|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Intotheblock最近共享的一张图表表明,根据其未实用的交易产量(UTXO)的年龄,Litecoin(LTC)持有人之间存在显着鸿沟。通过根据持有期限对钱包进行分类,数据可以更深入地了解投资者的情绪和市场行为。

A recent chart shared by IntoTheBlock highlights a significant divide among Litecoin (LTC) holders, categorized by the age of their unspent transaction outputs (UTXOs).

Intotheblock最近共享的一张图表突出了Litecoin(LTC)持有人之间的显着鸿沟,该持有人归类为其未支付交易产量(UTXOS)的年龄。

As seen in the chart below, there are two main categories of wallets: those holding LTC for 3–5 years and those holding for over five years.

如下图所示,有两个主要的钱包类别:持有LTC 3 - 5年的LTC和持有五年多的钱包。

Wallets that have been accumulating Litecoin over the 2020–2021 bull run and have been holding for 3–5 years now show strategic selling.

在2020-2021公牛运行中累积了莱特币的钱包,并且已经持有3 - 5年了,现在显示出战略性销售。

These holders sell their positions in two critical phases: at the beginning of a new rally and at the beginning of a bear phase. This same selling trend manifested in 2024 as well.

这些持有人在两个关键阶段出售自己的职位:在新集会的开始和熊阶段开始时。同样的销售趋势也出现在2024年。

When LTC prices increased, these investors sold out, exhibiting the same trend as in previous market cycles. More recently, distribution signals have appeared with the price reversal in mid-2025.

当LTC价格上涨时,这些投资者售罄,表现出与以前的市场周期相同的趋势。最近,分销信号在2025年中期出现在价格逆转。

However, its actions are dictated by a thoughtful strategy: ride out one cycle, sell on the next, and skip over extreme corrections.

但是,它的行动取决于一个周到的策略:乘一个周期,在下一个周期出售,然后跳过极端的校正。

Conversely, wallets holding LTC for more than five years depict a different picture. Such addresses now hold more than 20.6% of all UTXOs and have steadily accumulated irrespective of market volatility.

相反,持有LTC的钱包超过五年描绘了不同的图片。现在,此类地址占所有UTXO的20.6%以上,并且无论市场波动如何,都稳步积累。

Their development seems stable, which is an indicator of a conviction-based approach. This group has been less likely to react to price movements impulsively, thus building a solid base of Litecoin holders.

他们的发展似乎稳定,这是一种基于信念的方法的指标。该小组冲动地对价格变动做出反应的可能性较小,从而建立了Litecoin持有人的坚实基础。

Long-Term Litecoin Holders Gain Influence

长期Litecoin持有人获得了影响

The UTXO chart most likely has time on its X-axis, going from 2020 to 2025, and has a percentage of total UTXOs on its Y-axis. Red portions are areas where 3–5-year holders sold aggressively, initially into a rally and then in the down cycle.

UTXO图表很可能有X轴的时间,从2020年到2025年,其Y轴的总utxos占了一定比例。红色部分是3 - 5年持有者在集会上进行积极销售的3 - 5年持有人,然后在下降周期中。

This is in line with Litecoin’s price action in the post-2020 era: peaks in bull cycles with sharp price corrections thereafter.

这与Litecoin在2020年后时代的价格行动一致:此后价格较高的牛周期达到高峰。

Conversely, an independent path, perhaps colored in blue or green, is indicative of wallets that have been holding for over five years. This group’s proportion of total UTXOs has grown steadily regardless of short-term market conditions.

相反,一条可能以蓝色或绿色为彩色的独立路径表明已经持有超过五年的钱包。无论短期市场状况如何,该小组的总UTXO的比例都稳步增长。

Their existence has become an increasingly potent force within Litecoin’s environment, now holding over a fifth of UTXO distribution.

