|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

探索比特幣如何超越簡單投資的發展,為財務自由和現實世界應用中的槓桿作用提供了新的途徑。

Bitcoin, Freedom, and Leverage: Unlocking Financial Firepower in the New Crypto Era

比特幣,自由和槓桿:在新加密時代解鎖財務火力

Bitcoin is no longer just about speculation; it's about empowerment. This article explores how Bitcoin is being used to unlock new forms of financial freedom and leverage, moving beyond simple investment to real-world applications.

比特幣不再只是猜測;這是關於授權的。本文探討瞭如何使用比特幣來解鎖新形式的財務自由和槓桿作用,而不是簡單投資轉移到現實世界中的應用程序。

Bitcoin as Pristine Collateral: A New Paradigm

比特幣作為原始抵押品:一種新的範式

Jullian Duran, CEO of Lever, envisions Bitcoin as “pristine collateral,” opening doors in traditionally underinvested sectors. Instead of cashing out, Bitcoin holders can leverage their assets to fund ventures and opportunities. This approach allows users to diversify their investments and protect themselves from market volatility in both the crypto and real-world sectors. Duran argues that 'Firepower, it’s an exercise of freedom'

Lever首席執行官Jullian Duran設想比特幣是“原始抵押品”,這是傳統投資不足的部門的開門。比特幣持有人無需兌現,而是利用其資產來資助企業和機會。這種方法使用戶能夠多樣化投資並保護自己免受加密和現實領域的市場波動。杜蘭認為“火力,這是一種自由的練習”

Real-World Use Cases: Beyond Speculation

現實世界的用例:超越猜測

Unlike volatile DeFi protocols, Lever focuses on generating returns from stable industries like utilities, housing, and infrastructure. These sectors offer dollar-based yields uncorrelated with crypto markets, providing a more secure and predictable return on investment. This shift represents a significant evolution in how Bitcoin can be utilized.

與揮發性偏差協議不同,Lever專注於從公用事業,住房和基礎設施等穩定行業產生回報。這些領域提供了與加密貨幣市場不相關的美元收益率,從而提供了更安全和可預測的投資回報。這種轉變代表瞭如何利用比特幣的重大發展。

The Human Element: Bitcoin and Ambitious Living

人類元素:比特幣和雄心勃勃的生活

Duran shares a story of a Bitcoin billionaire in Puerto Rico who couldn't use his wealth to buy a mansion without selling his Bitcoin. This highlights the core issue Lever aims to solve: enabling Bitcoin holders to live ambitiously without sacrificing their crypto assets. The idea is to have your foot in a lot of different places at once,” Duran said. “There’s a run on Bitcoin? You’re protected. There’s a run on real-world industries? You’re protected.

杜蘭(Duran)在波多黎各分享了一個比特幣億萬富翁的故事,他在不出售比特幣的情況下無法利用自己的財富購買豪宅。這突出了Lever旨在解決的核心問題:使比特幣持有人雄心勃勃地生活而無需犧牲其加密資產。杜蘭說:“想法是一次讓您的腳步進入許多不同的地方。比特幣有一項運行嗎?你受到保護。現實世界中有一個運行嗎?你受到保護。

Potential Risks and Market Corrections

潛在的風險和市場更正

While the future looks bright, independent crypto analyst Ali Martinez cautioned of a potential downside for Bitcoin after spotting a bearish signal from a reliable technical indicator. Martinez noted that the TD Sequential sent a sell signal in 2015, and a 75% Bitcoin drop ensued. In 2018, the same setup saw Bitcoin plummet by over 85%.

儘管未來看起來光明,但獨立的加密分析師阿里·馬丁內斯(Ali Martinez)警告說,從可靠的技術指標發現看跌信號後,比特幣的潛在缺點。馬丁內斯指出,TD順序在2015年發出了賣出信號,隨之而來的是75%的比特幣。在2018年,相同的設置使比特幣墜落下降了85%以上。

Cloud Mining and Passive Income: Hashj's Approach

雲採礦和被動收入:哈希的方法

Platforms like Hashj are emerging to make crypto mining more accessible. Hashj supports multiple currencies, including XRP, USDT, SOL, and DOGE, allowing users to earn daily rewards. They focus on cloud mining, eliminating the need for complex hardware and offering diversified portfolio options. Hashj claims to have stablecoin mining (USDT) – low risk, stable returns, suitable for conservative investors.

