|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

A Leveraged Trader Who Doubled Down on Their Ethereum ETH/USD Short Bet on Wednesday Was Sitting on Unrealized Profits

Jun 12, 2025 at 05:35 pm

As the second-largest cryptocurrency fell in value

A leveraged trader, who had already doubled down on their Ethereum (ETH) / USD short bet on Wednesday, was still sitting on unrealized profits as the second-largest cryptocurrency fell further in value.

What Happened: According to on-chain tracker LookonChain, the trader had deposited an additional US$3.37 million in USD Coin (USDC) / USD to increase their short on Ethereum. At press time, the position stands at 40,000 ETH, valued at around US$109.9 million.

The trader opened a 15x leveraged short position on ETH on the decentralized perpetual trading platform Hyperliquid at an entry price of $2,793.81.

The trader has an unrealized profit of $1.80 million at the time of writing. The entire position would be liquidated if ETH rallies to $2,938.2

[object Node].

The trader appears to be an avid leveraged trader, having previously made a profit of $5.18 million in just two weeks by going long on ETH. He flipped short and exited the position after prices fell last week.

See Also: Why Jeff Bezos Might Emerge As The Biggest Winner In The Trump-Musk Feud

The trader's moves come after ETH's rally, which began earlier this week, was cut short on Wednesday. The cryptocurrency took a U-turn after cruising to $2,877.63 in the early hours.

Interestingly, nearly 60% of Binance traders with open ETH positions were positioned long, suggesting that they were expecting the price to go up.

According to blockchain analytics firm IntoTheBlock, the balance held by long-term holders of ETH rose in the last 24 hours, indicating that accumulation was taking place.

At the time of writing, Ethereum was trading at $2,746.34, down 12.81% over the last 24 hours, according to data from Benzinga Pro.

This content was partially produced with the help of Benzinga Neuro, which assists in creating unique articles and engaging content.

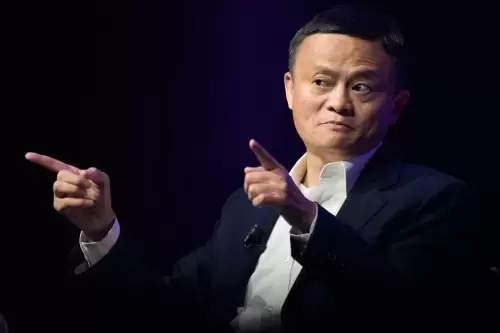

Photo Courtesy: VPLAB On Shutterstock

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

- Singapore needs to welcome Bitcoin-related businesses to maintain its status as a global financial hub

- Jun 13, 2025 at 09:45 pm

- The 34-year-old rose to prominence last month during the general election as one of just two independent candidates, pulling in 36.16 per cent of the votes in Mountbatten SMC.

-

-

-

-

-

- HKMA explores blockchain-based efficiency in asset subscription using a stablecoin backed by the AUD converted into a Hong Kong CBDC

- Jun 13, 2025 at 09:35 pm

- The exercise involved a simulation in which a stablecoin backed by the AUD was converted into a Hong Kong central bank digital currency (CBDC) and subsequently used to purchase a tokenized money market fund.

-