|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

加密货币新闻

December CPI Data Looms, BTC Options Flows Show Cautious Sentiment as Puts Roll Below the Key $90k Support

2025/01/15 20:00

Markets are bracing for the first major U.S. economic event of 2023: December CPI data. The print will be closely watched by traders for clues on the Federal Reserve's monetary policy path, especially amid persistent hawkish concerns.

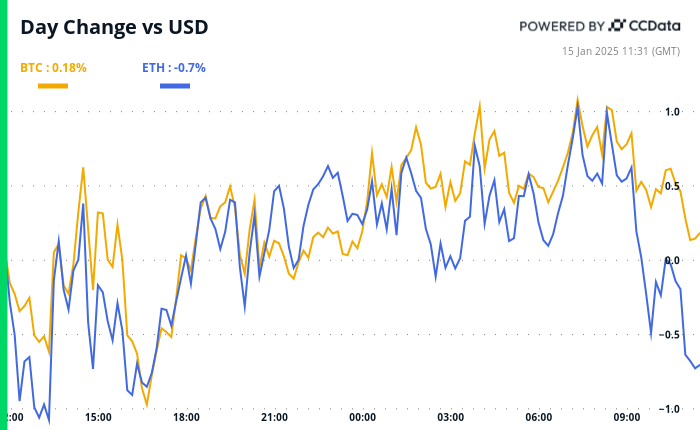

Bitcoin's strengthening correlation with tech stocks has also made Wednesday's report more significant for the digital assets market. The stalled liquidity inflows via stablecoins have also raised questions on the sustainability of price recovery from sub-$90K levels. Hence, traders are bracing for potential downside volatility by adding short-dated puts.

Here’s what experts are saying about the upcoming event:

* QCP Capital: "In crypto, cautious sentiment is evident in BTC options flows, with puts rolled below the key $90k support. Front-end vols and flies remain elevated, while the VIX stays high at 18.68 – suggesting volatility to persist through January."

* Geoffrey Chen, author of the Fidenza Macro blog: "The rising markets in November and the lifting of election uncertainty pushed business confidence higher, resulting in stronger data. The frontloading of goods imports and the raising of prices to get ahead of tariffs may have also contributed to higher PMIs. On top of that, oil has woken up and rallied over 10% from its December levels, reinforcing the stagflation regime. None of this bodes well for CPI tomorrow [Jan. 15] and the FOMC later this month. These risk events may surprise towards hawkish and stagflationary outcomes, putting more pressure on risk assets.”

* Markus Thielen, founder of 10x Research: "Bitcoin continues to trade within a narrowing wedge, with several critical catalysts on the horizon. Expectations for a higher CPI number have risen, creating a scenario where a softer-than-expected inflation reading could trigger a bitcoin rally."

Focus on XRP and AI

XRP surged to $2.90 early today, matching the December high with technical analysis suggesting a continued run higher.

Meanwhile, dip buyers have been active in AI coins, namely FAI, GRASS, VIRTUAL, Ai16z and TAO, according to Wintermute. These coins, therefore, could chalk out bigger gains in case the CPI spurs renewed risk-taking in financial markets.

What to Watch

Token Events

Conferences:

Token Talk

By Oliver Knight

Derivatives Positioning

Market Movements:

Bitcoin Stats:

Technical Analysis

Crypto Equities

ETF Flows

Spot BTC ETFs:

Spot ETH ETFs

Source: Farside Investors, as of Jan. 14

Overnight Flows

Chart of the Day

While You Were Sleeping

In the Ether

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

- 在不断变化的地缘政治潮流中,阿联酋投资者获得了与特朗普相关的加密货币公司的主要股权

- 2026-02-02 06:00:09

- 解开涉及特朗普、阿联酋投资者以及区块链企业大量股份的复杂的金融、政治和加密网络。

-

- Pepe Meme 币:应对炒作、价格预测以及 2026 年及以后的未来展望

- 2026-02-02 05:40:00

- 佩佩米姆硬币的价格预测是猜测和希望的旋风。分析最新趋势、2026 年预测和长期前景。

-

-

-

- 阿普托斯陷入困境:下跌趋势加深,但在下一次暴跌之前出现短暂的缓解反弹

- 2026-02-02 05:00:45

- Aptos 在持续下跌趋势中触及新低,但分析师将潜在的短暂缓解反弹视为战略抛售机会。

-

- Pi Network、ATL 和社区:引领移动优先加密货币运动的潮流

- 2026-02-02 04:54:33

- 尽管市场波动,但探索 Pi Network 代币近期的价格低点以及推动其发展的弹性社区精神。

-

- 2026 年格莱美奖:获奖者、提名者和新兴趋势揭晓

- 2026-02-02 04:50:09

- 第 68 届格莱美颁奖典礼已落下帷幕,表彰了多元化的人才。以下是主要获奖者、著名提名者以及他们对音乐行业的意义。

-

-