|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

比特币(Crypto:BTC)在星期三早些时候着火,只是随着市场下降而崩溃。

Crypto investors were closely watching the 20-year Treasury auction on Wednesday, and the results weren’t pretty.

加密投资者在周三密切观看了20年的国库拍卖,结果并不漂亮。

The U.S. Treasury failed to place any bids at the top of the market for the 20-year bond, which resulted in a big spike in yields and a drop in bond prices. That also led to a crash in Bitcoin (CRYPTO:BTC) and other cryptocurrencies.

美国财政部未能将所有出价放在20年债券的市场顶部,这导致收益率很高,债券价格下跌。这也导致比特币(Crypto:BTC)和其他加密货币发生崩溃。

The weak auction is likely a result of strong demand for the 13-week bill, which sold at a lower-than-expected yield. Together, the Treasury sold $60 billion in 13-week bills at a yield of 4.997%, $43 billion in 26-week notes at a yield of 5.079%, $32 billion in 20-year bonds at a yield of 4.277%, and $17 billion in seven-year notes at a yield of 4.065%.

薄弱的拍卖可能是对这项为期13周账单的强劲需求的结果,该账单的出售价格低于预期。美国财政部以4.997%的收益率售出了600亿美元的13周账单,26周的票据430亿美元,收益率为5.079%,20年期债券的收益率为320亿美元,收益率为4.277%,收益率为4.277%,七年期票据的收益率为170亿美元。

The bill went for a yield of 4.58%, but economists had expected a yield around 4.47%. Meanwhile, the 20-year bond sold fully at 3.95%, while economists were expecting a rate closer to 4%.

该法案的收益率为4.58%,但经济学家预计收率约为4.47%。同时,20年期债券的销售额为3.95%,而经济学家预计利率接近4%。

That led to a big spike in yields, with the 10-year Treasury yield rising 16 basis points to 4.04%. Higher yields typically mean investors are fleeing from high-risk assets to safer assets, and crypto may be one asset class that investors are cutting back on.

这导致收益率很高,十年期财政收益率上升了16个基点,达到4.04%。较高的收益率通常意味着投资者从高风险的资产逃到更安全的资产,而加密货币可能是投资者正在削减的一种资产类别。

Crypto investors may think Bitcoin is a “safe” asset, but history tells us that Bitcoin trades correlated with growth stocks and isn't a safe haven if there’s a recession or the market drops.

加密投资者可能认为比特币是“安全”的资产,但是历史告诉我们,比特币交易与增长股票相关,如果经济衰退或市场下降,则不是避风港。

Bitcoin’s jump to $109,722 happened just before 1 p.m. ET, just before the 20-year auction took place. The value dropped to $106,307 within minutes and is now down to $107,191 as I’m writing. Ethereum (CRYPTO:ETH) took a similar path, falling 5% to $2,480 in a few minutes and Dogecoin (CRYPTO:DOGE) dropped 5.6% peak to trough and is now at $0.226 per token.

比特币的跃升至109,722美元,就在美国东部时间下午1点之前,就在20年拍卖之前。该价值在几分钟内下降至106,307美元,现在我写作的是107,191美元。以太坊(Crypto:ETH)走了一条类似的道路,几分钟内下跌了5%至2,480美元,而Dogecoin(加密:Doge)跌至低谷5.6%,现在为0.226美元。

Image source: Getty Images.

图像来源:盖蒂图像。

The crypto reality

加密现实

As much as crypto investors would like to think cryptocurrencies are a hedge against the market, the reality is crypto is very correlated with growth stocks.

加密投资者想认为加密货币是针对市场的对冲,现实是加密货币与增长股票非常相关。

You can see that in the movement of Bitcoin and the Vanguard Growth Index ETF over the past three years.

您会看到,在过去三年中,比特币和先锋增长指数ETF的运动中。

Bitcoin Price data by YCharts

YCHARTS的比特币价格数据

And the same correlation holds when the market fell in late 2021 into 2022.

