Bitcoin's price movements and related market dynamics. Examining Saylor's Bitcoin-backed strategies, Metaplanet's challenges, and the broader implications for crypto.

Bitcoin continues to make waves, and the interplay between strategic investments, market sentiment, and all-time high aspirations is more fascinating than ever. Let's dive into the current dynamics of Bitcoin and related market trends.

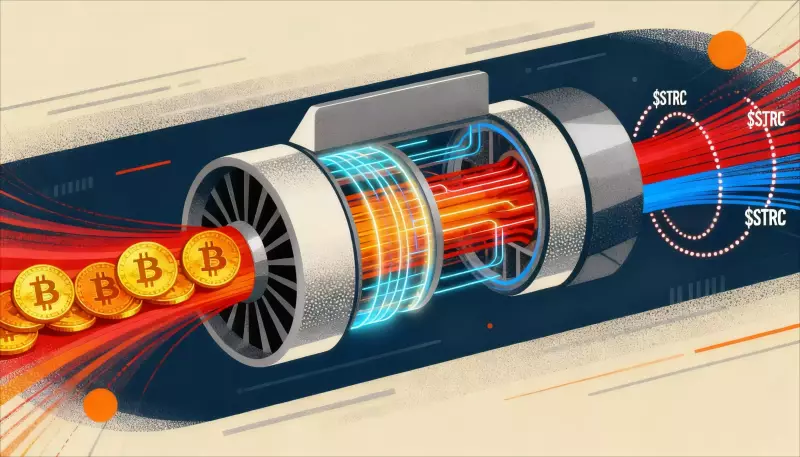

Saylor's Bitcoin Flywheel: Spinning Faster Than Ever

Michael Saylor's strategy of leveraging Bitcoin to generate capital is in full swing. His Bitcoin-backed preferred stock, $STRC, recently hit an all-time high of $100.01. This isn't just a stock price increase; it's a signal that investors are eager for more exposure to Saylor's Bitcoin yield model.

The magic here is the flywheel effect: investor demand leads to new stock issuances, which fund more Bitcoin purchases, boosting confidence and further fueling demand. With $STRC at record highs, Saylor's "digital credit factory" is accelerating globally, with Euro-denominated offerings on the horizon. The market isn't just watching him buy Bitcoin; it's actively funding him to do it faster.

Metaplanet's Bitcoin Bet: A Bumpy Ride

Not everyone is having an easy ride. Metaplanet, another significant Bitcoin treasury company, has faced challenges. Its stock has been under pressure, coinciding with a drop in Bitcoin's price. Despite raising $100 million in Bitcoin-backed funding to buy back its crashing stock, the company faces headwinds. Its stock has crashed significantly from its all-time high.

The company's management believes its stock is undervalued and aims to attract new investors. While these buybacks and Bitcoin accumulation are intended to stabilize the stock price, the ongoing bear market adds uncertainty.

Broader Market Sentiment and Strategic Bitcoin Reserves

The challenges faced by Metaplanet mirror those of other Digital Asset Treasury (DAT) companies, many of which have experienced significant declines. Despite this, key figures like Senator Cynthia Lummis are advocating for a Strategic Bitcoin Reserve for the U.S. government, viewing it as a way to manage the national debt. Even Donald Trump has voiced support. Such a move could potentially boost Bitcoin's price and benefit companies like Metaplanet and MicroStrategy.

ASTER's Potential Comeback

While we're on the subject of potential upturns, let's talk about ASTER. After a rocky start, ASTER is showing signs of life. Bouncing off a support line, it's gained significant ground, and indicators suggest a possible shift in momentum. Breaking above the falling wedge pattern could signal the start of a new phase, potentially challenging previous highs.

Final Thoughts: Riding the Crypto Coaster

The world of Bitcoin and crypto is never dull. We've seen the power of the flywheel effect with Saylor, the challenges of navigating a bear market with Metaplanet, and the glimmer of hope for tokens like ASTER. Whether it's strategic Bitcoin reserves or individual investment strategies, the game is constantly evolving. So buckle up, stay informed, and enjoy the ride—it's sure to be a wild one!

![The Graph Price Prediction [GRT Crypto Price News Today] The Graph Price Prediction [GRT Crypto Price News Today]](/uploads/2025/11/07/cryptocurrencies-news/videos/690d4df44fe69_image_500_375.webp)