|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

比特币(BTC)的价格在周日短暂降至该水平以下,持续到了范围内的行为,其价格低于94,000美元。

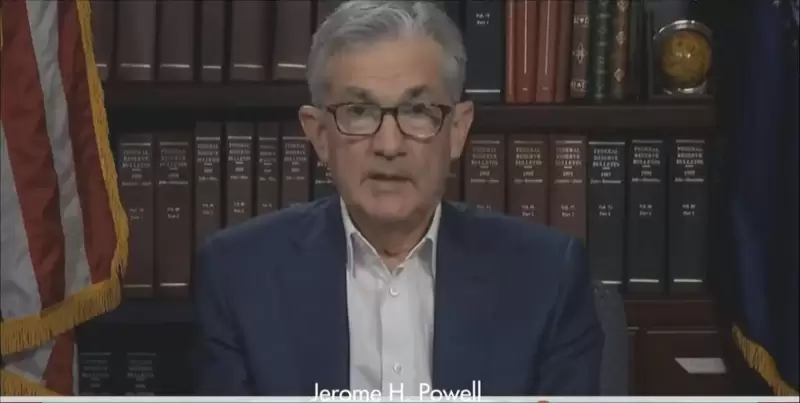

Cardano's ADA and XRP led losses among majors on Tuesday as traders await the outcome of the upcoming Federal Reserve (FOMC) meeting, where rates are expected to stay unchanged but Fed chair Jerome Powell's comments could provide cues on further market positioning.

随着贸易商等待即将举行的美联储(FOMC)会议的结果,Cardano的ADA和XRP在大满贯赛中造成了损失,预计利率将保持不变,但美联储主席杰罗姆·鲍威尔(Jerome Powell)的评论可以提供有关进一步市场定位的线索。

Bitcoin (BTC) prices held above $94,000 after briefly dipping below that level on Sunday, continuing its recent range-bound behavior.

比特币(BTC)的价格在周日短暂降至该水平以下,持续到了范围内的行为,其价格低于94,000美元。

ADA price dropped nearly 4% while XRP slid similarly. Ether (ETH) fell nearly 1%, BNB Chain's BNB rose 1.3% and memecoin dogecoin (DOGE) was down 2% in the past 24 hours.

ADA价格下降了近4%,而XRP也同样下跌。 Ether(ETH)下跌了近1%,BNB链的BNB上涨了1.3%,而Memecoin Dogecoin(Doge)在过去24小时内下降了2%。

The broad-based CoinDesk 20 (CD20), a liquid index that tracks the largest tokens by market capitalization, dropped a little over 1.8%.

基于广泛的Coindesk 20(CD20)是一种按市值跟踪最大令牌的液体指数,下降了1.8%以上。

Elsewhere, some DeFi tokens such as AAVE, Curve's CRV, and Hyperliquid's HYPE have seen a bump in demand over the past week in a sign of trader interest toward projects with utility and yield mechanisms, some say.

有人说,在其他地方,某些Defi令牌,例如AAVE,Curve的CRV和Hyproliquid的Hype在过去一周的需求中,人们对具有实用性和产量机制的项目的兴趣表明了贸易商的兴趣。

"As memecoins fall out of favor, traders are turning to projects with stronger fundamentals and token economics," said Kay Lu, CEO of HashKey Eco Labs, told CoinDesk in a Telegram message.

Hashkey Eco Labs的首席执行官Kay Lu在一份电报消息中告诉Coindesk:“随着Memecoins的失利,交易者正在转向具有更强基本面和代币经济学的项目。”

"DeFi ecosystems are benefiting from this pivot, especially as Bitcoin shows decreased volatility and macro uncertainty lingers. We're hopeful to see the DeFi trend continue as Bitcoin maintains decreased volatility and crypto acts as a hedge for economic uncertainty," Lu added.

卢(Lu)补充说:“ defi生态系统正在从这个枢纽中受益,尤其是比特币显示出降低的波动性和宏观不确定性的持续性。我们希望看到,随着比特币的波动性下降,defi趋势的持续下降,加密货币作为经济不确定性的对冲。”

HYPE led gains among the top 100 tokens with a 72% surge in the past week, with AAVE and CRV up as much as 40%.

在过去一周中,Hype带来了前100个代币中的增长,而AAVE和CRV上升了多达40%。

Powell's comment in focus

鲍威尔在焦点中的评论

Traders across both crypto and traditional finance markets are eyeing this week’s FOMC interest rate decision, with consensus expectations pointing to a pause in rate hikes.

加密货币市场和传统财务市场的交易者都在关注本周的FOMC利率决策,共识期望的预期表明速度上涨。

However, uncertainty around inflation, tariffs, and the broader U.S.–China trade tensions has left many participants cautious.

但是,通货膨胀,关税和更广泛的美国 - 中国贸易紧张局势的不确定性使许多参与者谨慎。

"We don’t expect the FOMC to trigger a major move in markets," said Augustine Fan, Head of Insights at SignalPlus, in a Telegram message. “It’s a coin flip on direction. Crypto will likely take cues from broader earnings growth and how the economy digests the impact of recent trade policies.”

SignalPlus的见解主管Augustine Fan在一条电报消息中说:“我们不希望FOMC引发市场的重大行动。” “这是朝向方向发展的硬币。加密货币可能会从更广泛的收入增长以及经济如何消化最近的贸易政策影响中。”

Recent stock market strength suggests that investors are pricing in only a mild recession risk, around 8%, according to historical drawdown models. That contrasts with more bearish signals from bond markets and macroeconomic forecasts, Fan added.

根据历史缩写模型,最近的股票市场实力表明,投资者的价格仅处于轻度衰退风险,约为8%。范补充说,这与债券市场和宏观经济预测的更多看跌信号形成鲜明对比。

Last week, President Trump confirmed no immediate plans for talks with China, dampening hopes for a breakthrough in U.S.–China trade negotiations. Still, the possibility of separate trade agreements has helped keep risk sentiment intact, as reported Monday.

上周,特朗普总统确认没有与中国进行会谈的直接计划,这削弱了对美国 - 中国贸易谈判取得突破的希望。如周一报道,尽管如此,单独的贸易协定的可能性仍有助于保持风险情绪的完整状态。

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

- 尽管顶级加密货币主导了头条新闻,但像渲染(RNDR)这样的安静竞争者正在精明的投资者中受到关注。

- 2025-05-07 02:25:12

- 渲染网络是一个分散的平台

-

-

- 比特币(BTC)在看涨激增后停止了:找到我们的完整分析和当前的技术前景。

- 2025-05-07 02:20:12

- 自从4月23日激增以来,比特币已合并约94,192美元,引发了显着的恢复。

-

- pyth在解锁之前建立了看跌势头

- 2025-05-07 02:20:12

- 目前,Pyth Coin的价格约为0.139美元,这反映了自昨天以来的不小上升。

-

- 标准特许在BNB令牌上的覆盖范围,预测到2028年的价格将攀升至2775美元

- 2025-05-07 02:15:11

- 自2021年5月以来,BNB的交易几乎与未加权的比特币和以太坊一致,就回报和波动而言

-

-

- 英国排除了创建比特币储备,理由是价格波动

- 2025-05-07 02:10:12

- 英国加入了越来越多的国家,拒绝比特币作为国库券的国家,理由是其价格在长时间内的价格波动。

-

-