the exorbitant fees and sluggishness of traditional wire transfers. Payments from stablecoins essentially settle instantly with minimal cost.

This model not only benefits the creators but also expands monetization opportunities within Meta's ecosystem, giving more avenues for engagement to influencers and content producers.

The Burning Question: Why Is Big Tech Finally Showing Interest in Crypto?

Regulation mixed with uncertainty brewed a perfect storm in the digital asset sphere. Now, as President Trump is set to take the reins, new opportunities are emerging for blockchain innovation.

At present, there is bipartisan support in Congress for two bills that would propose a proper legal framework for stablecoins. These bills are aiming to set clear rules for the issuance and use of stablecoins, offering legal clarity and institutional backing for these digital assets.

This emerging legal and regulatory landscape is paving the way for major tech companies to return to the crypto scene, having largely shied away from it in recent years due to the ambiguity and risk posed by the largely uncharted legal territory.

The Burning Question: Why Is Big Tech Finally Showing Interest in Crypto?

Regulation mixed with uncertainty brewed a perfect storm in the digital asset sphere. Now, as President Trump is set to take the reins, new opportunities are emerging for blockchain innovation.

At present, there is bipartisan support in Congress for two bills that would propose a proper legal framework for stablecoins. These bills are aiming to set clear rules for the issuance and use of stablecoins, offering legal clarity and institutional backing for these digital assets.

This emerging legal and regulatory landscape is paving the way for major tech companies to return to the crypto scene, having largely shied away from it in recent years due to the ambiguity and risk posed by the largely uncharted legal territory.

However, the regulatory climate is shifting, and with it, the calculus for tech giants is changing.

The U.S. administration has made significant progress in crafting a regulatory framework for digital assets, particularly stablecoins. This emerging legal and institutional certainty is encouraging major tech players to take a fresh look at the potential of blockchain technology and digital currencies.

Furthermore, the 2024 presidential election is likely to bring in a crypto-friendlier regime compared to the previous administration, which viewed cryptocurrencies with suspicion and aimed to restrict their use. This shift in political attitude is another factor pushing tech companies to return to the forefront of the crypto scene.

Finally, the competitive landscape is heating up, with several players making bold moves in the stablecoin space. For instance, credit card issuer Stripe recently acquired the stablecoin

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

- 没有50卢比的硬币?政府说,公众更喜欢轻巧的笔记。

- 2025-07-09 20:30:13

- 由于公众偏爱票据,印度政府没有计划50卢比的硬币。目前的50卢比设计设计面临视力障碍的公民面临挑战。

-

- 加密引擎点燃:2025年下半年要观看的主题和趋势

- 2025-07-09 20:30:13

- 准备狂野! 2025年下半年承诺,由机构采用,监管清晰度和经济力量相互作用驱动的加密进化。系好,它会被点亮!

-

-

- 大西洋十字路口的镍发现:EV供应链的游戏规则改变者

- 2025-07-09 18:50:12

- 第一大西洋镍的Awaruite发现是通过其环保,无冶炼厂的加工来重塑电动汽车供应链,并在全球挑战中提供了国内解决方案。

-

- 资深拥有的Aloha迷你高尔夫:全国范围内的岛屿乐趣

- 2025-07-09 18:55:12

- 由退伍军人创立的Aloha Mini高尔夫正在全国范围内扩展。该博客探讨了这种伙伴关系及其对企业家和社区的意义。

-

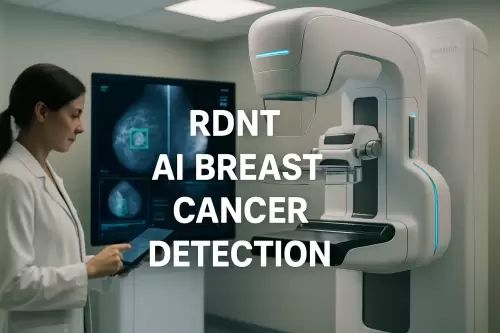

- AI癌症检测:Radnet技术与医疗保健伙伴关系改善乳腺癌筛查

- 2025-07-09 18:55:12

- Radnet与主要医疗团体合作,推出AI驱动的乳腺癌检测,增强早期检测和患者结局。

-

- Medicare覆盖范围,癌症复发和确切的科学:改变游戏规则

- 2025-07-09 19:00:13

- 精确科学的OnCodetect™测试可确保医疗保险的覆盖范围,标志着大肠癌患者和个性化医学的关键时刻。

-

- 转向未来:中国的IRCB系统驱动储蓄和自动创新

- 2025-07-09 19:00:13

- 中国的汽车行业看到了CAAS的IRCB转向系统,有望储蓄并推进自动驾驶。

-