|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

這筆資金來自與英國維爾京群島的投資者的股票購買協議,該協議旨在建立長期加密保護區。

Nasdaq-listed company, GD Culture Group (GDC), is planning to use a stock purchase agreement to secure up to $300 million in funding from a British Virgin Islands-based investor for investing in Bitcoin (BTC) and the Trump-themed token, OFFICIAL TRUMP (TRUMP).

納斯達克上市的公司GD文化集團(GDC)計劃使用一項股票購買協議從一家位於英國維爾京群島的投資者投資比特幣(BTC)和特朗普主題的特朗普(Trump),官方特朗普(BTC)的投資中獲得高達3億美元的資金。

The company will hold these digital assets as part of its treasury operations, aiming to build a long-term crypto reserve. The company's move to add Bitcoin and TRUMP tokens to its balance sheet signals its interest in decentralized finance (DeFi) and blockchain adoption.

該公司將持有這些數字資產作為其國庫業務的一部分,旨在建立長期加密保護區。該公司將比特幣和特朗普代幣添加到資產負債表中的舉動表明其對分散的財務(DEFI)和區塊鏈採用的興趣。

This initiative is part of GDC's broader strategy to shift towards digital business, particularly through its subsidiary AI Catalysis, which specializes in livestreaming e-commerce and digital humans technology.

該計劃是GDC向數字業務轉向數字業務的更廣泛戰略的一部分,特別是通過其子公司AI催化,該催化專門研究電子商務和數字人類技術。

Despite this crypto endeavor, GDC is currently facing financial challenges. The company reported a $14.1 million net loss for 2024, showing a slight improvement compared to the previous year's $14.3 million loss.

儘管這項加密貨幣努力,但GDC目前仍面臨財務挑戰。該公司報告說,2024年的淨虧損為1410萬美元,與上一年的1,430萬美元虧損相比,略有改善。

However, the company also received a warning from Nasdaq for failing to meet the required $2.5 million stockholders' equity, which could lead to delisting from the exchange. The company now has 45 days to submit a plan to regain compliance or face the risk of being delisted from Nasdaq.

但是,該公司還因未能滿足所需的250萬美元股東權益而受到納斯達克的警告,這可能會導致交易所退出。現在,該公司有45天的時間提交計劃重新獲得合規性或面臨從納斯達克脫穎而出的風險。

"This investment in cryptocurrencies is a strategic leap that we're taking to adjust to the rapidly changing market landscape," said Chairman and CEO Xiaojian Wang.

董事長兼首席執行官Xiaojian Wang說:“對加密貨幣的這一投資是一種戰略上的飛躍,以適應迅速變化的市場格局。”

"We believe in the future of blockchain and are excited to integrate this technology into our operations to drive optimal performance and efficiency," he concluded.

他總結說:“我們相信區塊鏈的未來,並很高興將這項技術集成到我們的運營中,以提高最佳性能和效率。”

The company's crypto pivot comes amid broader interest from public companies in adding digital assets to their balance sheets.

該公司的加密透氣樞紐源於上市公司對將數字資產添加到資產負債表中的廣泛興趣。

Earlier this year, MicroStrategy reportedly sold a portion of its Bitcoin holdings to raise cash and pay down debt, while Metaplanet is planning to invest in metaverse and Web3 projects through its new $500 million fund.

據報導,今年早些時候,MicroStrategy出售了其比特幣持有量的一部分以籌集現金並償還債務,而Metaplanet計劃通過其新的5億美元基金投資於Metaverse和Web3項目。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

-

-

- 縮小到以太坊(ETH)的差距,Cardano(ADA)變得越來越受歡迎

- 2025-05-14 06:15:13

- 同樣,Remittix(RTX)憑藉其創造性的方法來提出越來越多的興趣。

-

-

- XRP期貨即將到來,CME集團擴大了代幣的機構採用

- 2025-05-14 06:10:13

- 正式發布會定於5月19日舉行,使其成為XRP市場的關鍵日期。這一舉動遵循了主要金融平台中XRP採用的勢頭的增加。

-

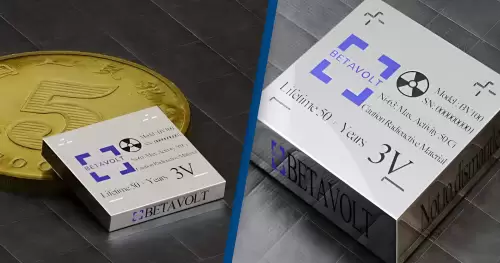

- 引入世界的第一個核電池,比硬幣小,持續了100年

- 2025-05-14 06:10:13

- 在可能永遠改變能源儲能的未來的飛躍中,中國推出了一個小於硬幣的核電池,該核電池比幾十年沒有一次充電了。

-

-

-