|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

探索港口訪問,日本公司和全球財務影響之間的多方面關係。從海軍友情到加密貨幣策略,日本的影響不可否認。

Port Visit Firms Ties with Japan: A Deep Dive

港口拜訪公司與日本聯繫:深入潛水

From naval camaraderie to complex financial strategies, the intersection of 'Port visit, Japan, firms' reveals a dynamic and influential relationship. Let's unpack what's happening.

從海軍友情到復雜的財務戰略,“港口訪問,日本,公司”的交集揭示了一種動態和影響力的關係。讓我們解開正在發生的事情。

Naval Ties: HMAS Sydney's Visit to Yokosuka

海軍領帶:HMAS悉尼訪問橫山

In June, HMAS Sydney made a port visit to Yokosuka, Japan, strengthening ties between the Australian and Japanese navies. The visit, part of its Indo-Pacific deployment, highlighted the strong relationship and shared commitment to regional stability.

6月,HMAS悉尼對日本橫田進行了港口訪問,加強了澳大利亞和日本海軍之間的聯繫。這次訪問是其印度太平洋部署的一部分,強調了牢固的關係和對區域穩定的共同承諾。

Commander Ben Weller of HMAS Sydney emphasized the importance of the Australian-Japanese relationship, noting a long history of close collaboration. Captain Ishidera Takahiko of the Japan Maritime Self-Defense Force (JMSDF) echoed these sentiments, underscoring the deepening trust between the two nations.

HMAS悉尼指揮官本·韋勒(Ben Weller)強調了澳大利亞 - 日本關係的重要性,並指出了悠久的密切合作歷史。日本海事自衛隊(JMSDF)的上尉伊希德拉·高希科(Ishidera Takahiko)呼應了這些情緒,強調了兩國之間的深入信任。

The exchange wasn't just ceremonial. It included tours of the Australian warship for JMSDF members and Japanese media, fostering better understanding of each other’s capabilities. Both Australia and Japan share values related to democracy, free trade, and a rules-based global order, reinforcing the importance of continued joint training to address challenges in the Indo-Pacific.

交換不僅僅是禮儀。它包括針對JMSDF成員和日本媒體的澳大利亞軍艦遊覽,從而更好地了解彼此的能力。澳大利亞和日本都有與民主,自由貿易和基於規則的全球秩序相關的價值觀,從而增強了繼續聯合培訓以應對印度太平洋挑戰的重要性。

The Perilous World of Japanese Government Bonds (JGBs)

日本政府債券(JGB)的危險世界

Shifting gears, the financial landscape reveals another critical facet of Japan's influence. Market analyst Weston Nakamura has dubbed the 40-year Japanese Government Bond (JGB) market as the “most dangerous market in the world.”

換檔,金融景觀揭示了日本影響力的另一個關鍵方面。市場分析師Weston Nakamura將40年的日本政府債券(JGB)市場稱為“世界上最危險的市場”。

Nakamura argues that the JGB market's sheer size, combined with widespread investor ignorance, creates a volatile mix that could trigger global financial contagion. The Bank of Japan’s (BOJ) decade-long “Quantitative and Qualitative Easing” (QQE) and Yield Curve Control (YCC) policies have significantly impacted the market, suppressing term premia and pushing Japanese insurers and banks into longer-term bonds.

中村認為,JGB市場的龐大規模,加上廣泛的投資者無知,創造了一種動蕩的組合,可能引發全球金融傳播。日本銀行(BOJ)十年長的“定量和定性寬鬆”(QQE)和收益曲線控制(YCC)政策對市場產生了重大影響,抑制了期限PREMIA,並將日本保險公司和銀行推向了長期債券。

The instability in the JGB market is already being felt globally, with correlations tightening between 30-year JGB and 30-year U.S. Treasury yields. Investors who focus solely on Washington risk missing the true drivers of long-term rates, which are often influenced by Tokyo's market dynamics.

JGB市場的不穩定已經在全球範圍內感受到,相關性在JGB和30年的美國財政部收益率之間的緊縮。僅關注華盛頓風險的投資者丟失了真正的長期利率驅動因素,而這通常受東京市場動態影響。

Japanese Firms Dive into Crypto

日本公司潛入加密貨幣

Beyond naval visits and bond markets, Japanese firms are also making waves in the crypto world. Hong Kong–based DDC Enterprise Ltd. recently secured $528 million to scale its Bitcoin holdings, signaling a growing corporate interest in digital assets.

