|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

到目前为止,在2025年,在经济不确定性的情况下,比特币和黄金都表现出了显着的表现。

Both Bitcoin and gold have displayed significant performance in 2025 amidst persisting economic uncertainties. Bitcoin is currently trading at around $98,000, indicating a year-to-date (YTD) gain of approximately 4%.

比特币和黄金在2025年持续存在的经济不确定性中都表现出显着的表现。比特币目前的交易价格约为98,000美元,表明一年一时(YTD)的增长约为4%。

On the other hand, gold has surged nearly 29% YTD, hitting record highs above $3,500 per ounce.

另一方面,黄金飙升了近29%的YTD,达到每盎司3,500美元以上的创纪录高点。

Bitcoin: A Digital Asset with High Growth Potential

比特币:具有高增长潜力的数字资产

Bitcoin, the world’s leading cryptocurrency, is known for its decentralized nature and potential for rapid price movements. Its volatility can be attributed to factors such as market sentiment, macroeconomic events, and institutional investment trends.

比特币是世界领先的加密货币,以其分散性的性质和快速价格变动的潜力而闻名。它的波动性可以归因于诸如市场情绪,宏观经济事件和机构投资趋势之类的因素。

In 2025, Bitcoin has shown resilience despite market turbulence. Its price has nearly doubled from the lows reached in 2024, showcasing the potential for substantial returns in the crypto market.

在2025年,尽管市场动荡,比特币表现出弹性。它的价格与2024年的低点几乎翻了一番,展示了加密货币市场上大量回报的可能性。

Bitcoin is increasingly being adopted by institutional investors, who are seeking new avenues for investment amid low interest rates and stock market valuations.

比特币越来越多地被机构投资者采用,他们正在为低利率和股票市场估值寻求新的投资途径。

Volatility and Risk Considerations

波动和风险考虑因素

While Bitcoin offers the potential for high returns, it is also recognized for its volatility.

尽管比特币提供了高回报的潜力,但它的波动性也被认可。

Gold: A Stable Haven in Turbulent Times

黄金:动荡时代的稳定避风港

Gold, a time-tested store of value, has traditionally served as a hedge against inflation and macroeconomic uncertainty.

黄金是经过时间测试的价值存储,传统上一直是抵抗通货膨胀和宏观经济不确定性的对冲。

In periods of economic distress, investors typically prefer safer assets like gold over riskier assets like stocks or cryptocurrencies.

在经济困扰时期,投资者通常更喜欢更安全的资产,例如黄金,而不是股票或加密货币等风险的资产。

As 2025 has seen heightened geopolitical tensions and unrest in several regions, investors have flocked to gold to preserve their wealth and mitigate risk.

随着2025年在几个地区的地缘政治紧张局势和动荡加剧,投资者涌向黄金,以维持其财富并减轻风险。

Gold or Bitcoin: A Matter of Risk Tolerance

黄金或比特币:风险承受能力的问题

In 2025, gold has outperformed Bitcoin in terms of YTD gains, further cementing its status as a traditional inflation hedge. However, Bitcoin's ongoing adoption by institutions and its potential for high returns continue to attract investors.

在2025年,黄金在YTD的增长方面优于比特币,进一步巩固了其作为传统通货膨胀对冲的地位。但是,比特币持续采用机构及其高回报的潜力继续吸引投资者。

The choice between gold or Bitcoin depends on individual risk tolerance, investment goals, and time horizon.

黄金或比特币之间的选择取决于个人风险承受能力,投资目标和时间范围。

Those with a high-risk appetite and a long-term view may prefer Bitcoin for its potential for substantial returns, while investors seeking stability and safety in turbulent times may opt for gold as a reliable store of value.

那些胃口高风险和长期视野的人可能更喜欢比特币的大量回报,而在动荡时期寻求稳定和安全性的投资者可能会选择黄金作为可靠的价值存储。

Ultimately, the best investment strategy will vary depending on individual circumstances and financial objectives.

最终,最佳投资策略将根据个人情况和财务目标而有所不同。

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

- Celestia的本地令牌TIA峰值13%

- 2025-05-08 21:20:12

- TIA是模块化区块链项目Celestia的本地硬币,如今飙升了约13%。这次激增与Celestia硬币价格行动相矛盾

-

-

- 布雷特·普莱斯(Brett Price)在过去24小时内增长了17%

- 2025-05-08 21:15:12

- 布雷特(布雷特)价格自达到0.235美元以来一直处于陡峭的趋势上

-

-

- 皇家造币厂发布VE第80周年纪念金币

- 2025-05-08 21:10:12

- 在VE日80周年纪念日,皇家造币厂将击中硬币的金色证明版

-

- 加密矿山的世界已正式进入了一个新时代

- 2025-05-08 21:10:12

- 比特币Solaris(BTC-S)使用户能够直接从其智能手机开采加密货币

-

- Altcoin季节突破?几个月出血后,索引信号转移

- 2025-05-08 21:05:13

- Altcoin赛季指数刚刚摆脱了多个月的下降趋势,引发了人们的希望,期待已久的Altcoin Rally可能会出现。

-

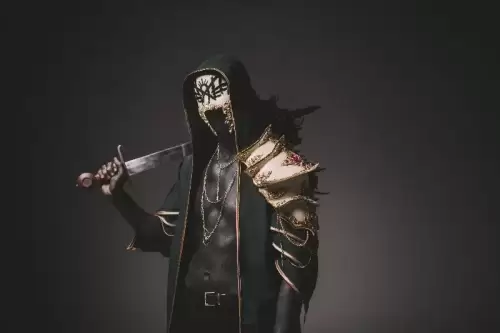

- 蒙面乐队的睡眠代币即将放弃他们的最新专辑

- 2025-05-08 21:05:13

- 蒙面的乐队睡眠令牌即将放弃他们的最新专辑,围绕该发行的炒作显而易见。

-