|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nachrichtenartikel zu Kryptowährungen

VanEck Files Form S-1 Registration Statement for Its Binance Coin (BNB) Exchange-Traded Fund (ETF)

May 05, 2025 at 08:23 pm

U.S. asset management firm VanEck has filed for an exchange-traded fund (ETF) that would track the price of Binance Coin (BNB).

The firm submitted Form S-1 registration statement for the "VanEck BNB ETF" with the U.S. Securities and Exchange Commission (SEC) on Friday.

The document includes details about the ETF's business operations, financial condition, and the methodology for determining the offering price of the ETF.

After previously launching Bitcoin (BTC) and Ethereum (ETH) ETFs in the U.S., VanEck is now looking to add another major cryptocurrency to its ETF portfolio with BNB.

The move comes after 21Shares launched the ETP earlier this year. However, that product is available in Europe, while VanEck’s ETF would target a U.S.-based clientele.

If approved by the SEC, the BNB held in the trust could be staked to earn additional BNB or other income, which would then be distributed to the ETF's holders.

The application for the ETF comes as the narrative around BNB is shifting. Once seen as an asset heavily tied to the exchange, traders are now recognizing BNB as a key component of the Web3 infrastructure.

This stands in contrast to the skepticism that met the initial applications for a spot Bitcoin ETF, which took several years to be approved.

Earlier this year, the SEC also approved the first two spot cryptocurrency ETFs, setting the stage for a wave of new products to hit the market.

However, the SEC has since hit a snag in its efforts to approve any more crypto ETFs. Despite this setback, the commission is continuing to process the applications that were submitted in the first quarter of the year.

Haftungsausschluss:info@kdj.com

Die bereitgestellten Informationen stellen keine Handelsberatung dar. kdj.com übernimmt keine Verantwortung für Investitionen, die auf der Grundlage der in diesem Artikel bereitgestellten Informationen getätigt werden. Kryptowährungen sind sehr volatil und es wird dringend empfohlen, nach gründlicher Recherche mit Vorsicht zu investieren!

Wenn Sie glauben, dass der auf dieser Website verwendete Inhalt Ihr Urheberrecht verletzt, kontaktieren Sie uns bitte umgehend (info@kdj.com) und wir werden ihn umgehend löschen.

-

-

- Interactive Stärke (TRNR) kündigt strategische Finanzmittel in Höhe von 500 Mio. USD für den Erwerb von FET -Token an

- Jun 12, 2025 at 07:40 am

- Die von der NASDAQ gelistete interaktive Stärke (TRNR) hat eine strategische Finanzierungsfazilität von 500 Millionen US-Dollar für den Erwerb von FET-Token angekündigt

-

-

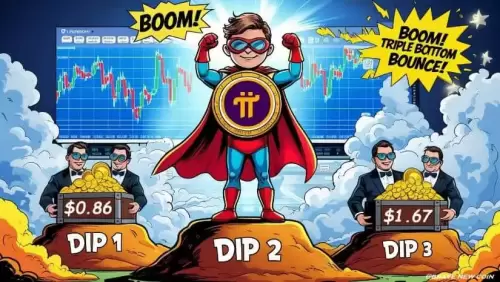

- PI Network (PI) -Marktklammern für eine mögliche Bewegung über 1,67 USD Widerstand, wenn sich Wale ansammeln

- Jun 12, 2025 at 07:35 am

- Mit der Bildung eines dreifachen unteren Musters und eines Anstiegs der Walakkumulation ist der PI -Münzmarkt auf einen möglichen Schritt über dem psychologischen $ 1,67 -Level verdrängt

-

-

-

-

-

- Zwei Männer, die wegen Entführung und Folter eines Kryptowährungshalters angeklagt sind, bekannten sich nicht schuldig

- Jun 12, 2025 at 07:25 am

- Zwei der Männer, die wegen Entführung und Folter eines Kryptowährungsinhabers in New York City angeklagt sind, haben sich Berichten zufolge nicht für alle Anklagepunkte schuldig bekannt.