|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

比特幣的價格在2025年5月9日超過100,000美元,在加密貨幣世界中引起了興奮的波動。

Bitcoin price rose past the $100,000 mark on May 9, 2025, sparking excitement in the crypto sphere.

比特幣價格上漲了2025年5月9日的100,000美元大關,引發了加密球體的興奮。

Here's a breakdown of the rally, considering macroeconomic backdrop, market internals, and varying perspectives.

考慮到宏觀經濟背景,市場內部和不同的觀點,這是集會的細分。

Bitcoin Price Surges Past $100K With Flurry of Macro Activity

比特幣價格飆升超過$ 100,000美元,宏觀活動

Traders saw BTC/USD quickly climbing from $97,200 in early Asian trading to a peak of $99,050 before settling around $103,900.

交易者看到BTC/USD迅速從亞洲早期交易的97,200美元攀升至99,050美元的峰值,然後定居於103,900美元左右。

The move came amid a flurry of macroeconomic developments that traders were watching closely.

此舉是在交易者密切關注的一系列宏觀經濟發展中。

China’s central bank trimmed its one-year lending rate by 15 basis points and cut the reserve requirement ratio by half a percentage point, together freeing an estimated $100 billion of liquidity into the market.

中國的中央銀行將其一年貸款率提高了15個基點,並將儲備金比率降低了一半,從而將估計的1000億美元流動性釋放到市場上。

The rate cut was the first easing since December 2024, coming as Beijing seeks to shore up growth and support its equity and property markets.

降價是自2024年12月以來的首次緩解,北京試圖提高增長並支持其股票和房地產市場。

Bankers and economists polled by Reuters had broadly expected a cut to the yuan interest rate, anticipating slower-than-expected economic recovery in the second quarter of 2024.

路透社對銀行家和經濟學家進行了民意調查,預計將降低人民幣的利率,預計在2024年第二季度的經濟復甦速度較慢。

"We expect further monetary policy easing to be announced in the coming months, in response to rising economic and financial risks," Yu Zeng, economist at Essence Securities, told Reuters.

Essence Securities的經濟學家Yu Zeng告訴路透社:“我們預計將在未來幾個月內宣布進一步的貨幣政策。”

These measures were announced just hours before Bitcoin broke $99,000.

這些措施是在比特幣打破99,000美元之前數小時宣布的。

This was in contrast to the U.S. Federal Reserve, which had paused its tightening cycle. In its May 1 statement, the Fed kept the federal funds target at 5.25 percent. Officials cited mixed growth signals and cooling inflation.

這與美國美聯儲相反,美國美聯儲暫停了其收緊週期。在5月1日的聲明中,美聯儲將聯邦資金目標定為5.25%。官員們引用了混合生長信號和冷卻通貨膨脹。

"The rapidly changing economic landscape will likely factor into upcoming Fed actions, presenting a unique challenge for navigating the delicate balance between stability and recovery," said Ben Casper, U.S. macro strategist at Jpmorgan Chase, in a note to clients.

摩根大通(JPMorgan Chase)美國宏觀戰略家本·卡斯珀(Ben Casper)表示:“迅速變化的經濟格局可能會導致即將進行的美聯儲行動,這是穩定與恢復之間微妙平衡的獨特挑戰。”

The pause contrasted with Beijing’s easing, highlighting divergent policy paths.

暫停與北京的輕鬆寬鬆形成對比,強調了不同的政策路徑。

Behind the scenes, U.S.–China relations also warmed with diplomats holding discreet talks on May 2 to start formal trade negotiations on Friday, May 16 (U.S. Trade Representative’s Office, May 2, 2025).

在幕後,美國與中國的關係還與5月2日舉行謹慎談判的外交官一起為5月16日星期五(美國貿易代表辦公室,2025年5月2日)開始正式貿易談判。

Traders saw this as a move that could reduce friction in goods and capital flows.

交易者認為這是可以減少商品和資本流量摩擦的舉動。

Market Internals Show Slip In U.S. Bitcoin Demand

市場內部顯示在美國比特幣需求中的滑倒

Not every indicator was bullish on May 9.

並非每個指標在5月9日都是看好的。

Coinbase Pro reported a slip in Bitcoin’s price premium versus global benchmarks into negative territory. U.S. traders were seen paying a slight discount, marking the first negative premium in six weeks.

Coinbase Pro報告說,比特幣的價格溢價與全球基準的滑倒是負面的。看到美國交易者略有折扣,標誌著六週內的第一個負溢價。

This signaled that the bulk of recent buying was seen in offshore markets, impacting market internals.

這表明最近在海上市場上看到了大部分購買,從而影響了市場內部。

Meanwhile, CryptoQuant reported record-high short interest among institutional funds. Funds had reportedly increased bearish positions as prices climbed. This setup bore similarities to prior short squeezes, where forced buy-ins might accelerate rallies.

同時,CryptoQuant報導了機構資金中創紀錄的短期興趣。據報導,隨著價格上漲,資金提高了看跌地位。這種設置與以前的短擠壓相似,強迫購買可能會加速集會。

Those covering shorts quickly could push Bitcoin past $100,000.

