Bitcoin's price navigates geopolitical tensions and technical indicators. Will it crash, or can support levels hold?

Bitcoin's been on a rollercoaster, huh? From geopolitical jitters to technical head-scratchers, the price action's got everyone on edge. Let's break down what's happening with Bitcoin price, crash potentials, and those all-important support levels.

The Recent Dip: What Caused It?

The most recent articles (June 2025) highlight a few key factors. First, escalating tensions between Iran and Israel have spooked the markets, sending investors scurrying towards safer assets. Robert Kiyosaki, the "Rich Dad Poor Dad" guy, even thinks a "Global Monetary Collapse" is coming, predicting a Bitcoin crash as a result. Spooky!

Key Support Levels to Watch

Despite the doom and gloom, Bitcoin has shown some resilience. The $99,000–$100,000 range seems to be acting as a crucial macro support level. One analyst, Titan of Crypto, pointed to this zone, noting the confluence of the Fair Value Gap (FVG) and the rising Tenkan-sen around this price region. Holding above this level could be critical for Bitcoin's long-term trajectory. But as Master Ananda highlighted, failing to hold at $88,888 could trigger another 5% decline toward $82,500 before bulls are able to put up any fight.

Is a Crash Imminent?

While some, like Kiyosaki, are bracing for a crash, others see potential for a rebound. The Bitcoin price today is trading around $101,530 after recovering sharply from a deep selloff that sent the asset below the $99,000 mark. The $102,800–$104,500 range is now presenting resistance, with EMAs clustered there. Whether Bitcoin can decisively break above this level will determine its short-term fate.

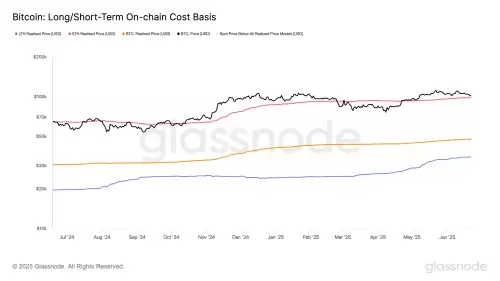

On-Chain Data: A Mixed Bag

The on-chain data paints a somewhat conflicting picture. While the price bounced, netflow data showed significant selling pressure across spot exchanges. This divergence suggests the recovery might be more technical (a short squeeze or relief rally) than driven by genuine buying interest. We'll see, I guess.

My Two Sats (That's Bitcoin slang for "cents," BTW)

Personally, I think the market's in a wait-and-see mode. Geopolitical events are always unpredictable, and they can certainly rattle the crypto cage. However, Bitcoin has proven its ability to bounce back from dips. If it can maintain levels above $100,000, we might see another run at higher prices. But hey, that's just my opinion, I am not a financial advisor, so don't take my word for it.

The Bottom Line

Bitcoin's price is in a delicate balance. Keep an eye on those support and resistance levels, and don't let the crash talk freak you out too much. After all, crypto is never boring, is it?