|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Crypto Banking Unleashed: Fed Joins Regulators in Crushing Old Guard Restrictions

Apr 27, 2025 at 03:30 pm

The Federal Reserve Board announced Thursday that it has withdrawn previous supervisory guidance related to banks’ crypto-asset and dollar token activities

The Federal Reserve Board has announced the withdrawal of previous supervisory guidance related to banks’ crypto-asset and dollar token activities. This move, announced Thursday, is part of a broader effort to adjust supervision in accordance with emerging risks and encourage innovation within the financial sector.

The Board has decided to rescind its 2022 supervisory letter that required state member banks to provide notification regarding planned or current crypto-asset activities. Instead, such oversight will now be incorporated into the standard supervisory process.

“As a result, the Board will no longer expect banks to provide notification and will instead monitor banks’ crypto-asset activities through the normal supervisory process,” the announcement reads.

Furthermore, the Board has revoked its 2023 supervisory letter concerning a supervisory nonobjection process for engagement in dollar token activities. Expressing a commitment to continually assess and adapt its approach, the Federal Reserve Board stated: “The Board will work with the agencies to consider whether additional guidance to support innovation, including crypto-asset activities, is appropriate.”

This decision follows similar steps taken by other U.S. banking regulators. Both the Office of the Comptroller of the Currency (OCC) and the Federal Deposit Insurance Corporation (FDIC) recently withdrew crypto-related guidance that had been issued during the Biden administration.

In response to the Federal Reserve's announcement, Republicans on the U.S. Senate Banking Committee had this to say:

Chairman Tim Scott applauds the Federal Reserve for following the OCC and the FDIC in taking the much-needed action to rescind harmful Biden-era guidance that reduced access to financial services for the digital asset industry.

White House crypto czar David Sacks also chimed in, stating: “It’s great to see the Federal Reserve reversing Biden-era rules that were created as part of Operation Chokepoint 2.0. Opening up banking to crypto will help drive further mainstream adoption.”

These coordinated steps by federal agencies suggest a broader shift toward a regulatory environment that encourages innovation within the crypto industry while maintaining the necessary oversight.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

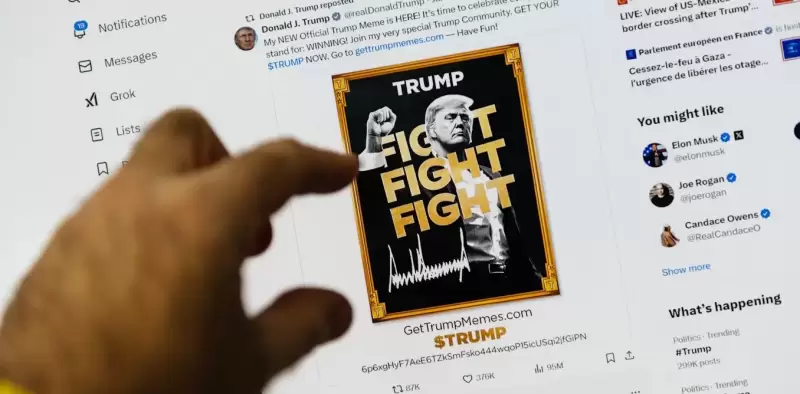

- Launched three days before the inauguration of Donald Trump, the crypto $ Trump, without concrete utility, nevertheless experienced a spectacular outbreak.

- Apr 28, 2025 at 01:35 am

- What if political notoriety became a sound and stumbling currency? It is the bet, provocative and potentially lucrative, that Donald Trump made by launching his cryptocurrency, soberly baptized $ Trumpon January 17, 2025, three days before his official return to the White House.

-

-

- Pi Network Named Official Sponsor of Consensus 2025: Analyst Gave His Price Prediction

- Apr 28, 2025 at 01:30 am

- In a major announcement, Pi Network was officially named as an Official Sponsor of Consensus 2025, one of the largest and most prestigious blockchain and cryptocurrency conferences globally.

-

-

-

- If You Missed Solana's Explosive Breakout, There May Still Be Time to Catch the Next Big Opportunity—Lightchain AI

- Apr 28, 2025 at 01:20 am

- With the crypto presale already raising $19.5 million, Lightchain AI is attracting early believers who see its long-term potential to rival previous market leaders.

-

-