|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

加密貨幣新聞文章

December CPI Data Looms, BTC Options Flows Show Cautious Sentiment as Puts Roll Below the Key $90k Support

2025/01/15 20:00

Markets are bracing for the first major U.S. economic event of 2023: December CPI data. The print will be closely watched by traders for clues on the Federal Reserve's monetary policy path, especially amid persistent hawkish concerns.

Bitcoin's strengthening correlation with tech stocks has also made Wednesday's report more significant for the digital assets market. The stalled liquidity inflows via stablecoins have also raised questions on the sustainability of price recovery from sub-$90K levels. Hence, traders are bracing for potential downside volatility by adding short-dated puts.

Here’s what experts are saying about the upcoming event:

* QCP Capital: "In crypto, cautious sentiment is evident in BTC options flows, with puts rolled below the key $90k support. Front-end vols and flies remain elevated, while the VIX stays high at 18.68 – suggesting volatility to persist through January."

* Geoffrey Chen, author of the Fidenza Macro blog: "The rising markets in November and the lifting of election uncertainty pushed business confidence higher, resulting in stronger data. The frontloading of goods imports and the raising of prices to get ahead of tariffs may have also contributed to higher PMIs. On top of that, oil has woken up and rallied over 10% from its December levels, reinforcing the stagflation regime. None of this bodes well for CPI tomorrow [Jan. 15] and the FOMC later this month. These risk events may surprise towards hawkish and stagflationary outcomes, putting more pressure on risk assets.”

* Markus Thielen, founder of 10x Research: "Bitcoin continues to trade within a narrowing wedge, with several critical catalysts on the horizon. Expectations for a higher CPI number have risen, creating a scenario where a softer-than-expected inflation reading could trigger a bitcoin rally."

Focus on XRP and AI

XRP surged to $2.90 early today, matching the December high with technical analysis suggesting a continued run higher.

Meanwhile, dip buyers have been active in AI coins, namely FAI, GRASS, VIRTUAL, Ai16z and TAO, according to Wintermute. These coins, therefore, could chalk out bigger gains in case the CPI spurs renewed risk-taking in financial markets.

What to Watch

Token Events

Conferences:

Token Talk

By Oliver Knight

Derivatives Positioning

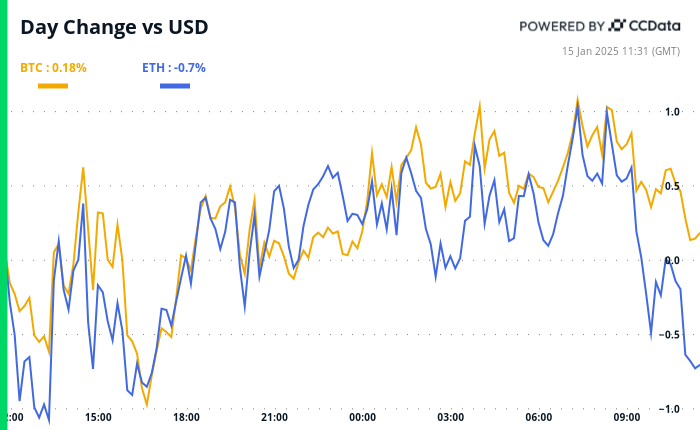

Market Movements:

Bitcoin Stats:

Technical Analysis

Crypto Equities

ETF Flows

Spot BTC ETFs:

Spot ETH ETFs

Source: Farside Investors, as of Jan. 14

Overnight Flows

Chart of the Day

While You Were Sleeping

In the Ether

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

-

-

- 比特幣的大跌:從頂峰希望到現在的暴跌

- 2026-02-02 16:52:14

- 比特幣面臨市場急劇下滑,導致價格大幅低於近期峰值,並引發投資者在宏觀經濟動盪中保持謹慎。

-

- 硬幣識別應用程序、硬幣收藏家和免費工具:錢幣學的數字革命

- 2026-02-02 16:45:23

- 硬幣識別應用程序正在改變硬幣收集,為愛好者提供免費工具來識別和評估他們的發現,將技術與傳統愛好融為一體。

-

-

-

- 隨著市場波動中多頭整合,以太坊有望上漲

- 2026-02-02 13:49:19

- 以太坊市場展現了希望與現實之間的一場令人著迷的拉鋸戰。隨著多頭盤整,潛在反彈的舞台已經準備就緒,但波動仍然是遊戲的主題。

-

- ETH 轉賬引發恐慌性拋售,在重大加密貨幣重組中消滅了交易者

- 2026-02-02 12:37:18

- 大量 ETH 轉移到幣安的同時,恰逢一位知名交易員的清算,引發了整個加密市場的恐慌性拋售和數十億美元的清算。

-