|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

US Government Imposes Reciprocal Tariffs on China, the UK and South Korea, Affecting the Entire Global Market

Apr 03, 2025 at 03:59 pm

Yesterday, the US government imposed reciprocal tariffs on some of its prominent trade partners, including China, the UK and South Korea. The tariff announcement has affected the entire global market.

Yesterday, the US government imposed reciprocal tariffs on some of its prominent trade partners, including China, the UK and South Korea. The tariff announcement has affected the entire global market. In the daily chart, Europe is showing a bearish signal of -0.31%, China (-0.18%), Japan (-3.19%), India (-0.21%), South Africa (-0.94%) and Australia (-0.93%). However, crypto analyst Michael van de Poppe predicts that demand for Bitcoin and altcoin may increase once market fears and uncertainty fade. Curious to know more! Read on!

Trump’s Tariffs against Trade Partners

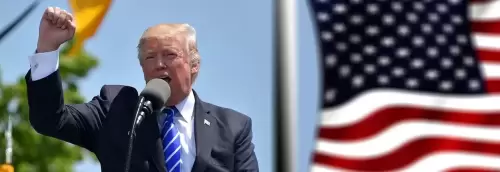

US President Donald Trump, who had jolted the global economy with his decision to impose tariffs against China, Mexico and Canada in early February, once again sent shockwaves across the global trade landscape yesterday with his reciprocal tariff announcement against some of his trade partners, including China, the UK, South Korea and India.

The US administration, led by Republican leader Trump, announced a 49% tariff on Cambodia, a 46% tariff on Vietnam, 34% tariff on China, a 26% tariff on India, a 25% tariff on South Korea and a 10% tariff on the UK.

Interestingly, the US president dubbed the tariff announcement ‘Liberation Day.’ White speaking at the tariff announcement event at the Rose Garden of the White House, Trump strongly defended his reciprocal tariff decision, saying “Taxpayers have been ripped off for more than 50 years. But it is not going to happen anymore.”

US Tariff Concerns Easing: What It Means for the Market

The tariff decision has created havoc in the global economy. Even the crypto market has been affected. In the last 24 hours, the crypto market has dropped by 2.8%. Bitcoin has slipped by 1.2%, Ethereum by 2%, XRP by 2.6%, Solana by 4.4%, and Dogecoin by 2.1%.

However, Michael van de Poppe, a renowned crypto analyst, forecasts that demand for Bitcoin and altcoins may increase once market fear and uncertainty fade.

Gold Expected to Drop: ‘Buy the Rumour, Sell the News’ in Action

Since March 1, the gold market has experienced a surge of at least 8.7%. During the period, it has outperformed the Bitcoin market, which has witnessed a drop of 1.30%.

Rumours related to Trump’s tariffs have created fear and uncertainty in the market. Experts believe that this market atmosphere encouraged investors to move from risky assets to safe options like gold.

Today, at one point, the gold price touched as high as $3,167.382. Now, it remains at $3,129.210.

Michael notes that investors brought gold as a hedge against uncertainty, but now that uncertainty is decreasing, gold prices may decline.

Bitcoin & Altcoins Could Rise

Machael points out that traders may have sold Bitcoin and altcoins earlier due to tariff fears. Now that the situation is clearer, they may start buying again, pushing prices up.

Today, Bitcoin has climbed from $82,543.74 to $83.021.56. Currently, the market looks bullish. Yesterday, at a point, it made a strong attempt to break above the previous swing high, rising as high as $88,534.92.

FAQs

Trump’s tariffs have triggered stock declines worldwide, causing uncertainty in crypto and commodity markets while influencing investor sentiment.

Analysts predict Bitcoin may recover as market fears fade, with traders potentially reinvesting in crypto after an initial drop.

China, the UK, South Korea, India, Vietnam, and Cambodia face high US tariffs, disrupting trade and financial markets.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

- Adidas is back in the crypto arena, this time teaming up with XOCIETY, an on-chain shooter RPG powered by the Sui Network (SUI)

- May 08, 2025 at 04:10 pm

- The partnership will introduce ALTS by Adidas content directly into the Sui-powered game environment, cementing the sportswear giant's growing stake in the digital asset ecosystem.

-

-

-

-

![Bitcoin [BTC] briefly retested $97K Bitcoin [BTC] briefly retested $97K](/assets/pc/images/moren/280_160.png)

-

-

![[2025.05.08] The two routes of Bitcoin continue to be observed, and gold is still bullish. [2025.05.08] The two routes of Bitcoin continue to be observed, and gold is still bullish.](/uploads/2025/05/08/cryptocurrencies-news/videos/routes-bitcoin-continue-observed-gold-bullish/image_500_375.webp)

![Bitcoin [BTC] briefly retested $97K Bitcoin [BTC] briefly retested $97K](/uploads/2025/05/08/cryptocurrencies-news/articles/bitcoin-btc-retested-k/image_500_300.webp)