|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Intotheblock最近共享的一張圖表表明,根據其未實用的交易產量(UTXO)的年齡,Litecoin(LTC)持有人之間存在顯著鴻溝。通過根據持有期限對錢包進行分類,數據可以更深入地了解投資者的情緒和市場行為。

A recent chart shared by IntoTheBlock highlights a significant divide among Litecoin (LTC) holders, categorized by the age of their unspent transaction outputs (UTXOs).

Intotheblock最近共享的一張圖表突出了Litecoin(LTC)持有人之間的顯著鴻溝,該持有人歸類為其未支付交易產量(UTXOS)的年齡。

As seen in the chart below, there are two main categories of wallets: those holding LTC for 3–5 years and those holding for over five years.

如下圖所示,有兩個主要的錢包類別:持有LTC 3 - 5年的LTC和持有五年多的錢包。

Wallets that have been accumulating Litecoin over the 2020–2021 bull run and have been holding for 3–5 years now show strategic selling.

在2020-2021公牛運行中累積了萊特幣的錢包,並且已經持有3 - 5年了,現在顯示出戰略性銷售。

These holders sell their positions in two critical phases: at the beginning of a new rally and at the beginning of a bear phase. This same selling trend manifested in 2024 as well.

這些持有人在兩個關鍵階段出售自己的職位:在新集會的開始和熊階段開始時。同樣的銷售趨勢也出現在2024年。

When LTC prices increased, these investors sold out, exhibiting the same trend as in previous market cycles. More recently, distribution signals have appeared with the price reversal in mid-2025.

當LTC價格上漲時,這些投資者售罄,表現出與以前的市場週期相同的趨勢。最近,分銷信號在2025年中期出現在價格逆轉。

However, its actions are dictated by a thoughtful strategy: ride out one cycle, sell on the next, and skip over extreme corrections.

但是,它的行動取決於一個周到的策略:乘一個週期,在下一個週期出售,然後跳過極端的校正。

Conversely, wallets holding LTC for more than five years depict a different picture. Such addresses now hold more than 20.6% of all UTXOs and have steadily accumulated irrespective of market volatility.

相反,持有LTC的錢包超過五年描繪了不同的圖片。現在,此類地址佔所有UTXO的20.6%以上,並且無論市場波動如何,都穩步積累。

Their development seems stable, which is an indicator of a conviction-based approach. This group has been less likely to react to price movements impulsively, thus building a solid base of Litecoin holders.

他們的發展似乎穩定,這是一種基於信念的方法的指標。該小組衝動地對價格變動做出反應的可能性較小,從而建立了Litecoin持有人的堅實基礎。

Long-Term Litecoin Holders Gain Influence

長期Litecoin持有人獲得了影響

The UTXO chart most likely has time on its X-axis, going from 2020 to 2025, and has a percentage of total UTXOs on its Y-axis. Red portions are areas where 3–5-year holders sold aggressively, initially into a rally and then in the down cycle.

UTXO圖表很可能有X軸的時間,從2020年到2025年,其Y軸的總utxos佔了一定比例。紅色部分是3 - 5年持有者在集會上進行積極銷售的3 - 5年持有人,然後在下降週期中。

This is in line with Litecoin’s price action in the post-2020 era: peaks in bull cycles with sharp price corrections thereafter.

這與Litecoin在2020年後時代的價格行動一致:此後價格較高的牛週期達到高峰。

Conversely, an independent path, perhaps colored in blue or green, is indicative of wallets that have been holding for over five years. This group’s proportion of total UTXOs has grown steadily regardless of short-term market conditions.

相反,一條可能以藍色或綠色為彩色的獨立路徑表明已經持有超過五年的錢包。無論短期市場狀況如何,該小組的總UTXO的比例都穩步增長。

Their existence has become an increasingly potent force within Litecoin’s environment, now holding over a fifth of UTXO distribution.

