|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

探索比特币ETF对投资,加密货币和更广泛的金融格局的影响。他们是在这里留下的还是短暂的趋势?

Bitcoin ETFs: Revolutionizing Investing or Just a Crypto Hype?

比特币ETF:革新投资或仅是加密宣传?

Bitcoin ETFs have exploded onto the scene, attracting billions in investments and reshaping how traditional finance interacts with cryptocurrency. But are these ETFs truly revolutionizing long-term investment strategies, or are they just another short-lived hype cycle?

比特币ETF在现场爆炸,吸引了数十亿美元的投资,并重塑了传统金融与加密货币的相互作用。但是,这些ETF是真的彻底改变了长期投资策略,还是只是另一个短暂的炒作周期?

The Rise of Bitcoin ETFs

比特币ETF的兴起

Since the approval of the first U.S. spot Bitcoin ETFs in late 2024, institutional capital inflows have surged. By the end of 2024, assets under management for these funds exceeded $120 billion. These ETFs provide a secure and straightforward way for investors to gain exposure to Bitcoin without the complexities of custody, private keys, or wallets.

自2024年末美国第一局比特币ETF的批准以来,机构资本流入激增。到2024年底,这些资金管理的资产超过了1,200亿美元。这些ETF为投资者提供了一种安全而直接的方式,即使没有托管,私钥或钱包的复杂性,可以接触比特币。

According to CoinTrust Research, Bitcoin ETFs are bridging the trust gap, making BTC more accessible to pension funds, IRAs, and traditional portfolio managers.

根据COINTRUST研究,比特币ETF正在弥合信任差距,使BTC更容易被养老基金,IRA和传统投资组合经理使用。

The Strategic Case for Bitcoin ETFs

比特币ETF的战略案例

Bitcoin's appeal lies in its fundamentals, with several firms recommending a 1-5% portfolio allocation in BTC via ETFs. This positions Bitcoin alongside gold and inflation-linked bonds in modern macro portfolios. The ease of trading and regulated custody services make Bitcoin ETFs an attractive option for institutional investors.

比特币的上诉在于其基本面,几家公司建议通过ETF在BTC中分配1-5%的投资组合。这将比特币与现代宏观投资组合中的黄金和通货膨胀相关的债券定位。交易和受监管服务的便利性使比特币ETF成为机构投资者的吸引人选择。

Bitcoin ETF assets now represent 6% of Bitcoin’s total market capitalization, highlighting growing institutional integration with the broader digital asset ecosystem.

现在,比特币ETF资产占比特币总市值的6%,强调了与更广泛的数字资产生态系统的制度一体化。

Or Just Another Trend?

还是另一个趋势?

Skeptics argue that ETFs may dilute the self-custodial ethos of Bitcoin. As one Bitcoin core developer noted, ETFs are onboarding TradFi but not necessarily onboarding people into Bitcoin’s original philosophy. There are also concerns that ETF-driven flows may fuel price speculation without corresponding on-chain adoption or utility growth.

怀疑论者认为,ETF可能会稀释比特币的自定义精神。正如一位比特币核心开发人员所指出的那样,ETF正在登上Tradfi,但不一定会登上人们进入比特币的原始哲学。也有人担心ETF驱动的流量可能会推动价格投机,而无需相应的链采用或公用事业增长。

Ethereum ETFs and Beyond

以太坊ETF及以后

Ethereum ETFs, introduced in July 2024, have also garnered strong investor interest, holding $9.90 billion in assets and making up 3.35% of Ethereum’s market value. The success of these ETFs has paved the way for potential ETFs for coins like Solana, XRP, and Dogecoin, appealing to a broader investor base.

2024年7月推出的Ethereum ETF还获得了强大的投资者利益,持有99亿美元的资产,并占以太坊市值的3.35%。这些ETF的成功为Solana,XRP和Dogecoin等硬币的潜在ETF铺平了道路,吸引了更广泛的投资者基础。

Total net assets for all crypto ETFs have surpassed $133.53 billion, with a growing portion held in non-Bitcoin funds, showcasing expanding investor interest across asset types.

所有加密ETF的净资产总额已超过1,335.3亿美元,其中不断增长的非比币基金持有,从而展示了跨资产类型的投资者利息的扩大。

The Road Ahead

前面的道路

The next evolution may include further regulatory clarity and sustained institutional demand. If these conditions are met, Bitcoin ETFs could become a fixture in global asset allocation models, rather than a passing phase.

下一个进化可能包括进一步的监管清晰度和持续的机构需求。如果满足这些条件,比特币ETF可能会成为全球资产分配模型的固定装置,而不是通过阶段。

Final Thoughts

最后的想法

Bitcoin ETFs have already reshaped how investors interact with digital assets. Whether they signal the future of crypto investing or merely bridge a transitional moment, one thing is clear: the traditional finance world has fully opened its doors to Bitcoin.

比特币ETF已经重塑了投资者与数字资产互动的方式。无论是标志着加密货币投资的未来还是仅仅弥合了过渡时刻,都很明显:传统的金融界已经完全打开了对比特币的大门。

So, are Bitcoin ETFs here to stay? Only time will tell, but one thing's for sure: the ride is going to be wild! Buckle up, buttercup, because the world of crypto investing just got a whole lot more interesting.

那么,这里的比特币ETF是否要留下来?只有时间会说明,但是可以肯定的是:骑行会很疯狂! Buttercup扣紧,因为加密货币投资的世界变得更加有趣。

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

-

- 以太坊,玛加科因财务和通货膨胀:加密投资者重点的转变

- 2025-07-02 10:30:12

- 以太坊和雪崩表现出冷却的迹象,因为玛加科因金融获得了吸引力。在市场谨慎的情况下,投资者正在探索以叙事驱动的新机会。

-

-

-

- USDC采矿与云采矿:2025年解锁每日奖励

- 2025-07-02 09:15:12

- 探索2025年USDC采矿和云采矿的兴起,重点关注DRML矿工等平台,这些平台可提供每日奖励和可访问的加密货币收益。

-

- XRP,云采矿和2025市场:纽约人的拍摄

- 2025-07-02 08:30:12

- 探索XRP在云采矿和2025市场中的作用。查找Hashj和DRML矿工等平台如何改变游戏,从而提供稳定性和轻松。

-

-

-

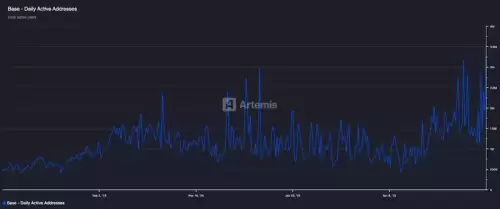

- 基地的链叙事:Bitmart研究深度潜水

- 2025-07-02 08:50:12

- BITMART研究分析了Base的爆炸性增长,不断发展的叙述以及机构一致性,突显了其在弥合传统金融和Web3中的作用。