除了海軍訪問和債券市場之外,日本公司還在加密貨幣世界中引起了轟動。基於香港的DDC Enterprise Ltd.最近獲得了5.28億美元來擴展其比特幣持有量,這表明公司對數字資產的興趣不斷增長。

DDC aims to acquire 5,000 BTC over three years, aligning with its mission to build the “world’s most valuable Bitcoin treasury.” This move reflects a broader trend of corporations adding digital assets to their treasuries, viewing them as stores of value and hedging instruments.

DDC的目標是在三年內收購5,000 BTC,與其建立“世界上最有價值的比特幣財政部”的任務保持一致。此舉反映了公司在國庫中增加數字資產的更廣泛趨勢,將其視為價值和對沖工具的存儲。

Personal Take

私人

It's fascinating to see Japan's multifaceted influence on the world stage. From fostering naval partnerships to potentially steering global financial markets through its bond policies, and now, influencing corporate crypto strategies, Japan's moves are worth watching closely. The interconnectedness is undeniable.

看到日本對世界舞台的多方面影響,這真是令人著迷。從建立海軍合作夥伴關係到通過其債券政策推動全球金融市場的潛在轉向,現在影響了企業加密戰略,日本的舉動值得關注。相互聯繫是不可否認的。

Wrapping Up

總結

So, next time you hear about a port visit, a quirky bond market, or a company diving into crypto, remember Japan might just be pulling some strings. It's a wild world out there, but hey, at least it's never boring!

因此,下次您聽到港口訪問,古怪的債券市場或潛入加密貨幣的公司時,請記住日本可能只是在拉一些弦樂。這是一個狂野的世界,但是,嘿,至少從來都不是無聊的!

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

- PI網絡,KYC Sync和PI2Day:深入了解最新發展

- 2025-06-20 18:45:13

- 探索PI網絡上的最新KYC同步功能,其對用戶的影響以及圍繞即將舉行的PI2DAY活動的預期。

-

- Dogecoin的三角探戈:看漲的情緒會導致突破嗎?

- 2025-06-20 19:05:12

- Dogecoin形成了對稱的三角形模式,暗示了潛在的60%的價格轉移。看漲的情緒會佔上風並引發突破嗎?

-

- 以太坊,比特幣,價格預測:在動蕩的市場中導航加密潮

- 2025-06-20 19:05:12

- 在地緣政治緊張局勢和市場波動中探索以太坊,比特幣和價格預測的最新趨勢和見解。發現潛在的機會和風險。

-

- 以太坊,比特幣和價格預測遊戲:現在是什麼熱?

- 2025-06-20 18:25:13

- 在以太坊,比特幣和價格預測周圍導航加密蜂鳴聲。在不斷發展的加密景觀中獲得最新的見解和潛在機會。

-

- 比特幣價格突破即將發生?解碼加密市場的下一個大舉動

- 2025-06-20 18:45:13

- 比特幣在重大突破的邊緣嗎?分析最近的市場趨勢,監管發展和鯨魚活動,以預測BTC和Dogecoin的下一個方向。

-

- 加密,人工智能和投資:瀏覽金融的未來

- 2025-06-20 19:25:12

- 探索加密貨幣,AI和投資的融合,從AI驅動的貿易助手到NFT的不斷發展的景觀以及可互操作的區塊鏈的承諾。

-

-

- 甜蜜的懷舊:生日蛋糕的傳統如何在周年紀念日持續

- 2025-06-20 19:45:13

- 探索生日蛋糕,懷舊和周年慶典的持久吸引力。發現傳統在保持情感價值的同時如何發展。

-

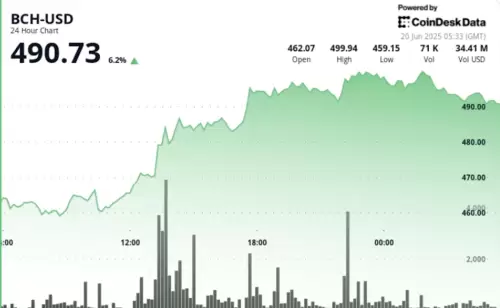

- 比特幣現金價格上漲:公牛以峰值收費!

- 2025-06-20 19:45:13

- 比特幣現金體驗由機構需求和交易量激增的巨大價格上漲,測試了關鍵的500美元電阻水平。