|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

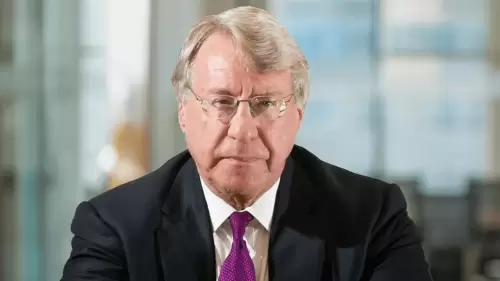

Prominent short-seller Jim Chanos, once a vocal critic of Bitcoin and cryptocurrencies, has revealed a new trading play that involves shorting shares of Strategy (formerly MicroStrategy) and buying Bitcoin.

May 15, 2025 at 08:10 pm

Prominent short-seller Jim Chanos, once a vocal critic of Bitcoin and cryptocurrencies, has revealed a new trading play that involves shorting shares of Strategy (formerly MicroStrategy) and buying Bitcoin.

Prominent short-seller Jim Chanos has revealed a new trading play that involves shorting shares of Strategy (formerly MicroStrategy) and buying Bitcoin (BTC).

At the Sohn Investment Conference in New York on May 7, Chanos told CNBC’s Becky Quick that he’s “selling MicroStrategy stock and buying Bitcoin.” The investor described the move as buying something for $1 and selling something for $2.50, referring to what he sees as a significant price mismatch.

According to Chanos, Strategy is selling the idea of buying Bitcoin in a corporate structure, and that other companies are following suit in hopes of receiving a similar market premium.

“It’s ridiculous. Sell MicroStrategy stock and buy the underlying Bitcoins,” said Chanos, adding that his trade is “a good barometer of not only just of the arbitrage itself, but I think of retail speculation.”

Chanos’ recent move assumes investors overpay for Bitcoin exposure through corporate wrappers. The investor’s move stands at a purchase price of $1 for one Bitcoin and a sale price of $2.50 for Strategy stock, aiming to highlight what he sees as a substantial price mismatch.

According to him, the thinking behind this trade is that investors are paying an overpremium for Strategy’s stock in anticipation of gaining indirect exposure to Bitcoin. However, Chanos believes it would be more efficient to buy Bitcoin directly at $1 and sell Strategy stock at $2.50 to capitalize on the overpricing.

This move suggests that holding Bitcoin through companies reflects excessive speculation and mispricing of risk. It assumes that retail investors’ idea of having Bitcoin indirectly through corporate wrappers can inflate the company’s stock valuations.

While shorting Strategy stock seems like a good idea, investors have already lost billions shorting Saylor’s company. In 2024, investors who bet against the firm lost about $3.3 billion as the company’s stock started to rise.

As of May 2025, Strategy holds approximately 568,840 Bitcoin, valued at around $59 billion. Since the company started accumulating Bitcoin in 2020, its stock price surged by 1,500%, outperforming the S&P 500’s gains during the same period.

In a recently released documentary from the Financial Times, Strategy analyst Jeff Walton said that the company’s Bitcoin holdings would help it become the “number one publicly traded equity in the entire market” in the future.

Chanos previously called Bitcoin a ‘libertarian fantasy’

In a 2018 interview, Chaons said that he wouldn’t want to live in a world where the food chain is holding up and the only currency that remains is Bitcoin.

“I suppose having digital currency as a store of value in the worst-case scenario wouldn’t work. If fiat currency brings the world down, the last thing I’d want to own is Bitcoin. Food would work the best,” said Chanos.

He also criticized Bitcoin for enabling illicit activity, calling the crypto sector “the dark side of finance” in a 2023 interview, and accused the industry of facilitating tax evasion and money laundering.

Chanos also expressed skepticism about spot Bitcoin exchange-traded funds (ETFs), saying that Wall Street needs to keep the public interested in crypto to profit from the fees.

Despite those critiques, Chanos now appears to see value in holding Bitcoin directly, particularly in contrast to investing in public companies with large BTC treasuries.

Related: $1B Bitcoin exits Coinbase in a day as analysts warn of supply shock

Chanos’ history in short-selling

Known for his short position against the energy company Enron before the firm filed for bankruptcy in 2001, A

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

- Coinbase, the Largest U.S. Cryptocurrency Exchange, Gets Some Good News: The Securities and Exchange Commission Is Dropping a Lawsuit

- May 16, 2025 at 02:35 am

- Not long after President Trump took office, Coinbase, the largest U.S. cryptocurrency exchange, got some good news: The Securities and Exchange Commission was dropping a lawsuit that had accused the company of illegally marketing digital currencies to the public.

-

-

-

-

-

-

-

-