|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

在周四的美國市場會議上,Coinbase股票價格漲幅4.6%,目前為203.76美元。

Coinbase Global Inc. and PayPal Holdings announced their strategic partnership to scale the adoption, distribution, and utilization of the PayPal USD (PYUSD) stablecoin. The collaboration aims to provide a seamless value for users by making PYUSD more accessible and useful across digital platforms and broader.

Coinbase Global Inc.和Paypal Holdings宣布了他們的戰略合作夥伴關係,以擴展PayPal USD(PYUSD)Stablecoin的採用,分發和利用。該協作旨在通過使Pyusd在數字平台之間更容易訪問和有用,從而為用戶提供無縫的價值。

“For years, we’ve worked with Coinbase to enable a best-in-class integration to provide a simple, familiar way for PayPal users to fund crypto purchases on Coinbase. Our objectives aligned further as we deployed PYUSD in combination with our payments expertise, enabling greater commerce applications,” said Alex Chriss, President and CEO, PayPal.

“多年來,我們一直與Coinbase合作,使一流的集成能夠為PayPal用戶提供一種簡單,熟悉的方式,以便在Coinbase上為加密貨幣購買資金。我們的目標進一步融合了我們在PYUSD結合使用付款專業知識的PYUSD時,可以提供更大的商務應用程序,從而使Alex Chriss Chriss Chriss Chriss,總統Payo和Ceo,Payo,Paypepal,Paypal,Paypal,Paypal。

What the Upgrade Delivers:

升級提供了什麼:

The partnership will see PYUSD become available for no-fee trading on the Coinbase exchange, allowing users to buy, sell, and trade the stablecoin without paying any platform fees.

該合作夥伴關係將使Pyusd可用於Coinbase Exchange上的無費用交易,使用戶可以在不支付任何平台費用的情況下購買,出售和交易Stablecoin。

Moreover, PYUSD will have a 1:1 convertibility with U.S. dollars inside the exchange ecosystem, providing seamless liquidity and usability.

此外,Pyusd將在交換生態系統內提供1:1的可兌換性,提供無縫的流動性和可用性。

The firms will co-develop PYUSD-based solutions for cross-border payments and digital commerce, leveraging PayPal’s vast network of 430 million consumer and merchant accounts.

這些公司將共同開發基於PYUSD的解決方案,用於跨境支付和數字商務,利用PayPal的4.3億個消費者和商家帳戶的龐大網絡。

Joint teams plan to pilot PYUSD in decentralized finance and on-chain platforms, broadening the stablecoin’s utility and use cases.

聯合團隊計劃在分散的金融和鏈平台中試用Pyusd,從而擴大了Stablecoin的實用程序和用例。

How It May Impact COIN Stock Price

它如何影響硬幣股票價格

The no-fee PYUSD trading could encourage more user transactions on the Coinbase exchange. The increased trading volume will boost revenues from the platform’s other services, such as staking, custody, and inspirational products.

無費用的PYUSD交易可以鼓勵在Coinbase Exchange上進行更多的用戶交易。增加的交易量將增加平台其他服務的收入,例如Staking,Custandody和Inspinational產品。

The partnership will significantly enhance Coinbase’s credibility and standing in the cryptocurrency market.

該合作夥伴關係將大大提高Coinbase的信譽並站在加密貨幣市場。

The aforementioned developments and user expansion could positively impact the assets’ intrinsic value and demand pressure.

上述發展和用戶擴展可能會對資產的內在價值和需求壓力產生積極影響。

Coinbase Stock Eyes $250 Rally With This Breakout

Coinbase股票眼睛$ 250 Rally,此突破

Over the past three weeks, the Coinbase stock price recovered from a $142.5 low to today’s closing value of $203.8, registering a 43.25% increase. The daily chart shows this reversal rebound from multiple support of $146, coinciding closely with the 61.8% Fibonacci retracement level.

