|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

探索比特币国库公司的潜在“死亡螺旋”及其对更广泛的加密市场的影响。

Bitcoin, Treasury Firms, and the Looming Death Spiral: A New York Perspective

比特币,国库公司和迫在眉睫的死亡螺旋:纽约的观点

The buzz around Bitcoin treasury firms is reaching a fever pitch, but lurking beneath the surface is a potential 'death spiral' scenario. Venture firm Breed is raising concerns, and it's time to pay attention.

比特币国库公司周围的嗡嗡声正在发烧,但是潜伏在地面上是一种潜在的“死亡螺旋”情况。风险投资公司正在引起人们的关注,现在该关注了。

The Bitcoin Treasury Firm Dilemma: A High-Stakes Game

比特币国库公司的困境:高风险游戏

The core issue? Many companies parking Bitcoin on their balance sheets might not survive the next market downturn unless they maintain a healthy market-to-NAV (MNAV) premium. Think of it like this: if Bitcoin's price takes a nosedive, these firms could find themselves in serious trouble.

核心问题?许多公司在资产负债表上将比特币停车可能无法在下一个市场的下一个市场下滑,除非他们保持健康的市场对NAV(MNAV)溢价。这样就这样认为:如果比特币的价格需要一个鼻子,这些公司可能会发现自己陷入严重麻烦。

The 'Death Spiral' Unveiled

“死亡螺旋”揭开了

Breed's worry centers on a chain reaction. A sharp Bitcoin drop shrinks a firm's MNAV premium. Investors lose interest, fresh capital dries up, and suddenly, these businesses are gasping for air. Many of these firms borrowed money specifically to buy more Bitcoin, betting on its continued climb. If that bet goes south and loans mature, lenders will come calling, forcing fire sales.

品种的忧虑集中在连锁反应上。尖锐的比特币下降会缩小公司的MNAV溢价。投资者失去了兴趣,新鲜的资本枯竭,突然之间,这些业务正在涌向空气。这些公司中的许多公司都借了专门购买更多比特币,押注其继续攀登。如果该下注向南移动并贷款成熟,贷方将来召集,迫使消防销售。

Each fire sale further depresses the Bitcoin price, creating a domino effect across the sector. Breed calls it a 'death spiral' – a chilling prospect for any investor. Currently, most treasury firms rely on equity funding, providing some cushion. However, Breed warns that cheap debt could tempt boards to over-leverage, making the sector far more vulnerable. A single sharp price swing could trigger mass liquidations.

每次火灾销售进一步降低了比特币价格,在整个行业产生了多米诺骨牌效应。 Breed称其为“死亡螺旋” - 对任何投资者来说都是令人震惊的前景。目前,大多数财政公司都依靠股权资金,提供一些缓冲。但是,繁殖警告说,廉价债务可能会诱使董事会过度贷款,从而使该行业更加脆弱。单个尖锐的价格摆动可能会触发大规模清算。

Who Will Survive?

谁能生存?

According to Breed, only a select few are likely to weather the storm. The survivors will be those who consistently increase Bitcoin-per-share, even in stagnant markets. Clear communication, strong governance, and a healthy cash buffer are key – more so than the sheer amount of Bitcoin held.

根据Breed的说法,只有少数几个可能会在风暴中度过。幸存者将是那些即使在停滞的市场中,也会始终如一地增加比特币的人。清晰的沟通,强大的治理和健康的现金缓冲是关键 - 比持有的比特币数量更重要。

The Bigger Picture: Beyond the Balance Sheet

大局:超越资产负债表

Since MicroStrategy pioneered the corporate treasury strategy in 2020, over 250 organizations have jumped on board. If 2025 brings the correction Breed anticipates, the true measure of success won't be how much Bitcoin a company initially bought, but how much it can hold onto when the dust settles. This all depends on Bitcoin's ability to break through key resistance levels. Technical analysis suggests Bitcoin is coiling into a wedge structure, and a breakout could determine whether it has the strength to clear its all-time high. If Bitcoin fails to breakout, it risks further downside volatility.

自从MicroStrategy在2020年开创了公司国库策略以来,超过250个组织已加入。如果2025带来了更正品种的预期,那么成功的真正衡量标准将不是公司最初购买的比特币,而是灰尘沉降时可以容纳多少比特币。这一切都取决于比特币突破关键阻力水平的能力。技术分析表明,比特币正盘旋成楔形结构,突破可以确定它是否有能力清除其历史最高的高度。如果比特币未能突破,则可能会进一步下行波动。

Looking Ahead

展望未来

The fate of Bitcoin treasury firms is tied to the performance of Bitcoin itself. It's a high-stakes game, and only the well-prepared will emerge victorious.

比特币国库公司的命运与比特币本身的表现有关。这是一款高风险的游戏,只有准备充分的准备就可以胜利。

So, keep an eye on those MNAV premiums, folks. And maybe, just maybe, avoid over-leveraging. After all, nobody wants to be caught in a crypto death spiral, right?

因此,请注意那些MNAV保费,伙计们。也许,也许,避免过度杠杆作用。毕竟,没有人愿意被加密死亡螺旋式捕获,对吗?

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

-

-

- BNB,Maxwell Fork和BSC Mainnet:导航速度,稳定性和地缘政治潮汐

- 2025-06-30 06:50:12

- 在市场波动中探索麦克斯韦硬叉对BNB智能连锁店的影响,使技术升级与经济现实平衡。

-

- 比特币价格,年轻一代和人工智能工作流离失所:一场完美的风暴?

- 2025-06-30 07:30:12

- 探索年轻一代对AI驱动的工作流离失所和传统金融体系的担忧如何推动比特币采用和价格。

-

- 韩国和山寨币:交易量加热!

- 2025-06-30 07:30:12

- 韩国加密用户正在多元化山顶!发现对韩国不断发展的山寨币交易量的趋势和见解。

-

-

-

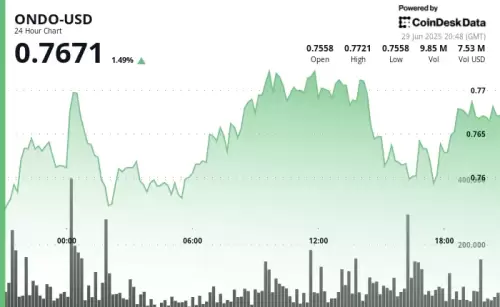

- Ondo Climbs:代币化的股票已准备好2025年收购?

- 2025-06-30 07:12:02

- Ondo Finance在2025年将股票押注大量,而双子座跳入欧盟市场。这是金融的未来吗?

-

- 比特币矿工:收入下降,但不出售?在加密货币场景上的纽约分钟

- 2025-06-30 07:12:03

- 比特币矿工在收入下降时面临艰难的时期,但令人惊讶的是没有出售他们的比特币。有什么交易?让我们分解,纽约风格。