|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

加密貨幣新聞文章

Bitcoin (BTC) Faces Correction Concerns After Retesting the $100,000 Level

2025/01/09 15:50

Bitcoin (BTC) price dropped sharply on Jan. 8 after retesting the $100,000 level, forming a bearish engulfing candle on the daily chart. The drop came as key U.S. economic data signaled strength in the labor market.

The BTC price flash crashed from $102,760 to $92,500 on Jan. 8 after data showed a stronger-than-expected increase in private payrolls in the United States. The data put pressure on equities and crypto markets, as traders anticipated a response from the Federal Reserve.

However, analysts pointed to the increasing supply of stablecoins as a potential driver of future capital inflows into Bitcoin. Crypto analyst Miles Deutscher noted that stablecoins had entered “price discovery,” indicating the availability of liquidity that could support a BTC recovery in the coming months.

“Stablecoins now in price discovery, signaling liquidity for the capital to flow back into BTC in the upcoming months,” Deutscher said in a Jan. 8 tweet.

Stablecoin supply signals liquidity expansion

Similarly, market analyst Jamie Coutts highlighted the increase in liquidity, which, when paired with strong dollar performance, could lead to higher Bitcoin prices within six months.

“Six months ago, the dollar was tanking and there was no liquidity in the market, hence the BTC price drop,” Coutts stated in a Jan. 8 analysis.

“Now, the dollar is strong and there's a huge amount of liquidity left in the market, setting up for new BTC price highs within six months.”)

Data from Binance spot markets showed a progressive rise in USD volumes throughout the year, with America’s market share hitting an all-time high of 42% in the 2024-2025 session. The growth in USD volumes highlights the strength of the current market and suggests robust demand for BTC.

Binance spot volumes reach all-time high

Despite these positive liquidity signals, Bitcoin’s 5.15% drop on Jan. 8 erased four days of bullish momentum. Historical data shows that BTC has only recovered immediately after such dips 20% of the time.

Out of 15 pullbacks of 5% or more since January 2024, Bitcoin has registered an immediate rebound on just three occasions, suggesting a low probability of an uptrend in the short term.

“Four days of green candles erased after a 5% drop, historically BTC has only recovered immediately after such dips 20% of the time,” Miles Deutscher noted in a Jan. 8 analysis.

“This time around, we're in a bull market and after a 5% drop, BTC has recovered immediately three out of 15 times since January 2024.”)

Crypto trader Krillin predicted that Bitcoin could consolidate between $92,000 and $90,000 throughout January before a potential market pump in February.

“Consolidating between $92,000 and $90,000 for the rest of the month before another market pump in February,” Krillin stated in a Jan. 8 analysis.

“Taking out equal lows of around $90,000 before aiming for new highs.”)

If Bitcoin closes below $90,000 on the daily chart, analysts warn of a deeper crash. A confirmed inverse head-and-shoulders pattern could lead to a further 20% drop, potentially targeting $71,500.

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

- 這是Altcoin季節,Ruvi著火了

- 2025-04-26 18:10:13

- 由於山寨幣終於到了,在明星中,Sui剛剛飆升至3.60美元

-

- 本週比特幣(BTC)ETF流入增長,吸引了26.8億美元的新投資

- 2025-04-26 18:10:13

- 這意味著越來越多的機構和零售投資者正在尋求進入比特幣的風險。這對應於比特幣ETF流入的增加

-

-

- 3月可能會大大增加的3個山寨幣超過BTC

- 2025-04-26 18:05:13

- 四月是加密貨幣市場的正月。許多Altcoins於4月7日達到底部,並從下降線爆發了幾個月。

-

- 中國在放棄美國國債,轉移到黃金和比特幣方面佔據了杆位

- 2025-04-26 18:00:45

- 中央銀行正在重新思考儲備戰略,中國在放棄美國財政部方面處於杆位。

-

- 比特幣比薩天2025

- 2025-04-26 18:00:45

- BTSE興奮地宣布2025年比特幣披薩日舉行了為期一個月

-

-

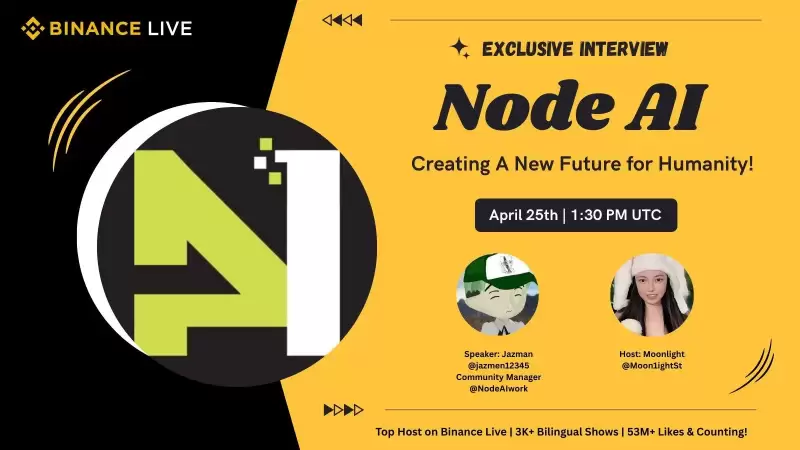

- 節點AI是在人工智能和分散技術交集建立的創新項目。

- 2025-04-26 17:55:13

- 我們的核心使命是通過使其開放,透明和以社區為導向來使對AI的訪問權限。

-

- 新聞與薄荷區塊鏈合作夥伴,以引入人類可讀的NFT轉移

- 2025-04-26 17:50:14

- Noves是一個備受推崇的區塊鏈數據層平台,已與MINT區塊鏈(以太坊2(L2)網絡)建立了戰略合作夥伴關係。