|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

加密貨幣新聞文章

Stock Symbol Coins: Revolutionizing Investing by Bridging Traditional Finance With Digital Innovation

2025/01/07 14:40

Stock Symbol Coins: A New Era in Investing?

In the ever-evolving landscape of financial markets, a new and intriguing concept has emerged, generating buzz across the investment community: the Stock Symbol Coin (SSC). This innovation blends the worlds of traditional stock trading and digital currency, offering a fresh perspective on portfolio diversification.

What is a Stock Symbol Coin? At its core, a Stock Symbol Coin represents a digital token tied to a particular stock’s performance. It essentially tokenizes the value of traditional stocks, enabling holders to gain exposure to the equity market without dealing directly in stocks. By bridging these two financial realms, SSCs allow investors to capitalize on stock movements via blockchain technology, enhancing liquidity and accessibility.

Why Does It Matter? The potential of SSCs lies in their ability to democratize access to stock markets. They provide a platform for both novice and experienced investors to diversify their portfolios beyond cryptocurrencies. Additionally, SSCs promise real-time transparency and lower transaction costs. For investors in regions with limited stock market access, this could be a game changer.

The Road Ahead However, this innovation does not come without challenges. Regulatory hurdles, market volatility, and technological issues are among the factors that could affect the widespread adoption of SSCs. As industries and investors delve deeper into this hybrid model, it will be crucial to closely monitor its development and address these challenges head-on.

The Stock Symbol Coin is more than a financial novelty—it's a glimpse into the future of investing, potentially bridging traditional finance with digital innovation.

What are Stock Symbol Coins and How Could They Revolutionize Investing?

Introduction to Stock Symbol Coins

The Stock Symbol Coin (SSC) is gaining attention as a new financial instrument combining traditional stock trading principles with cutting-edge blockchain technology. As this concept gathers momentum, the potential impacts on the investment landscape are becoming clearer. In this article, we delve into the emerging trends, advantages, and challenges associated with Stock Symbol Coins.

Trends and Innovations

The introduction of Stock Symbol Coins taps into several significant trends. First, it aligns with the growing interest in blending traditional finance with blockchain innovation. This fusion can facilitate easier cross-market investments and allow for new forms of digital assets. Additionally, the rise of SSCs highlights a broader trend of increasing digitization in the investment sector, which is paving the way for more real-time trading and greater market fluidity.

Benefits of Stock Symbol Coins

1. Democratized Access: SSCs provide a gateway for individuals globally to participate in stock markets without facing high barriers to entry, making it easier for people in underserved regions to diversify investments.

2. Enhanced Liquidity: By tokenizing stock performance, SSCs introduce new liquidity avenues within digital markets, allowing for easier buying and selling.

3. Cost-Effective Transactions: Using blockchain technology can reduce transaction fees compared to traditional stock exchanges, optimizing cost-efficiency for investors.

4. Real-Time Transparency: The blockchain’s intrinsic transparency ensures that investors have access to immediate, reliable information regarding market changes and asset performance.

Potential Challenges

Despite their promise, Stock Symbol Coins face a series of hurdles:

– Regulatory Scrutiny: Legal systems worldwide are still adapting to digital financial instruments, meaning SSCs must navigate complex regulatory landscapes.

– Market Volatility: The dual nature of being tied to both cryptocurrency and stock market fluctuations increases their exposure to potential volatility.

– Technological Dependence: As digital assets, SSCs heavily rely on robust technological infrastructure. Any weaknesses, such as network security breaches, could directly impact their stability and investor confidence.

Predictions and Future Outlook

As financial ecosystems continue to evolve, SSCs are expected to become significant players in the transition towards digital economies. They are likely to drive further integration between traditional and digital investments, offering new ways for investors to engage with global markets.

Conclusion

Stock Symbol Coins represent a pivotal moment in the merging of traditional and digital finance, promising both opportunities and challenges for investors. As the landscape continues to change, staying informed and adaptable will be key for those looking to leverage this innovative financial tool.

For more information on emerging trends in finance, you might explore expertly managed resources like Forbes and Bloomberg.

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

-

-

- 比特幣,自由和槓桿:在新加密時代解鎖財務火力

- 2025-07-04 04:00:15

- 探索比特幣如何超越簡單投資的發展,為財務自由和現實世界應用中的槓桿作用提供了新的途徑。

-

- Luna Crypto崩潰:從數十億美元失去到一個安靜的複出?

- 2025-07-04 02:35:18

- 探索戲劇性的露娜加密貨幣崩潰,目前的狀態,以及它是建立穩定的未來還是面臨另一個崩潰。

-

-

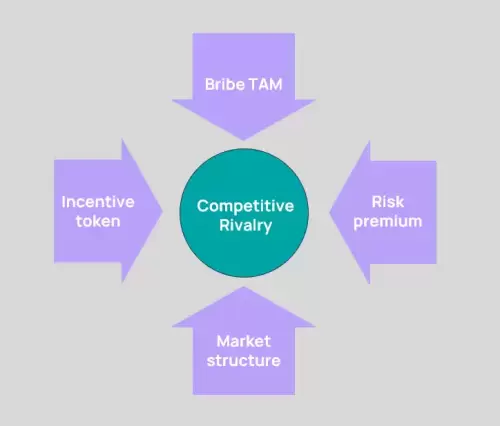

- 賄賂的四種力量:解碼加密動機的動力

- 2025-07-04 02:35:18

- 探索加密貨幣中的“四個動力,四個力量”,特別是在酒中,揭示了激勵措施的效率及其對代幣持有人的影響。讓我們潛入!

-

- Solana Defi積累:騎波浪還是只是在努力?

- 2025-07-04 02:40:12

- Solana Defi認為有趣的積累趨勢。從Memecoin的潮流到機構ETH的購買,我們深入介紹了加密貨幣的心臟。

-

-

- 比特幣的公牛運行:標準特許和ETF流入效應

- 2025-07-04 00:30:13

- 標準特許預測,到2025年,在ETF流入的推動下,比特幣將達到200,000美元。這對加密的未來意味著什麼?