它们的存在已成为Litecoin环境中日益强大的力量,现在拥有UTXO分布的五分之一。

Blockchain data analyst Kiwi Tucker referred to this trend, attributing it to these long-term players’ quiet but significant presence. These actions indicate high confidence in Litecoin’s underlying values and use case, particularly with recent moves like implementing MimbleWimble Extension Blocks (MWEB) privacy-focused updates.

区块链数据分析师奇异果塔克(Kiwi Tucker)提到了这一趋势,将其归因于这些长期参与者的安静但重要的存在。这些动作表明对Litecoin的基本价值和用例的信心很高,尤其是在实施Mimblewimble扩展块(MWEB)的最新动作中,以隐私为中心的更新。

At its current price level, trading at $83.25 as of April 23, market observers are keen to note how these conflicting holding trends will influence future price action. Past data indicate that times of growing long-term holder buying tend to signal major rallies by way of tightening supply and lowering selling pressures.

在目前的价格水平上,截至4月23日的交易价格为83.25美元,市场观察家渴望注意到这些相互矛盾的持有趋势将如何影响未来的价格行动。过去的数据表明,长期持有人购买的时间往往会通过收紧供应和降低销售压力来表明重大集会。

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

- 比特币的售价超过$ 90K,以太坊和山寨币现很出色的收益

- 2025-04-25 17:55:13

- 全球加密货币市场继续反映出看涨的情绪,比特币保持稳定的立场高于93,000美元。

-

- 分析师说

- 2025-04-25 17:55:13

- 一位广泛关注的加密分析师说,比特币(BTC)可能在看跌逆转之前向上行进程。

-

-

- SUI区块链的本地令牌SUI本周飙升了62%以上

- 2025-04-25 17:50:13

- SUI区块链的原住民令牌SUI本周飙升了62%以上,这是由于猜测与Pokémon的潜在合作所推动。

-

- 多聚市场捕获

- 2025-04-25 17:45:13

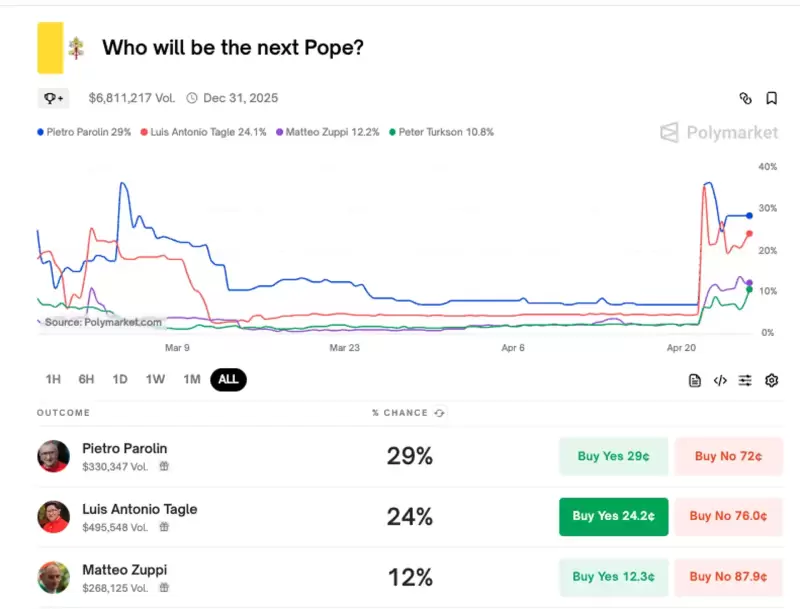

- 由于预计将在下个月举行的“结论”(教皇选举秘密会议)选举下一届教皇时,围绕教皇候选人主题的Meme Coins引起了人们的关注。

-

-

-

- DraftKings支付1000万美元以解决NFT证券集体诉讼

- 2025-04-25 17:40:13

- 流行的体育博彩和幻想体育公司Draftkings已同意达成1000万美元的和解,以解决集体诉讼

-