当市场在2021年末到2022年市场时,相同的相关性也存在。

Bitcoin Price data by YCharts

YCHARTS的比特币价格数据

As bond values fall (because yields are rising), it’s likely investors pull back from growth stocks and risky assets like cryptocurrencies. We’re seeing that in a small move today, but don’t be surprised if it gets worse.

随着债券价值的下降(因为收益率上升),投资者很可能会从增长股票和加密货币等风险资产中退缩。我们看到今天的举动很小,但是如果情况变得更糟,请不要感到惊讶。

Why are bonds telling a negative story?

债券为什么讲一个负面故事?

The concern for investors is that bond markets are sending a warning. When yields jump like this it’s an indication investors are seeing rising risk in Treasuries. This could be because they’re not seeing the dollar as the safe haven it once was or there’s higher risk of rising rates in the future because of inflation.

投资者关注的是债券市场正在发出警告。当产量跳高时,这表明投资者看到国库的风险增加。这可能是因为他们没有将美元视为曾经的避风港,或者由于通货膨胀,将来利率上升的风险更高。

Those higher rates would be because the Federal Reserve has to fight inflation caused by tariffs. And with companies already starting to make decisions about holiday purchases, it’s likely that higher prices will start flowing to consumers relatively soon. When that shows up in the data, it’s likely too late, and the market is reacting before conditions get bad.

这些较高的利率是因为美联储必须与关税造成的通货膨胀作斗争。而且,随着公司已经开始对假期购买做出决定,很快,更高的价格将开始流向消费者。当数据出现在数据中时,可能为时已晚,并且在情况恶劣之前,市场正在反应。

Higher prices are what led to the market’s crash in 2022 as consumers pulled back, companies cut spending, and the economy slowed. But a recession was avoided in part because labor markets were still tight and stimulus money was still flowing. That may not be the case this time around.

随着消费者退缩,削减支出和经济放缓,较高的价格导致了2022年市场崩溃的原因。但是,避免衰退的部分原因是劳动力市场仍然很紧张,刺激性金钱仍在流动。这次可能不是这种情况。

Crypto’s bubble is bursting

加密泡沫正在破裂

There have been a lot of tailwinds for the crypto industry from the election to rising markets, but this could be a new paradigm. If the U.S. goes into a tariff-induced recession and interest rates rise, rather than fall as you would expect in a recession, there will be massive fallout.

从选举到不断上升的市场,加密货币行业都有很多逆风,但这可能是一个新的范式。如果美国陷入关税引起的衰退和利率上升,而不是像您在经济衰退中所期望的那样下降,那将会有大规模的后果。

Holding cryptocurrencies may be the last thing investors want to do in that environment and that’s why there’s so much volatility in a down market. Expect that to continue if bond yields rise and stocks fall in 2025.

持有加密货币可能是投资者在那种环境中要做的最后一件事,这就是为什么在下跌市场中如此多波动性的原因。预计如果债券收益率上升,股票在2025年下跌,将继续下去。

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

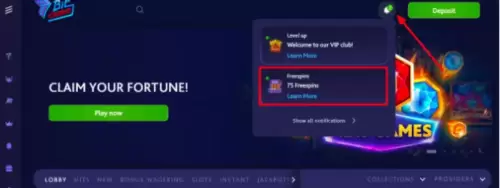

- 7bit赌场是2025年最好的加密赌场

- 2025-05-22 17:10:15

- 找到合适的加密赌场可能是一个挑战,尤其是对于寻求安全和有意义的游戏体验的玩家。

-

-

-

-

- 比特币超过了以前的历史最高水平,超过了100,000美元

- 2025-05-22 17:00:13

- 全球最大的加密货币触及109,760.08美元,持续1.1%,至108,117美元。

-

- AI代理部门以戏剧性的速度增长

- 2025-05-22 17:00:13

- 该行业的总市值在过去24小时内攀升了近3%,截至2025年5月21日,该行业的总资本化达到了108.7亿美元。

-

-

- 澄清我早期参与运动项目

- 2025-05-22 16:55:13

- 最近,Coindesk发表了一篇文章,描述了我早期参与运动项目。该推文的目的是澄清事实。

-