|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Bitcoin and crypto prices have been thrust into the spotlight by U.S. president Donald Trump this year

May 06, 2025 at 07:46 pm

The bitcoin price has rebounded to around $95,000 per bitcoin after dropping to April lows of $75,000

U.S. president Donald Trump's embrace of bitcoin and crypto was named as a driver behind Wall Street's bets on a bitcoin price boom.

High-speed trading giant Tower Research Capital has joined Citadel Securities in "bulking up its bets on cryptocurrencies," it was reported by Bloomberg, citing an anonymous source.

One of Tower Research Capital’s trading groups has “increased capital allocation to its crypto trading book,” and upgraded its crypto market making infrastructure, the source told the financial newswire.

Wall Street is quietly ramping up its support for bitcoin and crypto as the Trump administration promises to open up access to bitcoin trading and crypto markets, rolling back Biden-era restrictions and fast-tracking legislation that will rewire the financial system.

Last week, Wall Street giants that manage a combined $10 trillion on behalf of clients are predicted to "open for bitcoin price today in range after Trump-fueled rally' on Monday, allowing advisors to recommend bitcoin ETFs to clients for the first time.

The dozen U.S. spot bitcoin ETFs, which rocketed to assets under management of more than $100 billion last year, pulled in almost $2 billion last week, according to data from SoSoValue, marking a return to growth after a recent period of outflows that mirrored the stock market's volatility.

“The flows are back in a big way,” BlackRock’s head of digital assets, Robert Mitchnick, said during a recent bitcoin and crypto conference panel discussion, it was reported by The Block.

The bitcoin price has bounced back from April lows, putting its all-time high of nearly $110,000 per bitcoin back in range.

However, the market momentum seems to have fallen away over the last week, with the bitcoin price surge that propelled it to close to $95,000 failing to carry it over the psychological barrier.

“Bitcoin has rallied 25% over the past month, supported by aggressive ETF inflows and institutional spot buying,” Markus Thielen, the chief executive of 10x Research, said in an emailed note, pointing to “weak funding rates” and “mounting” macro pressures as reason the bitcoin price rally may be fading.

"A potential consolidation is forming near the $95,000 level as traders await new catalysts. This is not a time for blind risk-taking but tactical positioning with well-defined exposure."

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

- Trump-Backed Cryptocurrency Promises to Influence U.S. Trade Policies

- May 07, 2025 at 03:00 am

- An artificial intelligence and machine learning driven supply chain firm says it plans to buy $20 million in cryptocurrency backed by President Donald Trump with the stated purpose of influencing U.S. trade policies.

-

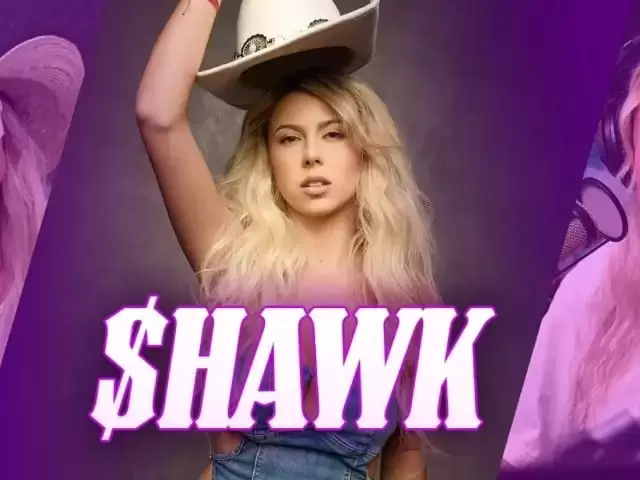

- Haliey Welch, the viral star known as "Hawk Tuah Girl," has opened up about the controversy surrounding the $HAWK meme coin

- May 07, 2025 at 02:55 am

- Haliey Welch, the viral star known as "Hawk Tuah Girl," has opened up about the controversy surrounding the $HAWK meme coin that led to significant financial losses for many investors.

-

-

-

-

-

-

- US Representative Maxine Waters leads Democrats out of a joint hearing on digital assets in response to what she called “the corruption of the President of the United States” concerning cryptocurrencies.

- May 07, 2025 at 02:40 am

- In a May 6 joint hearing of the HFSC and House Committee on Agriculture, Waters remained standing while addressing Republican leadership, saying she intended to block proceedings due to US President Donald Trump’s “ownership of crypto” and oversight of government agencies.