|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

在周四的美国市场会议上,Coinbase股票价格涨幅4.6%,目前为203.76美元。

Coinbase Global Inc. and PayPal Holdings announced their strategic partnership to scale the adoption, distribution, and utilization of the PayPal USD (PYUSD) stablecoin. The collaboration aims to provide a seamless value for users by making PYUSD more accessible and useful across digital platforms and broader.

Coinbase Global Inc.和Paypal Holdings宣布了他们的战略合作伙伴关系,以扩展PayPal USD(PYUSD)Stablecoin的采用,分发和利用。该协作旨在通过使Pyusd在数字平台之间更容易访问和有用,从而为用户提供无缝的价值。

“For years, we’ve worked with Coinbase to enable a best-in-class integration to provide a simple, familiar way for PayPal users to fund crypto purchases on Coinbase. Our objectives aligned further as we deployed PYUSD in combination with our payments expertise, enabling greater commerce applications,” said Alex Chriss, President and CEO, PayPal.

“多年来,我们一直与Coinbase合作,使一流的集成能够为PayPal用户提供一种简单,熟悉的方式,以便在Coinbase上为加密货币购买资金。我们的目标进一步融合了我们在PYUSD结合使用付款专业知识的PYUSD时,可以提供更大的商务应用程序,从而使Alex Chriss Chriss Chriss Chriss,总统Payo和Ceo,Payo,Paypepal,Paypal,Paypal,Paypal。

What the Upgrade Delivers:

升级提供了什么:

The partnership will see PYUSD become available for no-fee trading on the Coinbase exchange, allowing users to buy, sell, and trade the stablecoin without paying any platform fees.

该合作伙伴关系将使Pyusd可用于Coinbase Exchange上的无费用交易,使用户可以在不支付任何平台费用的情况下购买,出售和交易Stablecoin。

Moreover, PYUSD will have a 1:1 convertibility with U.S. dollars inside the exchange ecosystem, providing seamless liquidity and usability.

此外,Pyusd将在交换生态系统内提供1:1的可兑换性,提供无缝的流动性和可用性。

The firms will co-develop PYUSD-based solutions for cross-border payments and digital commerce, leveraging PayPal’s vast network of 430 million consumer and merchant accounts.

这些公司将共同开发基于PYUSD的解决方案,用于跨境支付和数字商务,利用PayPal的4.3亿个消费者和商家帐户的庞大网络。

Joint teams plan to pilot PYUSD in decentralized finance and on-chain platforms, broadening the stablecoin’s utility and use cases.

联合团队计划在分散的金融和链平台中试用Pyusd,从而扩大了Stablecoin的实用程序和用例。

How It May Impact COIN Stock Price

它如何影响硬币股票价格

The no-fee PYUSD trading could encourage more user transactions on the Coinbase exchange. The increased trading volume will boost revenues from the platform’s other services, such as staking, custody, and inspirational products.

无费用的PYUSD交易可以鼓励在Coinbase Exchange上进行更多的用户交易。增加的交易量将增加平台其他服务的收入,例如Staking,Custandody和Inspinational产品。

The partnership will significantly enhance Coinbase’s credibility and standing in the cryptocurrency market.

该合作伙伴关系将大大提高Coinbase的信誉并站在加密货币市场。

The aforementioned developments and user expansion could positively impact the assets’ intrinsic value and demand pressure.

上述发展和用户扩展可能会对资产的内在价值和需求压力产生积极影响。

Coinbase Stock Eyes $250 Rally With This Breakout

Coinbase股票眼睛$ 250 Rally,此突破

Over the past three weeks, the Coinbase stock price recovered from a $142.5 low to today’s closing value of $203.8, registering a 43.25% increase. The daily chart shows this reversal rebound from multiple support of $146, coinciding closely with the 61.8% Fibonacci retracement level.

