|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

比特币的价格走势和相关市场动态。审视 Saylor 的比特币支持策略、Metaplanet 的挑战以及对加密货币的更广泛影响。

Bitcoin continues to make waves, and the interplay between strategic investments, market sentiment, and all-time high aspirations is more fascinating than ever. Let's dive into the current dynamics of Bitcoin and related market trends.

比特币继续掀起波澜,战略投资、市场情绪和空前的远大抱负之间的相互作用比以往任何时候都更加令人着迷。让我们深入了解比特币的当前动态和相关市场趋势。

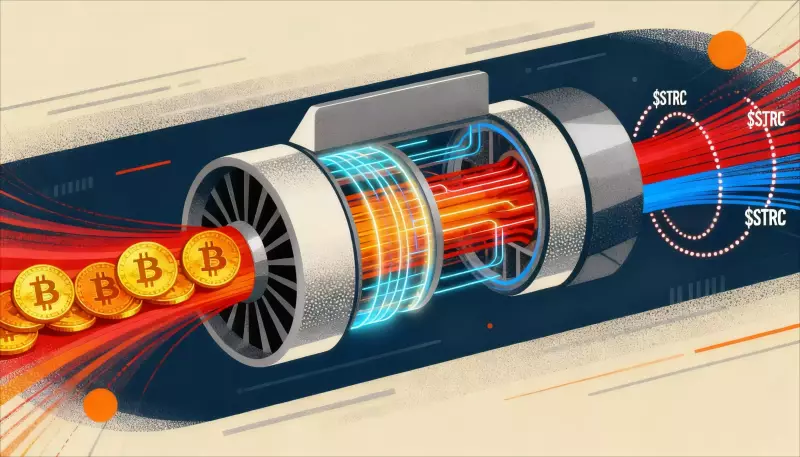

Saylor's Bitcoin Flywheel: Spinning Faster Than Ever

Saylor 的比特币飞轮:旋转得比以往更快

Michael Saylor's strategy of leveraging Bitcoin to generate capital is in full swing. His Bitcoin-backed preferred stock, $STRC, recently hit an all-time high of $100.01. This isn't just a stock price increase; it's a signal that investors are eager for more exposure to Saylor's Bitcoin yield model.

迈克尔·塞勒利用比特币产生资本的战略正在如火如荼地进行。他的比特币支持的优先股 $STRC 最近触及 100.01 美元的历史新高。这不仅仅是股价上涨;这是一个信号,表明投资者渴望更多地接触塞勒的比特币收益率模型。

The magic here is the flywheel effect: investor demand leads to new stock issuances, which fund more Bitcoin purchases, boosting confidence and further fueling demand. With $STRC at record highs, Saylor's "digital credit factory" is accelerating globally, with Euro-denominated offerings on the horizon. The market isn't just watching him buy Bitcoin; it's actively funding him to do it faster.

这里的魔力在于飞轮效应:投资者的需求导致新股票的发行,从而为更多的比特币购买提供资金,提振信心并进一步刺激需求。随着 $STRC 创下历史新高,Saylor 的“数字信贷工厂”正在全球加速发展,以欧元计价的产品即将推出。市场不仅关注他购买比特币,还关注他购买比特币。它正在积极资助他更快地完成这项工作。

Metaplanet's Bitcoin Bet: A Bumpy Ride

Metaplanet 的比特币押注:坎坷之路

Not everyone is having an easy ride. Metaplanet, another significant Bitcoin treasury company, has faced challenges. Its stock has been under pressure, coinciding with a drop in Bitcoin's price. Despite raising $100 million in Bitcoin-backed funding to buy back its crashing stock, the company faces headwinds. Its stock has crashed significantly from its all-time high.

并非每个人都一帆风顺。另一家重要的比特币财务公司 Metaplanet 也面临着挑战。随着比特币价格下跌,其股票一直面临压力。尽管筹集了 1 亿美元的比特币支持资金来回购崩盘的股票,但该公司仍面临阻力。其股价已从历史高点大幅下跌。

The company's management believes its stock is undervalued and aims to attract new investors. While these buybacks and Bitcoin accumulation are intended to stabilize the stock price, the ongoing bear market adds uncertainty.