在過去的三周中,Coinbase股票價格從低點低至今天的收盤價值為203.8美元,增加了43.25%。每日圖表顯示,這種反轉反轉從146美元的多重支持中,與61.8%的斐波那契反回接頭緊密相吻合。

Theoretically, the FIB level is firm support and assists buyers in recuperating the bullish momentum. The recent price jump above the 20- and 50-day EMA slope signals renewed bullish momentum and a change in market sentiment.

從理論上講,FIB水平是堅定的支持,並協助買家恢復看漲的勢頭。最近的價格高於20天和50天的EMA斜坡信號,這使看漲勢頭和市場情緒變化。

By press time, the Coinbase stock price was less than 2% away from challenging the last swing high resistance of $207. The potential breakout accelerates the bullish momentum and pushes the asset 10.6% to hit the downsloping resistance trendline, which drives the current correction.

發稿時,Coinbase股票價格距離挑戰上次搖擺高度207美元的高級搖擺不定不到2%。潛在的突破加速了看漲的勢頭,並將資產提高了10.6%,以擊中降低的阻力趨勢線,從而推動了當前的校正。

A bullish breakout from this resistance is necessary to drive a sustained upswing above $250.

必須從這種抵抗中獲得看漲的突破,以推動超過250美元以上的持續上漲。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

- 比特幣的售價超過$ 90K,以太坊和山寨幣現很出色的收益

- 2025-04-25 17:55:13

- 全球加密貨幣市場繼續反映出看漲的情緒,比特幣保持穩定的立場高於93,000美元。

-

- 分析師說

- 2025-04-25 17:55:13

- 一位廣泛關注的加密分析師說,比特幣(BTC)可能在看跌逆轉之前向上行進程。

-

-

- SUI區塊鏈的本地令牌SUI本週飆升了62%以上

- 2025-04-25 17:50:13

- SUI區塊鏈的原住民令牌SUI本週飆升了62%以上,這是由於猜測與Pokémon的潛在合作所推動。

-

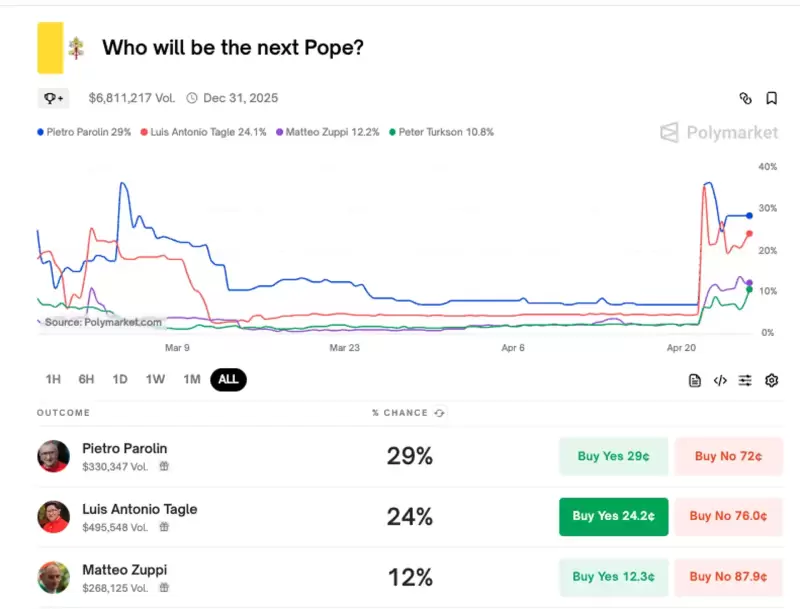

- 多聚市場捕獲

- 2025-04-25 17:45:13

- 由於預計將在下個月舉行的“結論”(教皇選舉秘密會議)選舉下一屆教皇時,圍繞教皇候選人主題的Meme Coins引起了人們的關注。

-

-

-

- DraftKings支付1000萬美元以解決NFT證券集體訴訟

- 2025-04-25 17:40:13

- 流行的體育博彩和幻想體育公司Draftkings已同意達成1000萬美元的和解,以解決集體訴訟

-