|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

相對於比特幣而言,共依鍵過度擴展了嗎?分析縮短硬幣的潛力和長時間的BTC。

Coinbase, Bitcoin, and Shorting: A Mean Reversion Opportunity?

Coinbase,Bitcoin和Shorting:卑鄙的回歸機會?

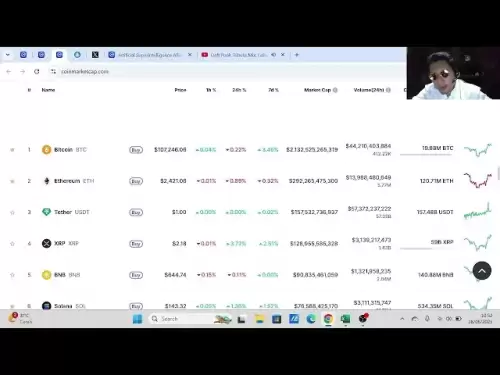

Coinbase (COIN) and Bitcoin (BTC) have historically danced in step, but lately, they're doing different routines. Is COIN overvalued compared to BTC, creating a shorting opportunity? Let's dive in.

Coinbase(硬幣)和比特幣(BTC)在歷史上逐步跳舞,但最近,他們正在做不同的例程。與BTC相比,硬幣是否被高估了,創造了短路機會?讓我們潛水。

The Divergence: COIN's Surge vs. Bitcoin's Steady Climb

分歧:硬幣的激增與比特幣的穩定攀登

While Bitcoin has seen modest gains, Coinbase's stock has skyrocketed, breaking from their usual correlation. 10x Research's model suggests COIN is significantly overextended relative to Bitcoin's price and trading volume. This divergence, exceeding historical thresholds, hints at a potential mean reversion.

雖然比特幣已經看到了適度的收益,但Coinbase的股票卻飆升,從通常的相關性中斷出來。 10X Research的模型表明,相對於比特幣的價格和交易量,硬幣大大過度擴張。這種差異超過歷史閾值,暗示了潛在的平均歸還。

What's Fueling the COIN Rally?

是什麼促進了硬幣集會?

Factors like the Senate's GENIUS Act and Coinbase's EU MiCA license have contributed to COIN's rise. The market has aggressively priced in these catalysts. However, Coinbase's trading volumes have actually declined, undermining the fundamental justification for its valuation. It seems sentiment, rather than solid business metrics, is driving the stock.

參議院的天才法和Coinbase的歐盟雲母許可等因素促成了硬幣的上升。市場在這些催化劑中積極定價。但是,Coinbase的交易量實際上已經下降了,破壞了其估值的基本理由。看來感情而不是堅實的業務指標正在推動股票。

The Case for Shorting COIN, Going Long BTC

縮短硬幣的情況,長時間BTC

Several factors support a short COIN, long BTC strategy:

幾個因素支持短硬幣,長BTC策略:

- Mean Reversion: COIN's overextension is unsustainable.

- Insider Skepticism: CEO Brian Armstrong's recent significant share sale raises eyebrows.

- Bitcoin's Resilience: Bitcoin is holding its own, potentially becoming a macro-hedging asset.

Technical Signals

技術信號

COIN's stock has consistently tested the upper Bollinger Band, signaling overbought conditions. A break below its 20-day moving average would confirm a reversal. Bitcoin, meanwhile, remains in neutral territory.

硬幣的庫存始終測試了上布林帶,信號表達了過多的條件。低於其20天移動平均線的休息將證實逆轉。同時,比特幣仍位於中立領域。

Execution Strategies

執行策略

Consider these approaches:

考慮以下方法:

- Short COIN via puts: Buy COIN put options.

- Long BTC via futures: Purchase BTC futures contracts.

- Pair trade ratio: Allocate accordingly (e.g., $75 to BTC for every $100 shorted in COIN).

Don't Forget the Risks!

不要忘記風險!

Keep a close eye on market volatility, regulatory changes, and any further decoupling of Coinbase from Bitcoin's price movements. Remember, even the best strategies come with inherent risks.

密切關注市場波動,監管變化以及與比特幣價格變動的任何進一步的共耦合。請記住,即使是最好的策略也帶有固有的風險。

A Word on US PCE Inflation

關於我們PCE通貨膨脹的一句話

Worth a quick mention: The latest US Personal Consumption Expenditures (PCE) inflation data shows an increase, potentially impacting the crypto market. While Bitcoin dipped slightly, large investors might see it as a buying opportunity.

值得一提的是:美國最新的個人消費支出(PCE)通貨膨脹數據顯示出增加,可能影響加密市場。儘管比特幣略有下降,但大型投資者可能將其視為購買機會。

Final Thoughts

最後的想法

Coinbase's stock has sprinted ahead of Bitcoin, potentially creating a mean reversion opportunity. Shorting COIN while going long BTC could offer an attractive risk-reward profile. But always do your own research, set those stop-losses, and remember: in the wild world of crypto, even “free lunches” come with a side of risk. Happy trading, New Yorkers!

Coinbase的股票已在比特幣之前衝刺,有可能創造出平均的回歸機會。長時間BTC的短期硬幣可以提供有吸引力的風險獎勵。但是,請務必進行自己的研究,設置這些停止損失,並記住:在加密貨幣的野生世界中,即使是“免費午餐”都帶有風險。愉快的交易,紐約人!

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

- 加密的第一個原則:返回是否仍然紮根於公平性?

- 2025-06-28 22:30:12

- 加密仍在民主化金融嗎?還是追求回報掩蓋了其建立理想?讓我們深入了解公平的發射,可持續性和未來。

-

-

-

-

-

- 蟲洞,波紋,風險差距:導航互操作性格局

- 2025-06-28 23:30:12

- Ripple與蟲洞的合作關係解鎖了XRP Ledger的交叉鏈潛力。但是橋樑的體積下降和看跌信號引起了人們的關注。

-

- 特朗普,比特幣和美元:紐約關於不斷變化的景觀的觀點

- 2025-06-28 23:30:12

- 探索特朗普對比特幣的不斷發展的立場及其對美元的影響,這是在不斷變化的市場動態和全球加密貨幣採用的背景下。

-

- 特朗普,比特幣和黃金:交織在一起的命運的新時代?

- 2025-06-28 23:50:12

- 探索特朗普,比特幣和黃金之間令人驚訝的聯繫,因為特朗普不斷發展的立場影響了加密貨幣和WLFI雄心勃勃的項目。

-