在过去的三周中,Coinbase股票价格从低点低至今天的收盘价值为203.8美元,增加了43.25%。每日图表显示,这种反转反转从146美元的多重支持中,与61.8%的斐波那契反回接头紧密相吻合。

Theoretically, the FIB level is firm support and assists buyers in recuperating the bullish momentum. The recent price jump above the 20- and 50-day EMA slope signals renewed bullish momentum and a change in market sentiment.

从理论上讲,FIB水平是坚定的支持,并协助买家恢复看涨的势头。最近的价格高于20天和50天的EMA斜坡信号,这使看涨势头和市场情绪变化。

By press time, the Coinbase stock price was less than 2% away from challenging the last swing high resistance of $207. The potential breakout accelerates the bullish momentum and pushes the asset 10.6% to hit the downsloping resistance trendline, which drives the current correction.

发稿时,Coinbase股票价格距离挑战上次摇摆高度207美元的高级摇摆不定不到2%。潜在的突破加速了看涨的势头,并将资产提高了10.6%,以击中降低的阻力趋势线,从而推动了当前的校正。

A bullish breakout from this resistance is necessary to drive a sustained upswing above $250.

必须从这种抵抗中获得看涨的突破,以推动超过250美元以上的持续上涨。

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

- 比特币的售价超过$ 90K,以太坊和山寨币现很出色的收益

- 2025-04-25 17:55:13

- 全球加密货币市场继续反映出看涨的情绪,比特币保持稳定的立场高于93,000美元。

-

- 分析师说

- 2025-04-25 17:55:13

- 一位广泛关注的加密分析师说,比特币(BTC)可能在看跌逆转之前向上行进程。

-

-

- SUI区块链的本地令牌SUI本周飙升了62%以上

- 2025-04-25 17:50:13

- SUI区块链的原住民令牌SUI本周飙升了62%以上,这是由于猜测与Pokémon的潜在合作所推动。

-

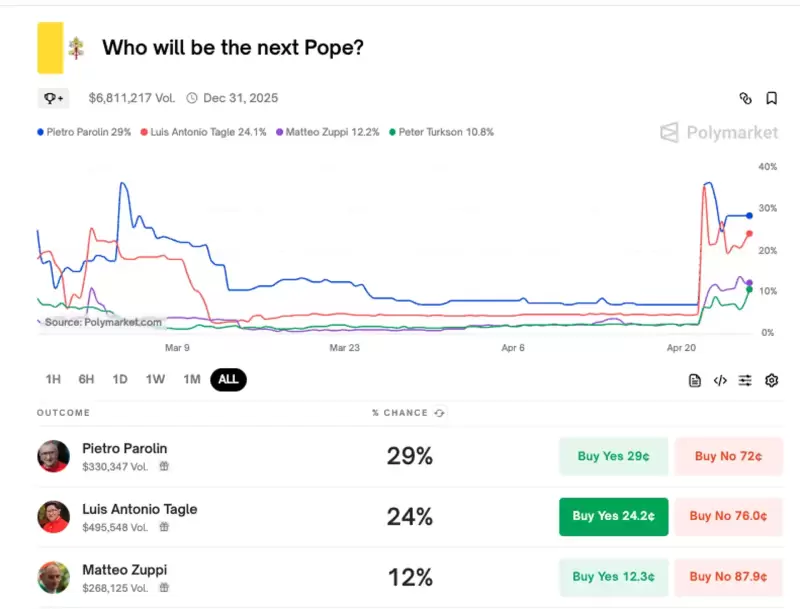

- 多聚市场捕获

- 2025-04-25 17:45:13

- 由于预计将在下个月举行的“结论”(教皇选举秘密会议)选举下一届教皇时,围绕教皇候选人主题的Meme Coins引起了人们的关注。

-

-

-

- DraftKings支付1000万美元以解决NFT证券集体诉讼

- 2025-04-25 17:40:13

- 流行的体育博彩和幻想体育公司Draftkings已同意达成1000万美元的和解,以解决集体诉讼

-