|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

當涉及加密貨幣投資時,這是我所知道的最好的,這是一個好主意,將所有雞蛋放在一個籃子裡

Cryptocurrency investing is a risky venture, and it’s important to diversify your portfolio to minimize losses. A well-diversified portfolio will include a mix of large-cap, mid-cap, and small-cap cryptocurrencies. Large-cap cryptocurrencies are typically the most stable and have the highest trading volume. Mid-cap cryptocurrencies are less stable than large-cap cryptocurrencies, but they also have the potential for higher returns. Small-cap cryptocurrencies are the most volatile and have the lowest trading volume. However, they also have the potential for the highest returns.

加密貨幣投資是一項冒險的冒險,重要的是要多樣化投資組合以最大程度地減少損失。多元化的投資組合將包括大型,中盤和小型加密貨幣的混合。大型加密貨幣通常是最穩定的,交易量最高。中型加密貨幣不如大型加密貨幣穩定,但它們也有可能獲得更高的回報。小型加密貨幣是最動蕩的,交易量最低。但是,它們也具有獲得最高回報的潛力。

When diversifying your cryptocurrency portfolio, it’s important to consider your financial goals and risk tolerance. If you’re new to cryptocurrency investing, it’s best to start with a small portfolio of large-cap cryptocurrencies. As you gain more experience, you can gradually add mid-cap and small-cap cryptocurrencies to your portfolio.

在使您的加密貨幣投資組合多樣化時,重要的是要考慮您的財務目標和風險承受能力。如果您是加密貨幣投資的新手,那麼最好從一小部分大型加密貨幣投資組合開始。隨著您獲得更多的經驗,您可以逐漸在投資組合中添加中型和小型加密貨幣。

One common cryptocurrency diversification strategy is the 80/20 rule. This rule states that 80% of your cryptocurrency portfolio should be invested in large-cap cryptocurrencies, such as Bitcoin and Ethereum. The remaining 20% of your portfolio can be invested in mid-cap and small-cap cryptocurrencies.

80/20規則是一種常見的加密貨幣多元化策略。該規則指出,您的加密貨幣投資組合的80%應投資於大型加密貨幣,例如比特幣和以太坊。其餘20%的投資組合可以投資於中型和小型加密貨幣。

The 80/20 rule is a good starting point for beginner cryptocurrency investors. However, as you gain more experience, you may want to adjust the ratio of large-cap to mid-cap and small-cap cryptocurrencies in your portfolio.

對於初學者加密貨幣投資者來說,80/20規則是一個很好的起點。但是,隨著您獲得更多的經驗,您可能需要調整投資組合中的大型中蓋和小型加密貨幣的比例。

Here’s a closer look at some of the best large-cap cryptocurrencies for upside potential in 2023:

仔細研究了一些最好的大型加密貨幣,以期在2023年上漲:

* Bitcoin (BTC)

*比特幣(BTC)

* Ethereum (ETH)

*以太坊(ETH)

* Binance Coin (BNB)

* Binance硬幣(BNB)

* XRP (XRP)

* XRP(XRP)

* Cardano (ADA)

* cardano(那裡)

These cryptocurrencies are all ranked in the top 10 by market capitalization, and they have all shown strong performance in 2023. If you’re looking to diversify your cryptocurrency portfolio and maximize your potential for upside, these are some of the best options to consider.

這些加密貨幣都按市值排名前10位,並且在2023年都表現出強勁的表現。如果您希望多樣化加密貨幣投資組合併最大程度地提高您的上漲潛力,那麼這些都是值得考慮的最佳選擇。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

- Xploradex預售在最後幾個小時,機會之窗快速關閉

- 2025-04-26 04:50:13

- Xploradex預售僅剩下72個小時,而$ XPL代幣分佈幾乎完成

-

-

-

-

- 介紹切片:21世紀網格的支付機制

- 2025-04-26 04:40:12

- 自GPU和地下室設置時代以來,比特幣採礦已經走了很長一段路。在那個時候,礦工以無數的方式進步。

-

- “這一最新行動提出了嚴重的道德和法律關注”

- 2025-04-26 04:40:12

- “這項最新行動提出了嚴重的道德和法律問題,包括特朗普總統和其他官員可能會涉及'付費'腐敗的嚴重風險

-

-

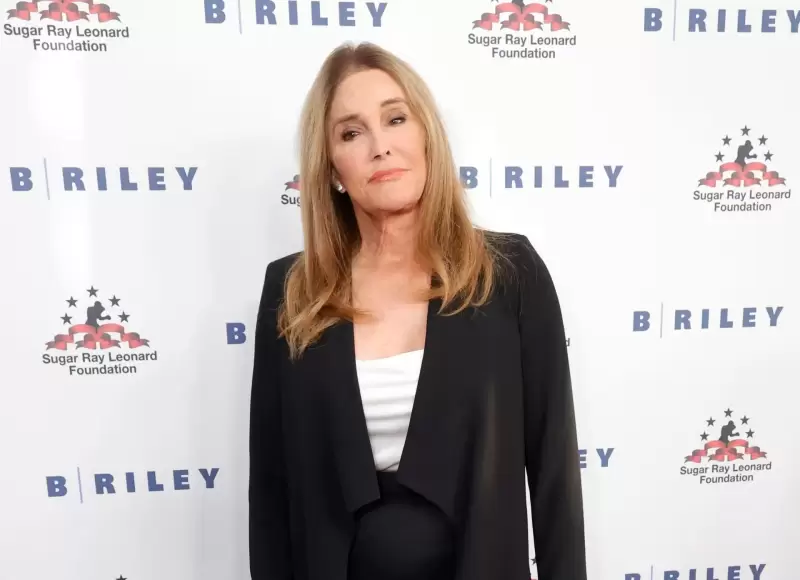

- 凱特琳·詹納(Caitlyn Jenner

- 2025-04-26 04:35:13

- 據報導,一群成員購買者指責詹納(Jenner)出售名人代幣作為未註冊的安全。

-

- 納斯達克敦促SEC將與證券的數字資產應用相同的監管標準

- 2025-04-26 04:30:13

- 交易所表示,美國金融監管機構需要為加密貨幣建立更清晰的分類法,包括將一部分數字資產歸類為“金融證券”。