它們的存在已成為Litecoin環境中日益強大的力量,現在擁有UTXO分佈的五分之一。

Blockchain data analyst Kiwi Tucker referred to this trend, attributing it to these long-term players’ quiet but significant presence. These actions indicate high confidence in Litecoin’s underlying values and use case, particularly with recent moves like implementing MimbleWimble Extension Blocks (MWEB) privacy-focused updates.

區塊鏈數據分析師奇異果塔克(Kiwi Tucker)提到了這一趨勢,將其歸因於這些長期參與者的安靜但重要的存在。這些動作表明對Litecoin的基本價值和用例的信心很高,尤其是在實施Mimblewimble擴展塊(MWEB)的最新動作中,以隱私為中心的更新。

At its current price level, trading at $83.25 as of April 23, market observers are keen to note how these conflicting holding trends will influence future price action. Past data indicate that times of growing long-term holder buying tend to signal major rallies by way of tightening supply and lowering selling pressures.

在目前的價格水平上,截至4月23日的交易價格為83.25美元,市場觀察家渴望注意到這些相互矛盾的持有趨勢將如何影響未來的價格行動。過去的數據表明,長期持有人購買的時間往往會通過收緊供應和降低銷售壓力來表明重大集會。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

- 比特幣的售價超過$ 90K,以太坊和山寨幣現很出色的收益

- 2025-04-25 17:55:13

- 全球加密貨幣市場繼續反映出看漲的情緒,比特幣保持穩定的立場高於93,000美元。

-

- 分析師說

- 2025-04-25 17:55:13

- 一位廣泛關注的加密分析師說,比特幣(BTC)可能在看跌逆轉之前向上行進程。

-

-

- SUI區塊鏈的本地令牌SUI本週飆升了62%以上

- 2025-04-25 17:50:13

- SUI區塊鏈的原住民令牌SUI本週飆升了62%以上,這是由於猜測與Pokémon的潛在合作所推動。

-

- 多聚市場捕獲

- 2025-04-25 17:45:13

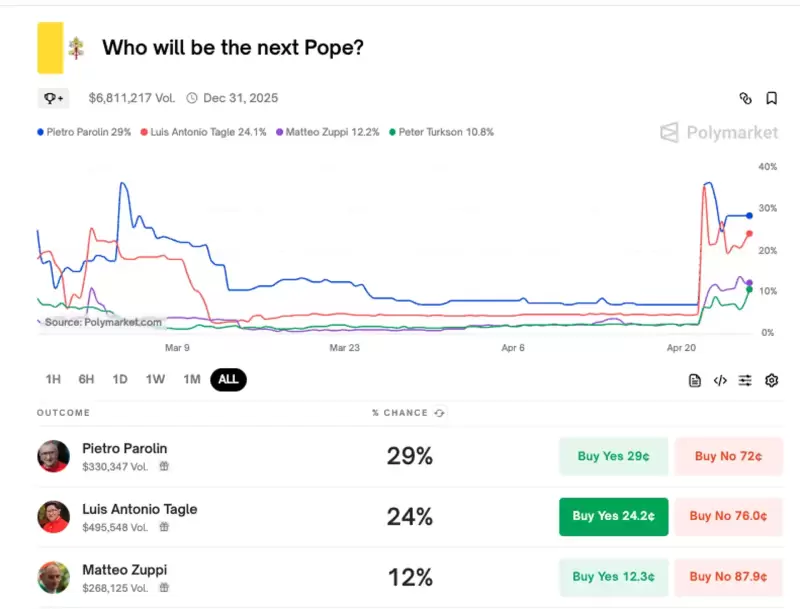

- 由於預計將在下個月舉行的“結論”(教皇選舉秘密會議)選舉下一屆教皇時,圍繞教皇候選人主題的Meme Coins引起了人們的關注。

-

-

-

- DraftKings支付1000萬美元以解決NFT證券集體訴訟

- 2025-04-25 17:40:13

- 流行的體育博彩和幻想體育公司Draftkings已同意達成1000萬美元的和解,以解決集體訴訟

-