像哈希(Hashj)這樣的平台正在興起,使加密礦山開採更容易訪問。 HASHJ支持包括XRP,USDT,SOL和DOGE在內的多種貨幣,使用戶可以每天獲得獎勵。他們專注於雲採礦,消除了對複雜硬件的需求,並提供了多元化的投資組合選項。 Hashj聲稱擁有Stablecoin採礦(USDT) - 低風險,穩定的回報,適合保守投資者。

Leveraged ETFs: Amplifying Exposure

槓桿ETF:擴增暴露

Firms are creating leveraged ETFs, such as a 2x Long BONK product, to amplify exposure to crypto assets. These ETFs aim to provide investors with increased returns, but they also come with higher risks. Similar 2x long exposure funds for other assets, including SOL, TRUMP, MELANIA, XRP, ADA and LTC.

公司正在創建槓桿ETF,例如2倍長的Bonk產品,以擴大對加密資產的影響。這些ETF旨在為投資者提供增加的回報,但它們的風險也更高。其他資產的2倍長期曝光資金,包括Sol,Trump,Melania,XRP,ADA和LTC。

Final Thoughts: Embracing the Future of Bitcoin

最終想法:擁抱比特幣的未來

From pristine collateral to cloud mining and leveraged ETFs, Bitcoin's evolving landscape offers exciting possibilities for financial freedom and leverage. While risks exist, the potential to unlock new opportunities is undeniable. So, buckle up, crypto enthusiasts! The future of Bitcoin is looking brighter than a New York skyscraper on a sunny day. And remember, always do your own research!

從原始的抵押品到雲採礦和槓桿ETF,比特幣的不斷發展的景觀為財務自由和槓桿提供了令人興奮的可能性。儘管存在風險,但解鎖新機會的潛力是不可否認的。因此,搭扣,加密愛好者!在晴天,比特幣的未來看起來比紐約摩天大樓更光明。請記住,始終做自己的研究!

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

- 房子,特朗普比爾,比特幣集會:宏觀和加密貨幣的紐約分鐘

- 2025-07-04 10:30:12

- 特朗普的法案激發了比特幣的嗡嗡聲!了解財政政策,清潔能源削減和模因硬幣躁狂症如何在永遠野生的加密世界中交織在一起。

-

-

-

-

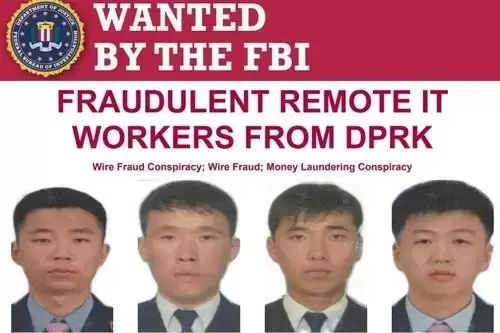

- 平壤在壓力下:看美國起訴書和朝鮮演員

- 2025-07-04 08:30:12

- 解碼美國對朝鮮人的最新起訴以及他們對平壤策略的揭示。

-

-

- Robinhood的風險遊戲:假代幣,真正的麻煩?

- 2025-07-04 09:10:14

- Robinhood進入令牌化資產的企業引發了爭議,因為Openai距離“假”令牌距離,引發了有關風險和透明度的疑問。

-

-

- Shiba Inu的潛在加密集會:乘坐價格上漲?

- 2025-07-04 09:15:12

- Shiba Inu是否準備反彈?分析最新數據,鏈活動和技術指標,以發現加密拉力賽在加密貨幣集會中的價格上漲的可能性。