|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

探索比特幣ETF對投資,加密貨幣和更廣泛的金融格局的影響。他們是在這裡留下的還是短暫的趨勢?

Bitcoin ETFs: Revolutionizing Investing or Just a Crypto Hype?

比特幣ETF:革新投資或僅是加密宣傳?

Bitcoin ETFs have exploded onto the scene, attracting billions in investments and reshaping how traditional finance interacts with cryptocurrency. But are these ETFs truly revolutionizing long-term investment strategies, or are they just another short-lived hype cycle?

比特幣ETF在現場爆炸,吸引了數十億美元的投資,並重塑了傳統金融與加密貨幣的相互作用。但是,這些ETF是真的徹底改變了長期投資策略,還是只是另一個短暫的炒作週期?

The Rise of Bitcoin ETFs

比特幣ETF的興起

Since the approval of the first U.S. spot Bitcoin ETFs in late 2024, institutional capital inflows have surged. By the end of 2024, assets under management for these funds exceeded $120 billion. These ETFs provide a secure and straightforward way for investors to gain exposure to Bitcoin without the complexities of custody, private keys, or wallets.

自2024年末美國第一局比特幣ETF的批准以來,機構資本流入激增。到2024年底,這些資金管理的資產超過了1,200億美元。這些ETF為投資者提供了一種安全而直接的方式,即使沒有託管,私鑰或錢包的複雜性,可以接觸比特幣。

According to CoinTrust Research, Bitcoin ETFs are bridging the trust gap, making BTC more accessible to pension funds, IRAs, and traditional portfolio managers.

根據COINTRUST研究,比特幣ETF正在彌合信任差距,使BTC更容易被養老基金,IRA和傳統投資組合經理使用。

The Strategic Case for Bitcoin ETFs

比特幣ETF的戰略案例

Bitcoin's appeal lies in its fundamentals, with several firms recommending a 1-5% portfolio allocation in BTC via ETFs. This positions Bitcoin alongside gold and inflation-linked bonds in modern macro portfolios. The ease of trading and regulated custody services make Bitcoin ETFs an attractive option for institutional investors.

比特幣的上訴在於其基本面,幾家公司建議通過ETF在BTC中分配1-5%的投資組合。這將比特幣與現代宏觀投資組合中的黃金和通貨膨脹相關的債券定位。交易和受監管服務的便利性使比特幣ETF成為機構投資者的吸引人選擇。

Bitcoin ETF assets now represent 6% of Bitcoin’s total market capitalization, highlighting growing institutional integration with the broader digital asset ecosystem.

現在,比特幣ETF資產佔比特幣總市值的6%,強調了與更廣泛的數字資產生態系統的製度一體化。

Or Just Another Trend?

還是另一個趨勢?

Skeptics argue that ETFs may dilute the self-custodial ethos of Bitcoin. As one Bitcoin core developer noted, ETFs are onboarding TradFi but not necessarily onboarding people into Bitcoin’s original philosophy. There are also concerns that ETF-driven flows may fuel price speculation without corresponding on-chain adoption or utility growth.

懷疑論者認為,ETF可能會稀釋比特幣的自定義精神。正如一位比特幣核心開發人員所指出的那樣,ETF正在登上Tradfi,但不一定會登上人們進入比特幣的原始哲學。也有人擔心ETF驅動的流量可能會推動價格投機,而無需相應的鏈採用或公用事業增長。

Ethereum ETFs and Beyond

以太坊ETF及以後

Ethereum ETFs, introduced in July 2024, have also garnered strong investor interest, holding $9.90 billion in assets and making up 3.35% of Ethereum’s market value. The success of these ETFs has paved the way for potential ETFs for coins like Solana, XRP, and Dogecoin, appealing to a broader investor base.

2024年7月推出的Ethereum ETF還獲得了強大的投資者利益,持有99億美元的資產,並佔以太坊市值的3.35%。這些ETF的成功為Solana,XRP和Dogecoin等硬幣的潛在ETF鋪平了道路,吸引了更廣泛的投資者基礎。

Total net assets for all crypto ETFs have surpassed $133.53 billion, with a growing portion held in non-Bitcoin funds, showcasing expanding investor interest across asset types.

所有加密ETF的淨資產總額已超過1,335.3億美元,其中不斷增長的非比幣基金持有,從而展示了跨資產類型的投資者利息的擴大。

The Road Ahead

前面的道路

The next evolution may include further regulatory clarity and sustained institutional demand. If these conditions are met, Bitcoin ETFs could become a fixture in global asset allocation models, rather than a passing phase.

下一個進化可能包括進一步的監管清晰度和持續的機構需求。如果滿足這些條件,比特幣ETF可能會成為全球資產分配模型的固定裝置,而不是通過階段。

Final Thoughts

最後的想法

Bitcoin ETFs have already reshaped how investors interact with digital assets. Whether they signal the future of crypto investing or merely bridge a transitional moment, one thing is clear: the traditional finance world has fully opened its doors to Bitcoin.

比特幣ETF已經重塑了投資者與數字資產互動的方式。無論是標誌著加密貨幣投資的未來還是僅僅彌合了過渡時刻,都很明顯:傳統的金融界已經完全打開了對比特幣的大門。

So, are Bitcoin ETFs here to stay? Only time will tell, but one thing's for sure: the ride is going to be wild! Buckle up, buttercup, because the world of crypto investing just got a whole lot more interesting.

那麼,這裡的比特幣ETF是否要留下來?只有時間會說明,但是可以肯定的是:騎行會很瘋狂! Buttercup扣緊,因為加密貨幣投資的世界變得更加有趣。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

-

- 以太坊,瑪加科因財務和通貨膨脹:加密投資者重點的轉變

- 2025-07-02 10:30:12

- 以太坊和雪崩表現出冷卻的跡象,因為瑪加科因金融獲得了吸引力。在市場謹慎的情況下,投資者正在探索以敘事驅動的新機會。

-

-

-

- USDC採礦與雲採礦:2025年解鎖每日獎勵

- 2025-07-02 09:15:12

- 探索2025年USDC採礦和雲採礦的興起,重點關注DRML礦工等平台,這些平台可提供每日獎勵和可訪問的加密貨幣收益。

-

- XRP,雲採礦和2025市場:紐約人的拍攝

- 2025-07-02 08:30:12

- 探索XRP在雲採礦和2025市場中的作用。查找Hashj和DRML礦工等平台如何改變遊戲,從而提供穩定性和輕鬆。

-

-

-

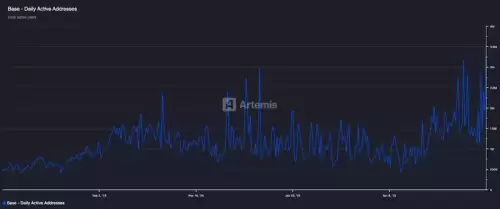

- 基地的鏈敘事:Bitmart研究深度潛水

- 2025-07-02 08:50:12

- BITMART研究分析了Base的爆炸性增長,不斷發展的敘述以及機構一致性,突顯了其在彌合傳統金融和Web3中的作用。