|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

在最近在巴黎舉行的脫口秀證明中,Bitmex主持的一個關鍵小組引起了人們對當今Web3行業中最緊迫的主題之一的關注

Recent Proof of Talk conference in Paris, a key panel discussion moderated by BitMEX brought up one of the most pressing topics in the Web3 industry today: crypto IPOs.

BITMEX主持的關鍵小組討論最近在巴黎舉行的脫口秀大會證明,提出了當今Web3行業中最緊迫的主題之一:Crypto IPO。

The fireside chat, featuring Crypto_SLutz, J.M. Mognetti, and Alex Irwin-Hunt, offered a unique perspective on this evolving intersection of traditional finance (TradFi) and crypto.

以Crypto_slutz,JM Mognetti和Alex Irwin-Hunt為特色的Fireside聊天為這種不斷發展的傳統金融(Tradfi)和Crypto提供了獨特的看法。

Usually confined to launchpads and venture-backed hype cycles, the crypto industry is now entering a new phase, where public listings are a legitimate path for growth and credibility. The panel discussion at the event delved into how crypto firms are increasingly considering IPOs as a way to achieve greater legal clarity, expand their investor base, and secure more stable funding.

加密貨幣行業通常僅限於發射台和風險投資支持的炒作週期,現在進入了一個新階段,公共列表是增長和信譽的合法途徑。該活動的小組討論深入研究了加密貨幣公司如何將IPO作為實現更高法律清晰,擴大投資者基礎並獲得更穩定的資金的一種方式。

J.M. Mognetti, known for his pragmatic takes on TradFi integration, highlighted the importance of understanding the difference between IPOs in traditional markets and those emerging from crypto-native companies. While TradFi IPOs come with decades of regulatory precedents, crypto IPOs are still navigating a landscape of inconsistent global regulation and rapidly changing investor sentiment.

JM Mognetti以務實的對Tradfi整合而聞名,他強調了了解傳統市場中IPO與加密本地公司中IPO之間差異的重要性。儘管Tradfi IPO具有數十年的監管先例,但加密IPO仍在瀏覽不一致的全球監管和迅速變化的投資者情緒的景觀。

The panelists agreed that, on paper, the structure of going public might appear similar, but the underlying motivations and implications are vastly different. For crypto firms, IPOs are not just about capital; they’re also about transparency, trust, and ensuring the long-term survival of their projects in a competitive and often volatile domain.

小組成員同意,從表面上看,公開的結構可能看起來相似,但是潛在的動機和含義卻大不相同。對於加密公司而言,IPO不僅與資本有關。他們還涉及透明,信任,並確保其項目在競爭性且經常動蕩的領域中的長期生存。

Alex Irwin-Hunt brought up the “identity shift” that comes with going public. Many crypto-native firms are built on decentralisation and community-led governance. However, IPOs demand adherence to regulatory frameworks, top-down structure, and traditional corporate disclosures. This tension between crypto’s grassroots ethos and the formal requirements of financial institutions is a critical point of contention.

亞歷克斯·歐文·亨特(Alex Irwin-Hunt)提出了公開公開的“身份轉變”。許多加密本地公司建立在權力下放和社區主導的治理上。但是,IPO要求遵守監管框架,自上而下的結構和傳統公司披露。加密的基層精神與金融機構的正式要求之間的這種緊張是一個關鍵的爭論點。

Crypto IPOs could be a sign of maturity in the Web3 space. They’ll serve as litmus tests for how well these firms can operate within—and be accepted by—mainstream financial ecosystems. But there are risks. IPOs might invite more regulatory scrutiny, alienate decentralised communities, or distract companies from their original vision.

加密IPO可能是Web3空間中成熟的標誌。他們將作為這些公司在內部運作和被總體金融生態系統的運作效果以及接受的測試。但是有風險。 IPO可能會邀請更多的監管審查,疏遠分散社區,或者分散公司的最初願景。

The Proof of Talk panel didn’t offer easy answers, but it raised valuable questions: Will crypto IPOs push projects toward centralisation? How can they retain community loyalty while complying with regulators? And will investors value crypto companies as tech innovators or financial assets?

談話面板的證明並沒有提供簡單的答案,但它提出了寶貴的問題:加密IPO會將項目推向集中化嗎?他們在遵守監管機構時如何保持社區忠誠度?投資者會將加密公司視為技術創新者或金融資產嗎?

BitMEX, typically recognized for its derivatives exchange, appears to be playing a broader role in facilitating dialogue across the crypto-finance spectrum. By hosting such discussions, the company seems interested not just in trading trends but also in fostering greater cross-industry understanding—a much-needed step as the lines between Web2, Web3, and Wall Street continue to blur.

Bitmex通常以其衍生品交換而被認可,似乎在促進加密金融頻譜的對話中起著更廣泛的作用。通過主持此類討論,該公司似乎不僅對交易趨勢感興趣,而且對促進更高的跨行業理解感興趣,這是急需的一步,因為Web2,Web3和華爾街之間的界限繼續變得模糊。

As the space evolves, forums like Proof of Talk will remain crucial for untangling complex narratives—and for reminding everyone that behind every market shift, there’s a human conversation trying to make sense of it all.

隨著空間的發展,像談話證據這樣的論壇對於弄清複雜的敘述至關重要,並提醒每個人在每個市場轉變背後的人,都有人類的對話試圖理解這一切。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

-

- Snorter令牌的效率承諾與Neo Pepe的授權目標

- 2025-06-13 19:15:12

- 加密貨幣愛好者一直在不斷權衡新項目,分析其潛力,並問這個古老的區塊鏈問題

-

-

- XRP在下降趨勢線上折斷了

- 2025-06-13 19:10:11

- 四個小時的二元表顯示,令牌引人入勝的$ 2.32左右,位於楔子上部邊界以北的北部。

-

-

-

- 當遊戲承諾變成空氣時。

- 2025-06-13 19:00:12

- 代幣已成為音樂椅遊戲中的最後一根棍子。

-

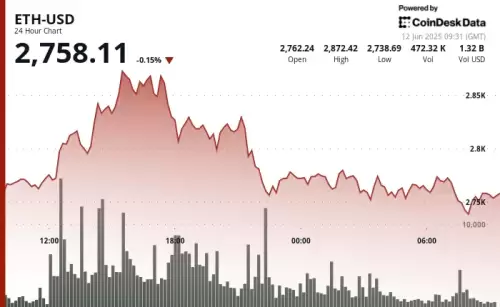

- 以太(ETH)

- 2025-06-13 19:00:12

- 回調是在簡短的集會上升至2,872.42美元的,事實證明,由於價格行動在15:00至17:00 UTC之間急劇逆轉,這是不可持續的

-

- 您的自助洗衣店或洗衣服務的全面保險

- 2025-06-13 18:55:12

- 隨著我們行業通過技術進步和客戶期望的變化而發展,確保全面的保險範圍從未如此重要