|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

探索Stablecoins的世界:他們不斷增長的市值,不同的用例,以及如何以NYC Edge來瀏覽這一令人興奮的景觀。

Stablecoins are making waves in digital finance, offering stability in the volatile crypto world. Let's dive into their market cap, how they're being used, and how to navigate this space like a true New Yorker.

Stablecoins在數字融資中引起了海浪,在揮發性加密世界中提供了穩定性。讓我們潛入他們的市值,如何使用它們以及如何像真正的紐約人一樣瀏覽這個空間。

Stablecoins: A Growing Force

Stablecoins:不斷增長的力量

Stablecoins have quietly become essential in digital assets, powering everything from trading to cross-border payments. Daily trading volumes exceed $135 billion, highlighting their growing popularity. These digital assets maintain a consistent value, providing stability in the crypto market.

Stablecoins在數字資產中靜靜地變得至關重要,從交易到跨境支付的所有功能。每日交易量超過1350億美元,強調了它們日益普及。這些數字資產具有一致的價值,從而在加密市場中提供了穩定性。

Top Stablecoins by Market Cap

最高穩定的市值

Here’s a look at the top stablecoins as of June 2025:

這是截至2025年6月的頂級穩定幣:

- Tether (USDT): With a market cap exceeding $155 billion, USDT is the most widely used stablecoin. It operates across multiple blockchains, offering broad compatibility and high transaction speed.

- USD Coin (USDC): USDC, issued by Circle Internet Group, has a market cap of over $61.5 billion. It's known for its strong regulatory posture and transparency, with monthly proof-of-reserves reports verified by Deloitte. Circle Internet Group went public on June 5, 2025, with shares surging 168% on the first day of trading.

- Ethena (USDe): This variant stablecoin uses a “delta hedging” strategy to reduce price swings. It has a market cap of over $5 billion and offers a yield-bearing version called “sUSDe.”

- Dai (DAI): The original decentralized stablecoin, issued by MakerDAO, aims to maintain a soft peg to the U.S. dollar without relying on a central authority. It rebranded as USDS in late 2024.

- World Liberty Financial USD (USD1): Launched in April 2025 under the Trump family’s World Liberty Financial platform, USD1 has a market cap just over $2.1 billion. It positions itself as a fully backed, stable digital dollar.

How Stablecoins Are Used

如何使用Stablecoins

Stablecoins have various real-world applications:

Stablecoins有各種各樣的現實應用程序:

- Peer-to-Peer Payments: Ideal for everyday transactions due to low fees and speed.

- Cross-Border Payments: Businesses use stablecoins for supplier settlements and treasury management.

- DeFi: Used in liquidity pools, lending protocols, and as collateral in crypto-native financial products.

According to Noam Hurwitz, head of engineering at Alchemy, stablecoins have become the backbone of internet payments, outpacing major card networks in onchain volume. Companies like PayPal and Stripe are integrating stablecoins for faster, cheaper transactions.

根據Alchemy工程主管Noam Hurwitz的說法,Stablecoins已成為互聯網支付的支柱,超過了OnChain量的主要卡網絡。 PayPal和Stripe等公司正在整合Stablecoins,以進行更快,更便宜的交易。

Navigating Stablecoins Safely

安全地瀏覽穩定菌

To use stablecoins securely:

安全地使用穩定菌:

- Choose a Reliable Wallet: Opt for non-custodial wallets for full control or hardware wallets for added security.

- Use Audited Platforms: Stick to verified tokens and platforms with strong security.

- Stay Vigilant: Avoid copycat tokens, phishing sites, and unverified protocols.

The Future of Stablecoins

Stablecoins的未來

With the recent passage of the GENIUS Act, the regulatory landscape is becoming clearer, benefiting established financial players and encouraging innovation. Infrastructure improvements will drive seamless crosschain interoperability, creating a more connected and efficient financial system built on stablecoins.

隨著《天才法》的最新通過,監管格局變得越來越清晰,使既定的財務參與者受益並鼓勵創新。基礎架構的改進將推動無縫的交叉鏈互操作性,從而創造出建立在穩定的基礎上。

Final Thoughts

最後的想法

Stablecoins are here to stay, offering a blend of stability and innovation in the digital world. Whether you're trading, making payments, or exploring DeFi, understanding stablecoins is key. So, stay informed, stay secure, and keep exploring the ever-evolving world of crypto. After all, in the city that never sleeps, there's always something new to discover! Just remember to do your homework and maybe grab a slice of pizza while you're at it – you'll need the energy.

Stablecoins將留在這裡,在數字世界中提供了穩定和創新的融合。無論您是進行交易,付款還是探索Defi,了解Stablecoins都是關鍵。因此,請保持了解,保持安全,並繼續探索不斷發展的加密世界。畢竟,在不睡覺的城市中,總會有一些新的發現!只要記住要做功課,也許在披薩時拿起一片披薩 - 您需要精力。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

-

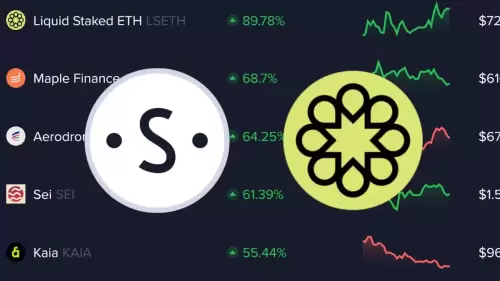

- 情感數據的隱藏寶石:您缺少的最佳性能加密

- 2025-07-01 23:10:15

- 揭開了由情感數據加油的最高表現的加密貨幣,包括隱藏的寶石和市場上意外的潮流。

-

-

- 雪崩,合作夥伴和比特幣:加密貨幣的紐約分鐘

- 2025-07-01 23:10:15

- 探索雪崩,夥伴關係和比特幣的交集,突出了加密貨幣領域的最新發展和未來趨勢。

-

-

- Zachxbt,Ripple和RLUSD採用:深度潛水

- 2025-07-01 22:30:12

- 分析Zachxbt的批評,Ripple的RLUSD採用策略以及對加密生態系統的更廣泛影響。

-

- Jasmycoin(Jasmy):看漲前景和價格預測

- 2025-07-01 23:15:11

- 根據最近的市場趨勢,分析師預測和關鍵支持水平,探索茉莉素幣的潛在看漲激增。日本的比特幣準備好突破了嗎?

-

- Open XP贖回樂觀:7月15日為OP代幣做好準備!

- 2025-07-01 22:35:12

- Superstacks於6月30日結束!從7月15日開始,通過官方應用程序兌換XP。

-

- 斧頭積分和排放減少:Axie Infinity中發生了什麼?

- 2025-07-01 22:55:12

- Axie Infinity一半軸軸承排放,影響通貨膨脹和APY。另外,新的基於收藏品還可以提高市場效率。