Navigating the crypto landscape amidst US economic indicators: Powell's testimony, jobless claims, and PCE data.

Decoding US Economic Indicators: Crypto Implications and Economic Data

Geopolitical tensions and shifting economic winds are creating a volatile environment, especially for crypto. Keep your eye on these key US economic indicators. Let's dive into what's moving the markets.

Powell's Testimony: A Hawkish or Dovish Signal?

All eyes are on Fed Chair Jerome Powell's testimony before Congress. His semiannual address will cover the state of the US economy, monetary policy, inflation, and employment. This isn't just academic; Powell's words can send shockwaves through financial markets, especially now with the geopolitical tensions in the Middle East. If Powell hints at higher interest rates to combat inflation, Bitcoin could take a hit, mirroring the market's reaction to Trump's tariffs in April 2025. A dovish tone, suggesting rate cuts, could propel Bitcoin past $100,000. Neutral remarks? Expect continued volatility.

Initial Jobless Claims: A Canary in the Coal Mine?

The US labor market is increasingly impacting Bitcoin. Recent initial jobless claims have exceeded expectations, signaling potential economic softening. If claims continue to rise, it could boost Bitcoin as traders anticipate Fed rate cuts, particularly with Middle East tensions fueling risk-off sentiment. Conversely, lower claims could strengthen the dollar, putting downward pressure on crypto prices. Keep an eye on those numbers, folks.

PCE: The Fed's Inflation Yardstick

Rounding out the list is the Personal Consumption Expenditures (PCE) index. The Fed's preferred inflation gauge, the PCE, measures the average price change for goods and services consumed by US households. Economists project the May PCE to rise, signaling persistent inflation. A higher-than-expected PCE could strengthen the dollar and pressure Bitcoin, while a lower PCE could raise rate cut hopes and boost Bitcoin. This is the data point to watch if you are trying to get ahead of the curve.

The Big Picture

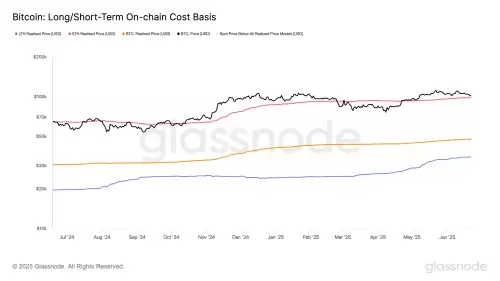

These US economic indicators don't exist in a vacuum. They're all interconnected and heavily influenced by global events. The interplay between Powell's testimony, jobless claims, and PCE data, coupled with ongoing geopolitical tensions, will dictate the near-term trajectory of Bitcoin. Currently, Bitcoin trades around $101,450, down slightly, but the game is far from over.

Final Thoughts

So, what does all this mean for you? Stay informed, stay nimble, and don't be afraid to adjust your portfolio accordingly. After all, in the world of crypto, change is the only constant. Keep stacking those sats!

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.