该公司管理层认为其股票被低估,旨在吸引新投资者。虽然这些回购和比特币积累的目的是稳定股价,但持续的熊市增加了不确定性。

Broader Market Sentiment and Strategic Bitcoin Reserves

更广泛的市场情绪和比特币战略储备

The challenges faced by Metaplanet mirror those of other Digital Asset Treasury (DAT) companies, many of which have experienced significant declines. Despite this, key figures like Senator Cynthia Lummis are advocating for a Strategic Bitcoin Reserve for the U.S. government, viewing it as a way to manage the national debt. Even Donald Trump has voiced support. Such a move could potentially boost Bitcoin's price and benefit companies like Metaplanet and MicroStrategy.

Metaplanet 面临的挑战与其他数字资产库 (DAT) 公司的挑战如出一辙,其中许多公司都经历了大幅下滑。尽管如此,参议员辛西娅·鲁米斯(Cynthia Lummis)等关键人物仍在倡导美国政府建立战略比特币储备,并将其视为管理国家债务的一种方式。就连唐纳德·特朗普也表达了支持。此举可能会推高比特币的价格,并使 Metaplanet 和 MicroStrategy 等公司受益。

ASTER's Potential Comeback

ASTER 的潜在卷土重来

While we're on the subject of potential upturns, let's talk about ASTER. After a rocky start, ASTER is showing signs of life. Bouncing off a support line, it's gained significant ground, and indicators suggest a possible shift in momentum. Breaking above the falling wedge pattern could signal the start of a new phase, potentially challenging previous highs.

当我们谈论潜在的好转时,我们来谈谈 ASTER。在经历了艰难的开局之后,ASTER 正在显示出生命的迹象。从支撑线反弹后,它取得了重大进展,指标表明势头可能会发生转变。突破下降楔形形态可能标志着新阶段的开始,可能会挑战之前的高点。

Final Thoughts: Riding the Crypto Coaster

最后的想法:乘坐加密货币过山车

The world of Bitcoin and crypto is never dull. We've seen the power of the flywheel effect with Saylor, the challenges of navigating a bear market with Metaplanet, and the glimmer of hope for tokens like ASTER. Whether it's strategic Bitcoin reserves or individual investment strategies, the game is constantly evolving. So buckle up, stay informed, and enjoy the ride—it's sure to be a wild one!

比特币和加密货币的世界永远不会沉闷。我们通过 Saylor 看到了飞轮效应的力量,通过 Metaplanet 看到了驾驭熊市的挑战,以及像 ASTER 这样的代币的一线希望。无论是比特币战略储备还是个人投资策略,游戏都在不断发展。所以请系好安全带,随时了解情况,享受这段旅程——这肯定是一次疯狂的旅程!

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

-

- Layer 2 代币:到 2026 年是否会出现潜在的爆炸?

- 2025-11-07 16:04:10

- 在可扩展性、创新和机构对加密货币的兴趣的推动下,探索 Layer 2 代币到 2026 年爆发的潜力。

-

-

- 比特币的狂野之旅:飙升、归零和寻求稳定性

- 2025-11-07 15:58:00

- 比特币最近的波动让投资者感到紧张。从 ETF 流出到山寨币流动性紧缩,我们详细分析了激增、零的可能性以及这一切意味着什么。

-

- XRP、比特币和反弹:纽约有什么交易?

- 2025-11-07 15:53:38

- 分析有关 XRP、比特币和潜在市场反弹的最新动态。现在是该跳进去的时候了,还是应该按兵不动?让我们深入了解一下。

-

- Filecoin、DePIN 和技术突破:最新动态是什么?

- 2025-11-07 15:53:15

- Filecoin 以技术突破领跑 DePIN!了解驱动力、关键水平以及这对去中心化存储的未来意味着什么。

-

- 比特币波动:ETF 流出和 10 万美元底线

- 2025-11-07 15:51:06

- 由于 ETF 资金外流,比特币坚守 10 万美元。在下一次飙升至 10 万美元之前,是否会出现更大幅度的回调?

-

-

![图表价格预测 [GRT 今日加密货币价格新闻] 图表价格预测 [GRT 今日加密货币价格新闻]](/uploads/2025/11/07/cryptocurrencies-news/videos/690d4df44fe69_image_500_375.webp)