那些迅速覆蓋短褲的人可能會將比特幣推到100,000美元以上。

FOMO Among Bulls Vs Caution From Bears

公牛與熊的謹慎

Thinking from the bulls was that China’s liquidity surge and the Fed’s hold on rates offered support. They saw the thaw in U.S.–China ties as a further catalyst, considering that cross-border flows may increase with formal trade talks slated for May 16.

從公牛隊看的是,中國的流動性激增和美聯儲對利率的持有提供了支持。考慮到跨境流的正式貿易會談可能會增加,他們將其解凍為進一步的催化劑,這是5月16日的正式貿易談判。

They argued that record shorts on major funds set the stage for a short squeeze.

他們認為,主要資金的記錄短褲為短暫的擠壓奠定了基礎。

Thinking from the bears was to urge caution as the negative Coinbase Pro premium was a warning sign. They argued that U.S. demand may lag behind overseas buying.

熊的思考是敦促謹慎,因為負面的Coinbase Pro Premium是一個警告信號。他們認為,美國的需求可能會落後於海外購買。

This was indicated by the varying price levels on Coinbase Pro and global spot markets, impacting how institutions were positioning for further moves.

這是由Coinbase Pro和全球現貨市場的價格水平變化所表明的,從而影響了機構如何對進一步行動的定位。

The bears were worried that heavy short positions signaled deeper skepticism, especially with those covering shorts quickly capable of pushing Bitcoin past $100,000.

熊隊擔心,沉重的短姿勢表明了更深疑的懷疑,尤其是那些能夠迅速將比特幣推到100,000美元以上的短褲的人。

Those shorts could reinforce selling if policy easing disappoints or trade talks stall. They also flagged lower Asian volume during Golden Week from May 10 to May 16.

如果政策緩解失望或貿易談判失速,這些短褲可能會加強銷售。他們還在5月10日至5月16日的黃金周上標記了下亞銷量。

Thin liquidity could exaggerate price swings in either direction, rendering market internals crucial for gauging buying and selling pressure.

較薄的流動性可能會誇大價格波動,這使市場內部質量對於衡量買賣壓力至關重要。

Bitcoin’s climb to just over $104,000 captured a moment of policy tug-of-war with Beijing’s easing and Washington’s steady rates offering mixed signals.

比特幣的攀升至剛好超過104,000美元,捕獲了北京的輕鬆脫口機和華盛頓的穩定利率,提供了混合信號。

Improving U.S.–China ties hinted at smoother trade, but market internals from negative U.S. premiums to peak shorts painted a complex picture.

改善了美國 - 中國領帶暗示了貿易更平滑,但是從美國負溢價到峰值短褲的市場內部貿易繪製了一幅複雜的畫面。

Whether FOMO will push Bitcoin towards a new all-time high (ATH) remains open as traders watch for forced short-covering and volume shifts with Asia reopening after Golden Week.

FOMO是否會將比特幣推向新的歷史最高水平(ATH),因為商人注意強迫短暫覆蓋和數量變化,黃金周後亞洲重新開放。

They will also keep an eye on updates from Beijing, the Fed, and USTR announcements.

他們還將密切關注北京,美聯儲和USTR公告的更新。

At the time of writing, Bitcoin’s price is $103,7

在寫作時,比特幣的價格為103,7美元

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

- 房子,特朗普比爾,比特幣集會:宏觀和加密貨幣的紐約分鐘

- 2025-07-04 10:30:12

- 特朗普的法案激發了比特幣的嗡嗡聲!了解財政政策,清潔能源削減和模因硬幣躁狂症如何在永遠野生的加密世界中交織在一起。

-

-

-

-

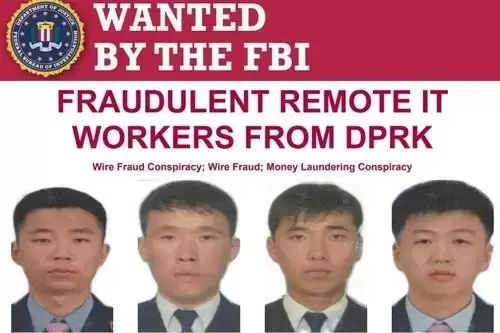

- 平壤在壓力下:看美國起訴書和朝鮮演員

- 2025-07-04 08:30:12

- 解碼美國對朝鮮人的最新起訴以及他們對平壤策略的揭示。

-

-

- Robinhood的風險遊戲:假代幣,真正的麻煩?

- 2025-07-04 09:10:14

- Robinhood進入令牌化資產的企業引發了爭議,因為Openai距離“假”令牌距離,引發了有關風險和透明度的疑問。

-

-

- Shiba Inu的潛在加密集會:乘坐價格上漲?

- 2025-07-04 09:15:12

- Shiba Inu是否準備反彈?分析最新數據,鏈活動和技術指標,以發現加密拉力賽在加密貨幣集會中的價格上漲的可能性。