|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exploring the multifaceted relationship between port visits, Japanese firms, and global financial implications. From naval camaraderie to crypto treasury strategies, Japan's influence is undeniable.

Port Visit Firms Ties with Japan: A Deep Dive

From naval camaraderie to complex financial strategies, the intersection of 'Port visit, Japan, firms' reveals a dynamic and influential relationship. Let's unpack what's happening.

Naval Ties: HMAS Sydney's Visit to Yokosuka

In June, HMAS Sydney made a port visit to Yokosuka, Japan, strengthening ties between the Australian and Japanese navies. The visit, part of its Indo-Pacific deployment, highlighted the strong relationship and shared commitment to regional stability.

Commander Ben Weller of HMAS Sydney emphasized the importance of the Australian-Japanese relationship, noting a long history of close collaboration. Captain Ishidera Takahiko of the Japan Maritime Self-Defense Force (JMSDF) echoed these sentiments, underscoring the deepening trust between the two nations.

The exchange wasn't just ceremonial. It included tours of the Australian warship for JMSDF members and Japanese media, fostering better understanding of each other’s capabilities. Both Australia and Japan share values related to democracy, free trade, and a rules-based global order, reinforcing the importance of continued joint training to address challenges in the Indo-Pacific.

The Perilous World of Japanese Government Bonds (JGBs)

Shifting gears, the financial landscape reveals another critical facet of Japan's influence. Market analyst Weston Nakamura has dubbed the 40-year Japanese Government Bond (JGB) market as the “most dangerous market in the world.”

Nakamura argues that the JGB market's sheer size, combined with widespread investor ignorance, creates a volatile mix that could trigger global financial contagion. The Bank of Japan’s (BOJ) decade-long “Quantitative and Qualitative Easing” (QQE) and Yield Curve Control (YCC) policies have significantly impacted the market, suppressing term premia and pushing Japanese insurers and banks into longer-term bonds.

The instability in the JGB market is already being felt globally, with correlations tightening between 30-year JGB and 30-year U.S. Treasury yields. Investors who focus solely on Washington risk missing the true drivers of long-term rates, which are often influenced by Tokyo's market dynamics.

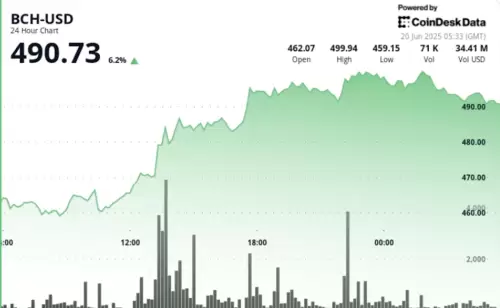

Japanese Firms Dive into Crypto

Beyond naval visits and bond markets, Japanese firms are also making waves in the crypto world. Hong Kong–based DDC Enterprise Ltd. recently secured $528 million to scale its Bitcoin holdings, signaling a growing corporate interest in digital assets.

DDC aims to acquire 5,000 BTC over three years, aligning with its mission to build the “world’s most valuable Bitcoin treasury.” This move reflects a broader trend of corporations adding digital assets to their treasuries, viewing them as stores of value and hedging instruments.

Personal Take

It's fascinating to see Japan's multifaceted influence on the world stage. From fostering naval partnerships to potentially steering global financial markets through its bond policies, and now, influencing corporate crypto strategies, Japan's moves are worth watching closely. The interconnectedness is undeniable.

Wrapping Up

So, next time you hear about a port visit, a quirky bond market, or a company diving into crypto, remember Japan might just be pulling some strings. It's a wild world out there, but hey, at least it's never boring!

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.